In my daily Euro against Swiss Franc analysis, it's easy to see that we are at a major inflection point.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Despite the fact that the ECB didn't do anything and the Euro lost ground against several other currencies, it has turned around against the Japanese Yen.

I can see that we are attempting a bit of a recovery, and it would make a certain amount of sense that the market will be very noisy and perhaps a bit of a stretch to the downside.

Top Regulated Brokers

In my daily NZD/CHF analysis, it’s easy to see that we are at an overstretched condition to the downside, so it’ll be interesting to see how the Swiss franc behaves.

This is a pair that continues to pressure the upside, and I think it’s probably only a matter of time before we truly find a lot of momentum entering this market.

The ASX 200 looks very exhausting at this point in time in my daily analysis, as I believe this asset remains positive, but at the same time it may have overstretched its momentum.

In my daily analysis of the Chinese yuan, I can see that the US dollar continues to hang around the 7.27 level, an area that obviously has been important multiple times.

In my daily US dollar against Norwegian Krone analysis, it's easy to see that the US dollar has really taken off a bit during the session on Thursday.

In my daily analysis of the dollar against the peso, it's easy to see that there is still a lot of volatility happening around the 50-day EMA.

Bonuses & Promotions

In my daily analysis of the British pound against the Japanese yen, it's easy to see that we have seen a massive turnaround.

The German DAX has fallen a bit during the early hours on Wednesday, but it does look like we are in the midst of trying to recover.

The British pound has plunged early in the trading session on Wednesday against the Swiss Franc, but we are approaching a major support level.

The Bitcoin market has struggled on Wednesday to maintain any type of momentum.

The Aussie dollar was all over the place during the early hours on Wednesday as we continue to see a lot of volatility.

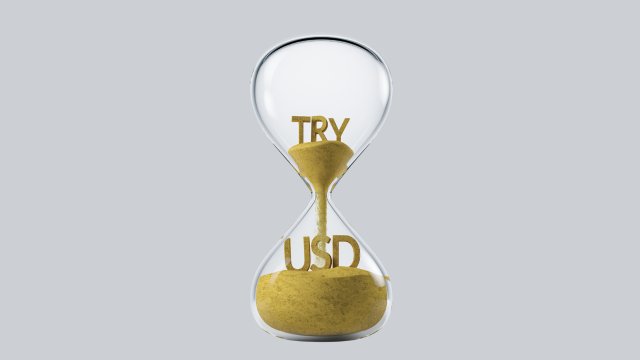

The performance of the Turkish currency declined against the dollar during the overall trading of the current week.