Bitcoin has broken down a bit during the trading session on Thursday as traders came back to work, continuing the overall negativity that we have seen for quite some time.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

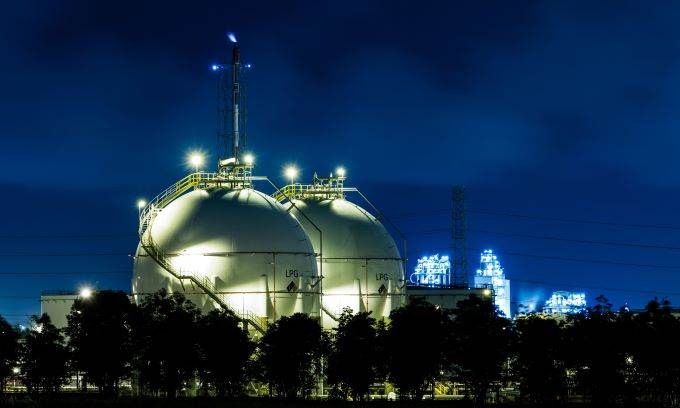

Natural gas markets broke down a bit during the trading session on Thursday as traders came back to work, making the back of a hammer from the previous trading session.

Since December 2019, the US Dollar has been under increasing selling pressure.

Top Regulated Brokers

Geopolitical tensions are on the verge of escalating in the Middle East after the US killed a top Iranian general in Iraq.

After entering a sideways trend inside its support zone, the EUR/AUD managed a breakout.

It has been less than 72 hours into the new year, and geopolitical tensions have already spiked.

Economic reports out of the US have been disappointing, and the US Dollar is under growing selling pressure across the board.

While the long-term outlook for the EUR/CHF remains bearish, a short-term recovery is favored to take this currency pair out of extreme oversold conditions.

While Japanese economic data has been soft, aiding the rally in the CAD/JPY, the Japanese Yen is anticipated to benefit from the return of a risk-off period

Bonuses & Promotions

Bullish momentum is on the rise after price action in the AUD/NZD was able to ascend above its support zone.

The West Texas Intermediate Crude Oil market initially pulled back during the trading session but did bounce a bit on Tuesday.

Natural gas markets have initially pulled back during the trading session on Tuesday but have shown quite a bit of resiliency by bouncing and forming a bit of a hammer.

The NASDAQ 100 initially pulled back during the trading session on Tuesday but turned around to show signs of support yet again as we have so much in the way of bullish pressure longer term

The S&P 500 has initially pulled back during the trading session on Tuesday only to turn around and show signs of life again.

Gold markets continue to look bullish overall, but the trading session on New Year’s Eve ended up forming a shooting star.