Australian consumer inflation expectations surged to 4.7% in January.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The spread of the Corona virus in China and the official announcement of the six deaths so far have frightened global markets, and global stock indicators collapsed amid expectations of more rapid spread of the virus.

Gold prices witnessed fluctuation in performance during yesterday's session between the $1569 resistance and a rapid decline.

Top Regulated Brokers

The improvement in job numbers and wages in the UK has not completely ended the pessimism that occurred after the announcement of the GDP growth and inflation figures from the UK.

Despite the improvement in the reading of the ZEW index of German economic sentiment to the highest level since 2015.

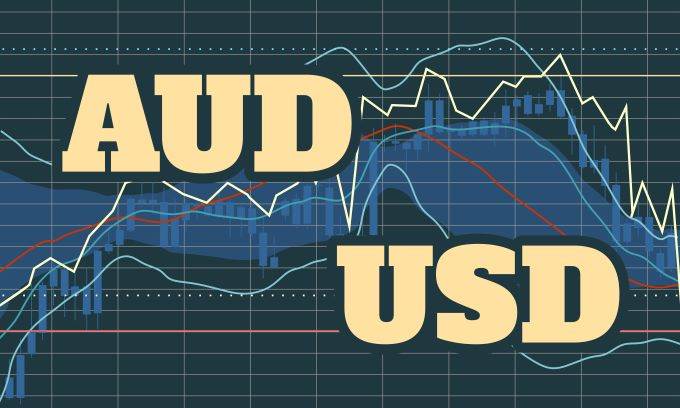

AUD/USD: Beware of bullish reversal from 0.6817

The S&P 500 should continue to find buyers on pullbacks going forward, and therefore the fact that we did up forming a bit of a hammer like candle

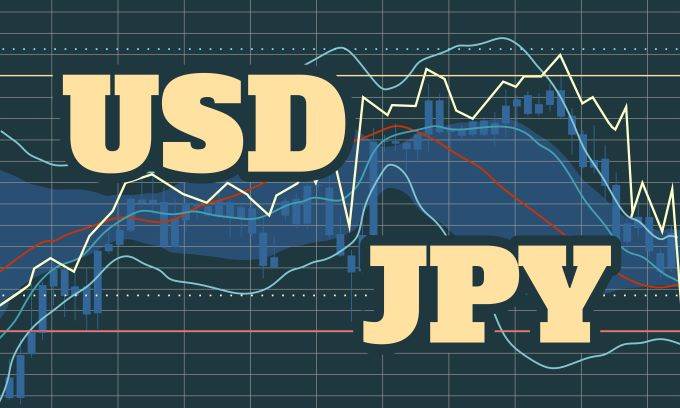

The US dollar has broken down significantly during the trading session on Tuesday, grinding below the ¥110 level later in the day.

The Euro initially tried to rally during the trading session on Tuesday but gave back all of the gains to turn around a break below the 1.11 handle again.

Bonuses & Promotions

The British pound has rallied a bit during the trading session on Tuesday, as traders came back to work in New York.

The NASDAQ 100 has gone back and forth during trading on Tuesday, as traders came back from the Martin Luther King Jr. holiday.

The Australian dollar initially tried to rally during the trading session on Tuesday but gave back the gains to break down significantly through the 50 day EMA.

USD/JPY: Longer-term bullish breakout still probable

With the start of 2020, bullishness across the cryptocurrency sector added to gains, which started to emerge in December 2019.

BTC/USD: Increasing bearish pressure