The DAX market gapped lower to kick off the trading session on Friday, reaching down below €12,000 in the futures market.

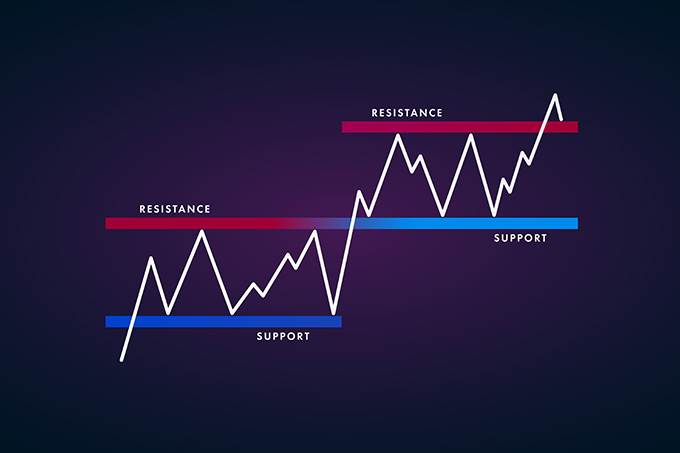

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

With trade talks between the EU and the UK set to begin under time pressure to display progress by June, the British Pound is well-positioned to continue its advance.

Despite the record-breaking contraction in the Chinese manufacturing and non-manufacturing PMI’s February, resulting from Covid-19

Top Regulated Brokers

Safe-haven demand continues to support the Japanese Yen, but the advance is exhausted following last week’s rout across the global financial system.

EUR/USD: Euro acting as safe haven

Get our trading strategies with our monthly & weekly forecasts of currency pairs worth watching using support & resistance for the week of March 2, 2020.

Get the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of March 1, 2020 here.

Get the weekly Forex forecast for major currency pairs for the week of March 2, 2020 here.

Singapore has been at the forefront of Covid-19 responses and containment measures.

Bonuses & Promotions

Volatility has returned to the cryptocurrency market.

The Euro has rallied rather significantly during the trading session on Thursday but reached into the massive 1.10 level which of course is a large, round, psychologically significant figure.

The US dollar has broken down significantly during the trading session on Thursday, slicing through the ¥110 level.

The S&P 500 has gotten absolutely hammered during the trading session on Thursday, and worse yet even close that the very lows.

The British pound has gone back and forth during the trading session on Thursday, as we continue to see a lot of confusion when it comes to the global markets.

The NASDAQ 100 E-mini contract has broken down extraordinarily low during the trading session on Thursday, as we see a lot of massive negativity.