After the US Federal Reserve slashed its benchmark interest rate by 50 basis points to 1.00% yesterday, downside pressure on the US Dollar increased.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Fourth-quarter Australian GDP surprised to the upside, eliminating fears of a technical recession in the first quarter.

EUR/USD: Euro acting as safe haven

Top Regulated Brokers

Get our trading strategies with our monthly & weekly forecasts of currency pairs worth watching using support & resistance for Tuesday, March 3, 2020 here.

The Euro has rallied yet again during the trading session on Monday, reaching towards the 1.1175 level,

The West Texas Intermediate Crude Oil market ended up forming a massive bullish engulfing candlestick on Monday to show a real turnaround when it comes to crude oil.

The S&P 500 has rallied significantly during the trading session on Monday, breaking above the 200 day EMA late in the session.

The natural gas markets have rallied significantly during the trading session on Monday as traders came back to work, as we reached as high as the $1.76 level.

The NASDAQ 100 has exploded to the upside during trading on Monday after initially dropping below the 200 day EMA and the E-mini contract.

Bonuses & Promotions

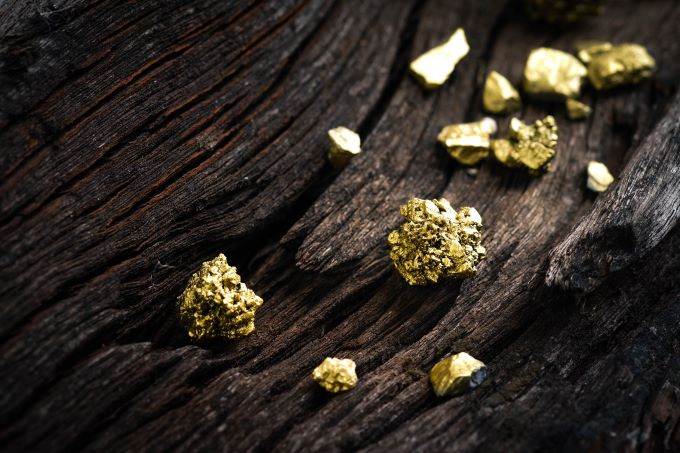

The gold markets gapped higher to kick off the trading session during the day on Monday, broke above $1600, and then pulled back towards the 50 day EMA.

The South African Rand has gained against the US dollar during trading on Monday, as the US dollar got hit by just about everything on the planet.

AUD/USD: Looks like the price put in a medium-term bottom

The death toll from the Coronavirus in the United States has risen to six and the disease has spread to more countries and capitals around the world, even as the number of new cases in China has fallen to its lowest level in six weeks.

USD/JPY: Stock rally not strongly reflected here

Since the beginning of this week’s trading, gold prices has been instable by trying to rise to the $1611 an ounce, and then returning to the $1584 support before settling around the $1600 level an ounce.