The Euro got crushed during trading on Friday as Germany has announced that it was willing to break its budget.

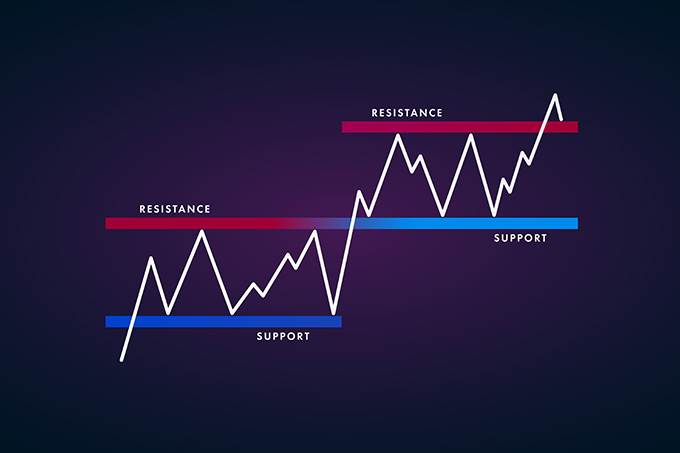

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The British pound initially tried to rally during the trading session on Friday but found enough exhaustion above the turn around and slice through the crucial 1.25 handle.

The Australian dollar has completely collapsed during trading on Friday, after initially trying to recover some of the losses.

Top Regulated Brokers

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Friday, reaching towards the $34 level.

The silver markets collapsed significantly during the day on Friday, losing 10%.

The gold markets have fallen significantly during the trading session on Friday, after initially gapping lower.

The Bitcoin market broke down significantly during the trading session on Friday, dropping another $2000 in the blink of an eye.

Following the second unscheduled interest rate cut by the US Federal Reserve on Sunday before the US futures market opened for trading,

After the European Central Bank (ECB) surprised financial markets by keeping interest rates unchanged, the Euro received a bullish fundamental catalyst.

Bonuses & Promotions

Inspired by panic-induced decision making out of the US Federal Reserve, which slashed interest rates by 150 basis points in two emergency sessions to 0.00%

Get our trading strategies with our monthly & weekly forecasts of currency pairs worth watching using support & resistance for Tuesday, March 16, 2020 here.

Get the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of March 16, 2020 here.

Get the weekly Forex forecast for major currency pairs for the week of March 16, 2020 here.

The Euro has been all over the place during trading on Thursday as we continue to see massive amounts of swings and volatility.

The S&P 500 is breaking down again, as the Tuesday session was brutal.