Throughout last week's trading, the price of the EUR/USD pair was trying to avoid a breakdown below the 1.08 psychological support in order not add to losses, especially with the continued strength of the US dollar as a safe haven.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The Euro has gone back and forth during the trading session on Friday again, and as a result it is obvious that the market has been dancing around the 1.08 level.

The US dollar has gone back and forth during the trading session on Friday, to close out the week on a relatively positive note as the candlestick looks a bit more like a hammer

Top Regulated Brokers

The Australian dollar has broken down during the trading session on Friday, reaching towards the 50 day EMA.

The S&P 500 went back and forth during the trading session on Friday, as we dug into the hammer and looked rather negative for a large portion of the session,

The NASDAQ 100 initially fell during the trading session on Friday, drifting below the 9000 level and another scary opening.

The British pound broke down significantly during the trading session on Friday, reaching towards 1.21 handle.

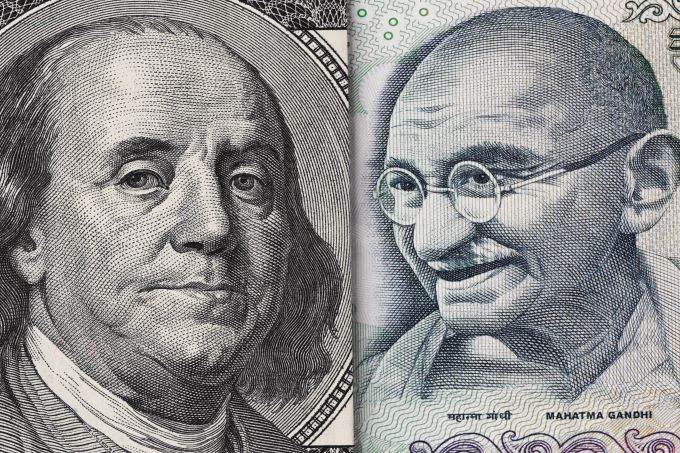

India is faced with a $1 trillion opportunity loss due to the Covid-19 pandemic and government response to it.

AUD/USD: Yet key support level at 0.6404

Bonuses & Promotions

USD/JPY: Bulls have small edge

BTC/USD: Yet strong resistance near $10,000

Silver markets have broken higher during the trading session on Friday, slicing through the 200 day EMA like it was not even there

The Bitcoin market went back and forth during trading on Friday again, as we yet again see the $10,000 level offer a significant amount of resistance.

Gold markets have rallied significantly during the trading session on Friday, peaking above the $1750 level.

The West Texas Intermediate Crude Oil market has rallied quite a bit during the trading session on Friday again, as we continue to see bullish pressure build up