Throughout last week’s transactions, the price of gold was in a continuous decline.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

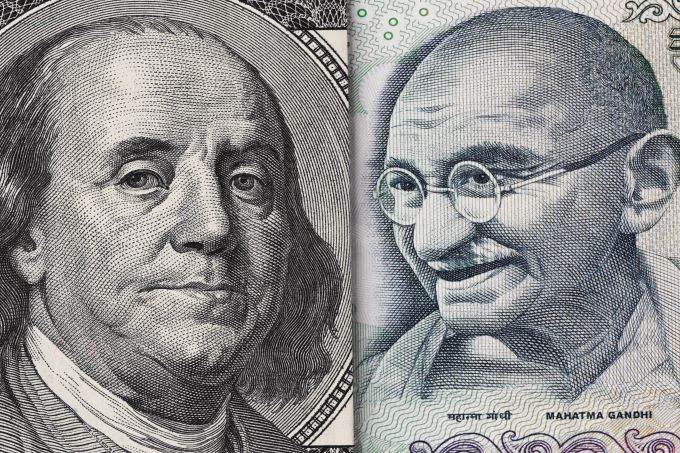

The US dollar has been selling off in the Forex market, as investors abandon it as a safe haven amid news of coronavirus vaccines and Trump’s initiation of a transition to Biden.

The British pound initially tried to rally during the course of the session on Friday, but then broke down to reach towards the 1.33 handle.

Top Regulated Brokers

The euro rallied again during the trading session on Friday, but remember that many people are away from their desks the day after Thanksgiving.

The Bitcoin market had a relatively quiet Friday, which is something that people needed to see in order to suggest that the uptrend will continue.

The US dollar fell slightly during the trading session on Friday, breaking down below the ¥104 level.

The Australian dollar rallied during the trading session on Friday, breaking above the 0.7350 level and then reaching towards the 0.74 handle.

The NASDAQ 100 pulled back during the trading session on Friday, but then rallied again to reach towards the 12,275 level, which was the most recent area for highs.

The West Texas Intermediate crude oil market pulled back a bit during the trading session on Friday, but found buyers underneath to support the market.

Bonuses & Promotions

The gold markets initially tried to rally during the trading session on Friday but then broke down significantly.

Silver markets pulled back during the trading session on Friday as we continue to see the move out of precious metals.

The S&P 500 pulled back a bit during the trading session on Friday to then turn around and show signs of strength.

The 13300.00 level may be giving speculators within the DAX Index a case of indigestion; several attempts have been made to sustain momentum above this mark in July, September and recently with limited success.

Traders of the USD/INR had to endure a difficult month of November trading.

November produced a strong amount of bearish momentum in the USD/ZAR and may raise suspicious eyebrows from speculators.