People will be trying to get away from the US dollar and closer to silver to protect their wealth.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Clearly, the buyers are in control as of late and likely will continue to be for the short term.

The best thing you can do is wait for a short-term pullback in order to take advantage of value in the euro.

Top Regulated Brokers

The market will look towards much higher levels and shoot through this like a beach ball that has been held underwater for far too long.

Price looking unlikely to break $20k.

2.5-year high price well above 1.2100.

The USD/ZAR continues to trade within the stronger elements of its bearish trend.

The USD/PKR is likely making speculators of the Forex pair rather nervous short term.

Starting off the month of November, the NZD/USD was challenging low water marks near 0.66000 as heightened risk-averse trading controlled sentiment.

Bonuses & Promotions

The USD/SGD has begun to show signs that its value may be reaching an accepted equilibrium and has demonstrated a rather tight range recently.

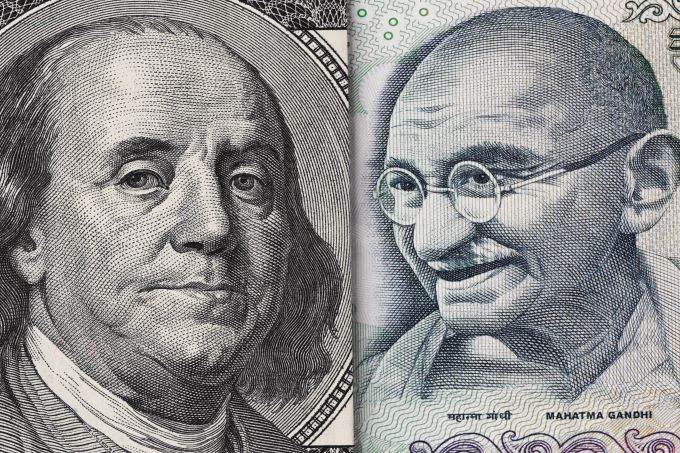

With India on course to breach 10,000,000 COVID-19 cases before the end of 2020, and after it entered its first recession since record-keeping began, S&P Global Ratings confirmed its 9.0% GDP contraction forecast for the 2020-2021 fiscal year.

Unlike most of its developed counterparts, New Zealand has control over the COVID-19 pandemic, similar to Singapore.

For three trading sessions in a row, the EUR/USD pair stabilized around and above the 1.2000 psychological resistance.

For the second month in a row, the British pound continues to achieve gains from optimism regarding a Brexit trade deal.

The price of gold surprisingly moved higher during yesterday's session.