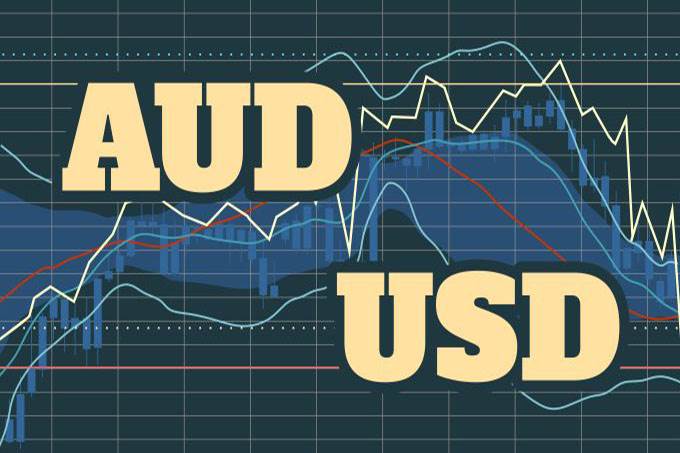

Price supported by ascending trend line.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Recent profit-taking sales pushed the EUR/USD towards the 1.2080 support.

Instability with a downward tendency is what recently characterized the GBP/USD performance.

Top Regulated Brokers

For the second week in a row, the price of gold is in a bullish correction range.

Stability around and below the 104.00 support level continues to fuel the survival of the USD/JPY in the range of a sharp downward channel.

In early trading this morning, the DAX Index has produced another solid leg upwards and its positive momentum is evident for all speculators to see.

The USD/BRL has developed what appears to be a sincere bearish trend since the end of October.

The 15.00000 mark was broken lower late yesterday via the USD/ZAR and its current value is sustaining the bearish trend.

After being able to display a solid bearish trend since late August, the USD/PKR has seen a small bullish reversal take place since the end of November.

Bonuses & Promotions

With the UK starting to vaccinate its population against COVID-19, global optimism continues to increase, and the debt burden of 2020 remains ignored.

With the COVID-19 pandemic resulting in governments around the world spiking debt to support their domestic economies and thus fueling an unsustainable debt bubble, central banks slashed interest rates but also spiked their gold purchases.

The pound is still trying to re-test the price channel and close below it, forming a broken pattern trend.

The AUD/USD pair rose at the beginning of the day's trading following optimistic data.

Bitcoin initially tried to rally during the trading session on Tuesday but continues to struggle with the idea of $20,000 above.

The Australian dollar pulled back a bit during the trading session on Tuesday, as we continue to see a lot of volatility in the markets in a relatively tight range.