Clearly, the USD/JPY performance is determined to end the 2020 trading year on a bearish note.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

BTC/USD has taken on the look of an equity index as it produces massive moves which have its believers singing its praises and speculators contemplating if they can still join the party.

The USD/ARS continues to produce a solemn and disastrous one-way direction in which the Argentine peso bleeds value.

Top Regulated Brokers

The AUD/USD rose within the general bullish trend, but the pair's rise was weak with the slowdown of the bullish momentum.

On early Monday, the USD/MXN produced a fear-induced spike higher as developing news regarding coronavirus caused momentary bedlam for many Forex pairs.

The USD/ZAR has consolidated the past day after seeing a spike higher two days ago.

The pair is showing short-term bullish price action.

The Brazilian real lost strength during the trading session on Tuesday as the US dollar got a boost against most currencies.

Bonuses & Promotions

The DAX Index gapped higher to kick off the trading session on Tuesday, fell a bit, and then closed relatively unchanged.

The West Texas Intermediate Crude Oil market pulled back during the trading session on Tuesday as we continue to see people worry about global risk appetite.

The S&P 500 has done very little during the trading session on Tuesday as we continue to see the markets focus on the holidays.

The NASDAQ 100 pulled back during the trading session on Tuesday as we continue to see a bit of malaise heading into the end of the year.

The Australian dollar fell during the trading session on Tuesday in what would have been very thin trading.

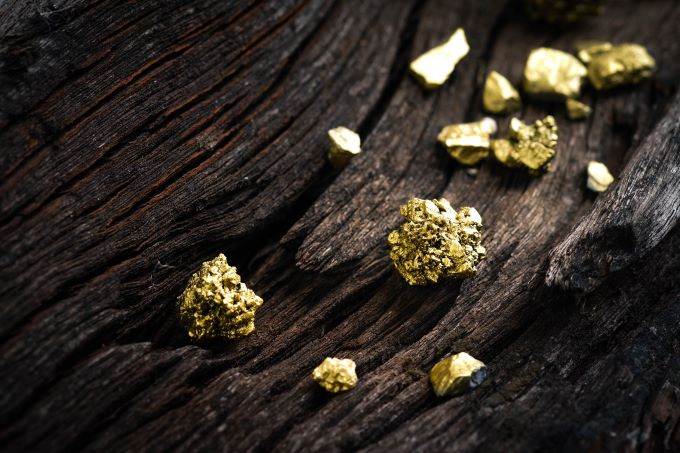

The gold market fell during the trading session on Tuesday, reaching down towards the 50-day EMA, just as we saw in the silver market.