Start the week of January 4, 2021 with our Forex forecast focusing on major currency pairs here.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

With risk appetite increasing due to announcements regarding coronavirus vaccines, the EUR/USD pair is correcting towards its highest gains and has so far reached the 1.2310 resistance, its highest since April of 2018.

The GBP/USD gained strong momentum during yesterday's trading session that pushed it towards the 1.3649 resistance, the pair's highest level since April 2018, where it stabilized as of this writing.

Top Regulated Brokers

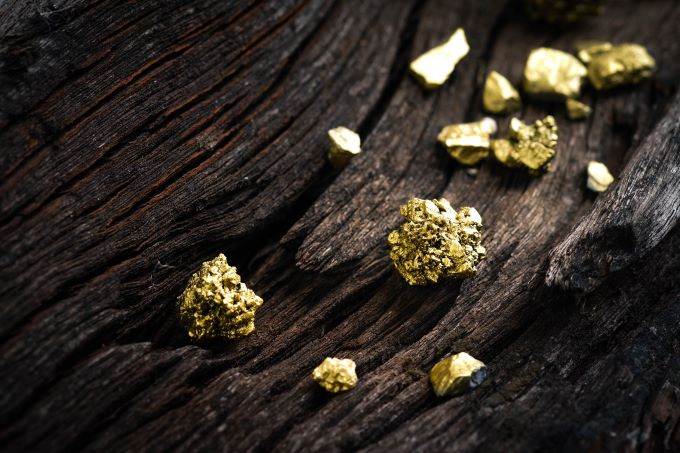

The price of gold received support from the USD's decline and tried to break through the level of psychological resistance at $1900 an ounce, which it reached at the beginning of this week’s trading.

The USD/JPY is about to close 2020 trading on a sharp decline, stable below the psychological support level at 103.00.

The AUD/USD pair rose yesterday to its highest level since April 2018 as increased investor risk appetite and USD sales helped boost the AUD.

The silver market has been rather quiet the past week and traders may have to be patient throughout the holiday to witness stronger moves emerge.

The holiday season has seen tight trading within the USD/BLR emerge the past week, but what should grab the attention of speculators is the ability the pair has shown to sustain its current value range.

The USD/MXN continues to flaunt its long-term bearish trend and is challenging price levels not seen since March of 2020.

Bonuses & Promotions

The USD/INR has seen downward momentum remain tantalizingly strong the past few trading days.

The euro rallied into the 1.23 level, an area of significant resistance that extends to the 1.25 handle.

The British pound rallied during the trading session on Wednesday to reach above the 1.36 level yet again.

The US dollar fell during the trading session on Wednesday to reach down towards the 14.50 rand level yet again.

The S&P 500 did very little during the trading session on Wednesday as we head towards New Year’s Eve, and traders are probably focused more on holidays than on trading.

The NASDAQ 100 is sitting just below the crucial 13,000 level, which will attract a lot of attention.