AUD/USD is consolidating near 0.6585, with technicals favoring a push toward 0.6700 as traders await US inflation data and the Fed’s next move.

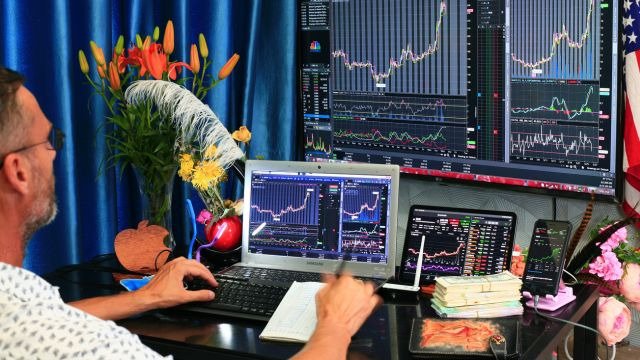

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

BTC/USD is consolidating near $112K, with weak US labor data and looming inflation reports raising the risk of a bearish breakout toward $107K support.

The EUR/USD pair remains bullish despite a pullback, with Fed rate cuts and steady ECB policy likely driving a push toward the 1.200 level.

Top Regulated Brokers

Gold surged to a record $3,659 per ounce on Tuesday, with Fed rate cut bets keeping XAU/USD bullish toward the $3,700 mark despite overbought signals.

EUR/USD remains bullish above 1.17 as traders eye ECB policy and US inflation data, though resistance at 1.1780–1.1860 could trigger a pullback.

The Nasdaq 100 hovers at 23,817 as buyers test resistance near 23,850, with US inflation data set to determine whether record highs can be challenged.

The S&P 500 holds near record highs at 6,511, with resistance at 6,520 in focus ahead of US inflation data that could shape Fed rate cuts.

A decrease in revenues over the past year, shrinking profit margins, rising competition, and negative reactions to Elon Musk’s political meddling create significant headwinds. Will a breakdown ignite a profit-taking sell-off?

Excessive valuations, shareholder value destruction, and issuance of new shares cloud an otherwise bright outlook. Will the head-and-shoulders pattern lead to more downside?

Bonuses & Promotions

The euro edged higher Monday but stayed locked in its 1.16–1.18 range, with ECB and Fed policy decisions set to drive the next breakout.

Bitcoin gained on Monday but remains capped by the 50-day EMA and $110K, with buyers eyeing $117K–$120K if resistance breaks.

Meta stock eased after initial gains Monday, with $800 acting as resistance and Nasdaq 100 weakness likely to weigh on its near-term outlook.

WTI crude oil is attempting a rebound but remains capped under $66, with strong supply pressures keeping the market in a potential “sell the rips” environment.

Gold broke out of consolidation Monday, with central bank buying and Fed rate cut expectations supporting a bullish move toward $3,800.

USD/CAD is finding dip buyers as weak Canadian jobs data drives risk-off flows, with a breakout above the 200-day EMA likely targeting 1.40.