The markets await a new rate hike announcement from the European Central Bank, the tone of its policy statement and the statements of the ECB governor

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The continued strength of the US dollar, supported by the expectations of a strong US interest rate hike in the coming months was enough to push the USD/JPY currency pair to move towards the 145.00 resistance level, its highest in 24 years.

The price of gold fell for a third day as the US dollar scale hit a record and Treasury yields rose amid expectations of further monetary tightening by the Federal Reserve.

Top Regulated Brokers

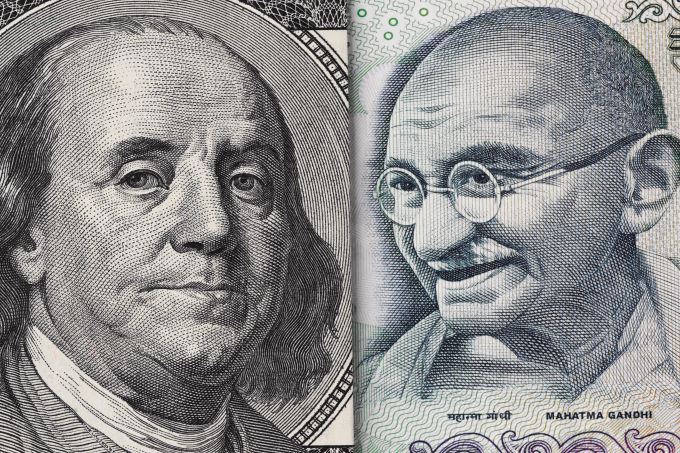

The USD/INR is trading near 79.6700 as of this writing, which is soundly within the scope of a higher price range when a long term approach is studied.

The GBP/USD has received a lot of bearish pressure recently as the Bank of England abandoned it regarding the future of its monetary tightening.

The Dow Jones Industrial Average rose in its recent trading at the intraday levels, to achieve sharp gains in its last sessions.

The USD/JPY has rallied significantly to reach the ¥145 level during the trading session on Wednesday but gave back the gain as we continue to see a lot of volatility and perhaps noise.

The GBP/USD fell initially during the trading session on Wednesday to dip below the 1.15 level.

The AUD/USD initially fell during trading on Wednesday to reach down to the 0.67 level.

Bonuses & Promotions

The S&P 500 rallied significantly during the trading session on Wednesday, testing the 3980 level.

The German index rallied rather significantly during the trading session on Wednesday to show signs of life.

The West Texas Intermediate Crude Oil market has broken down significantly during the trading session on Wednesday as the $85 level has been shattered.

Gold markets continue to be very volatile, initially dipping during the trading session on Wednesday only to turn around and show signs of life again.

The EUR/USD rallied rather significantly during the trading session on Wednesday to test the parity level.

Ethereum has initially fallen during the trading session on Wednesday but turned around as the $1500 level has offered a little bit of support.

.jpeg)