Ethereum markets have done very little during trading on Monday, as it is probably worth noting that the US dollar took a bit of a tumble.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The BTC/USD market rallied a bit during the trading session to break above the $22,250 level, gaining over 2% rather quickly.

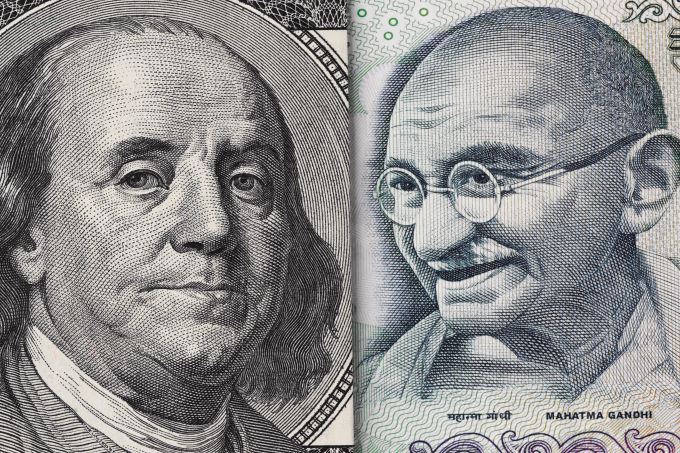

The USD/INR has continued to turn lower in early trading this morning, and has come within sight of support levels not seen since the second week of August.

Top Regulated Brokers

The EUR/USD moved sideways in the morning session as the market focused on the upcoming inflation data from the United States and some European markets.

The BTC/USD price continued recovering as investors focused on the upcoming Ethereum merge and US inflation data.

The AUD/USD price tilted upwards on Tuesday morning as the US dollar sell-off continued.

My previous GBP/USD signal on 5th September was not triggered, as there was no bearish price action when the price first reached the resistance level which I had identified at $1.1496.

Get today's recommendation on the lira against the dollar.

Spot natural gas prices (CFDS ON NATURAL GAS) advanced in the recent trading at the intraday levels, to achieve slight daily gains until the moment of writing this report, by 1.02%.

Bonuses & Promotions

The Dow Jones Industrial Average rose in its recent trading at the intraday levels, to achieve gains for the third consecutive session, by 1.19%.

Despite the recent hawkish signals from the European Central Bank and halting the pace of the record US dollar gains, the rebound gains for the EUR/USD currency pair did not exceed the 1.0113 level by the end of last week’s trading.

Despite the recent profit-taking sale of the USD/JPY currency pair, it is seen as healthy and normal after the currency pair's gains to its highest in 24 years.

Before the announcement of the growth rate of the British economy, the price of the GBP/USD currency pair is settling around the resistance level 1.1625.

The USD/BRL finished trading last week near the price of 5.1470, which is a short term lower price range.

The GBP/USD has rallied a bit during the trading session on Friday as the 1.15 level has offered a significant amount of support.

.jpeg)