This week I will begin with my monthly and weekly Forex forecast of the currency pairs worth watching.

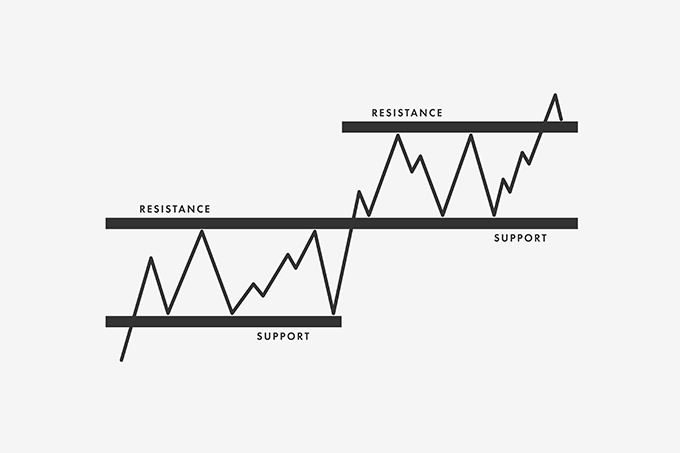

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

Start the week of September 25th, 2022 with our Forex forecast focusing on major currency pairs here.

A historic bearish trajectory took the GBP/USD to lows it has not seen since 1985.

Top Regulated Brokers

The EUR/USD will open around a price of nearly 0.96865 this week, barring a huge gap upon the start of its trading.

Get the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of September 25th, 2022 here.

The West Texas Intermediate Crude Oil market initially tried to rally on Thursday but gave back gain again as every time we rally it seems like people are jumping into push this market lower.

The USD/JPY has been all over the place during trading on Thursday, as the Bank of Japan jumped into the market and intervene.

The US dollar has rallied significantly against the Swiss franc during the trading session on Thursday as we have seen a huge move in the greenback overall.

The S&P 500 emitted a contract dropped a bit during the trading session on Thursday, as we continue to see a lot of noisy behavior.

Bonuses & Promotions

The NASDAQ 100 has fallen again during the trading session on Thursday as we continue to see a lot of negativities out there.

Gold markets have done very little during the trading session on Thursday, perhaps in a bid to take a bit of a breather after the massive moves that we have seen over the last couple of days that ended up in nothing but noise.

EUR/USD traders have tried to rally during the trading session on Thursday but as you can see, the market is likely to continue showing a lot of problems.

The EUR/CHF rallied rather significantly during the trading session on Thursday, reaching all the way to the 50-Day EMA.

The GBP/USD initially tried to rally during the trading session on Thursday piggybacking to show lackluster results.

The BTC/USD has been somewhat positive during the trading session on Thursday, as $18,000 level continues to be very important for the longer-term trend.