The West Texas Intermediate Crude Oil market has broken significantly through support, as the $80 level is now in the rearview mirror.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The AUD/USD pair continued crashing amid a strong US dollar and rising worries of the global economy. It dropped to a low of 0.6530, which was the lowest level

The BTC/USD price continued its consolidation phase during the weekend even as investors continued their fear in the market. Bitcoin was trading at 18,900

Top Regulated Brokers

The EUR/USD price continued falling as the strong US dollar continued its bullish trend. It crashed to a low of 0.9692, which was the lowest level in more than

The S&P 500 has fallen hard during the course of the trading session on Friday, to test the lows from June.

The GBP/USD price came under intense pressure as investors worried about the UK economy. It also crashed to a more than three-decade low as signs of a

The NASDAQ 100 has broken down significantly during the trading session on Friday as it looks like we are going to continue to see a lot of negativity.

The USD/ZAR has moved higher again in early trading this morning and the current price of the currency pair is near 18.04000 with dynamic conditions on display.

Bitcoin has fallen a bit during the trading session on Friday, losing almost 3% as we continue to see a lot of negativity out there.

Bonuses & Promotions

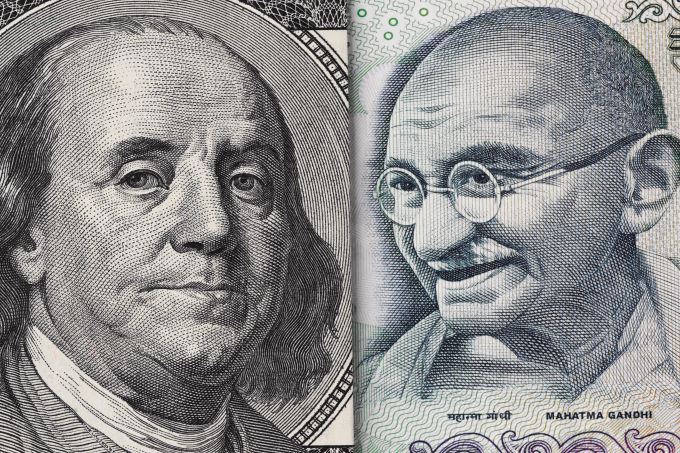

Trading the USD/INR may prove to be too dangerous for traders in the short term. Forex trading as a whole is producing a fireworks show globally and speculator

The EUR/USD currency pair has broken down significantly, losing almost 1.5% on Friday.

The US dollar has rallied on Friday as we continue the recovery from the ¥140 level.

The AUD/USD currency pair has broken down below the bottom of the hammer from the previous session to show even more weakness on Friday.

The US dollar has rallied yet again against the Canadian dollar during trading on Friday, as we are now threatening to break above the 1.36 level.

The New Zealand dollar has fallen significantly during the trading session on Friday, as the market has been quite negative for some time.