After the strong bullish move last Friday, XAU/USD (gold) price showed no direction throughout the trading day on Monday.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The Japanese Yen weakened again despite signs that Japan strengthened its defense of the currency with a second intervention in two sessions.

The GBP/USD exchange rate has surged strongly in recent trading and may rise further in the short term.

Top Regulated Brokers

With the start of this week's trading, the price of the EUR/USD currency pair succeeded in maintaining the gains of the end of last week.

The GBP/USD is trading within sight of the 1.13000 mark as of this morning.

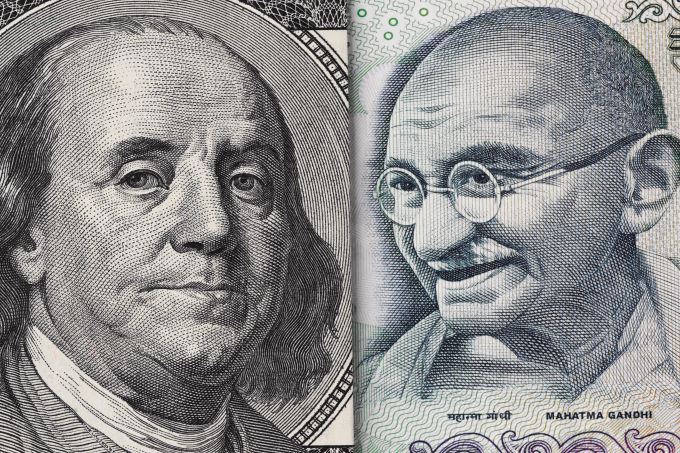

The USD/INR is trading near the 82.7600 realm as of this writing.

The GBP/USD price moved sideways as investors welcomed the new developments from the UK.

The EUR/USD held steady in the overnight session as the market reflected on the relatively weak European and American economic data.

The BTC/USD price continued consolidating this week amid a period of low volatility and volume.

Bonuses & Promotions

The AUD/USD price retreated slightly ahead of the upcoming government budget and after Xi Jinping’s new mandate.

The EUR/USD initially fell during the trading session on Monday, but then turned around to show signs of life again.

Gold markets have shot higher initially during the trading session on Monday but gave back gains.

The West Texas Intermediate Crude Oil market has gone back and forth over the course of the trading session on Monday, as we continue to hang around the $85 level.

The BTC/USD market has fallen a bit during the trading session on Monday as we continue to see a lot of lackluster momentum.

The Ethereum market has pulled back from the 50-Day EMA, and therefore looks as if it is not ready to go higher yet.

.jpeg)