In my previous analysis of the EUR/USD currency pair last Monday, I thought that we had a weakly bearish environment now.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The USD/CHF has fallen rather hard during the trading session on Wednesday, as the Swiss franc has taken full advantage of it.

The EUR/USD rallied again during the trading session on Monday, as the PMI figures coming out of the United States showed contraction.

Top Regulated Brokers

The EUR/GBP has fallen hard during the trading session on Wednesday, reaching down to the 200-Day EMA, right at the 0.86 GBP level.

The GBP/USD has rallied significantly during the session on Wednesday, to break above the psychologically important 1.20 level.

The AUD/USD has rallied a bit during the trading session on Wednesday, as the world is waiting for the FOMC Meeting Minutes.

Despite the recent gains of the EUR/USD currency pair, which recently affected the resistance level 1.0482, it stabilized after selling operations around the level of 1.0292 at the time of writing the analysis.

The Turkish currency maintained a limited range against the US dollar during trading today, Wednesday.

Sterling has bounced back from its previous sharp losses so far in the latest quarter, but it is likely to remain one of the biggest weak performers in the major currency complex into the new year 2023,

Bonuses & Promotions

The Dow Jones Industrial Average returned to rise during its recent trading at the intraday levels, to achieve gains in its last sessions, by 1.18%.

Spot natural gas prices (CFDS ON NATURAL GAS) continued to rise in early trading on Wednesday, to achieve new daily gains until the moment of writing this report, by 2.29%.

Amidst the bullish momentum enjoyed by the performance of the USD/JPY currency pair, the pair is awaiting important and influential US economic data.

XAU/USD gold futures recorded small gains yesterday, rebounding to the $1750 level, recovering from a decline towards the $1732 level.

The USD/CAD has moved lower after hitting a short-term high on Monday, the downwards momentum has returned the currency pair back to its recent bearish mode.

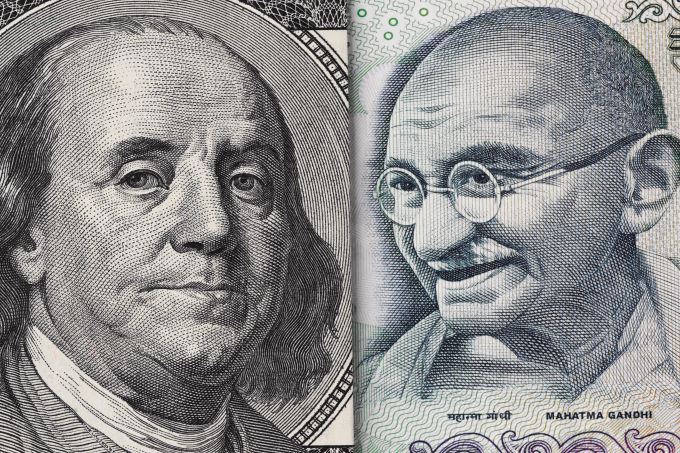

The USD/INR is trading near the 81.8100 mark as of this writing having put in solid incremental gains the past week.