Get the Forex Forecast using fundamentals, sentiment, and technical positions analyses for major pairs for the week of December 11th, 2022 here.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

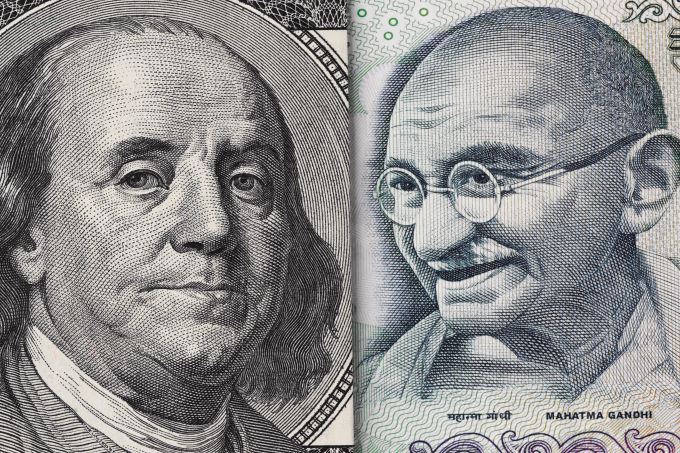

The USD/INR rallied a bit during the trading session on Wednesday, to break above the ₹82.50 level, before attempting to do the same thing on Thursday.

The S&P 500 rallied a bit during the trading session on Thursday but seems to be struggling to hang onto the gains.

Top Regulated Brokers

The NASDAQ 100 has rallied a bit during the trading session on Thursday as we are trying to recapture the 50-Day EMA.

The Hang Seng has rallied again during the trading session on Thursday, as we continue to flirt with the 200-Day EMA.

The BTC/USD has rallied ever so slightly during the trading session on Thursday, gaining 8/10 of a percent by the time the Americans were wrapping up the afternoon.

Gold markets have rallied a bit during the session on Thursday as we continue to see markets move toward the crucial $1800 level.

The EUR/USD has been trying to rally significantly for a while now.

The DAX initially dipped a bit during the trading session on Thursday, as the market looks as if it is getting a little bit “tired.”

Bonuses & Promotions

The GBP/USD has done very little during trading on Thursday, but it has shown itself to be somewhat resilient.

The AUD/USD has rallied a bit during the trading session on Thursday as we continue to see it consolidate overall.

The Dow Jones Industrial Average settled unchanged during its recent trading on intraday levels, achieving almost unnoticed gains, gaining about 1.58 points only.

EUR/USD is still trying to hold on to the 1.0500 resistance level, to confirm the bulls' control.

Two days after the GBP/USD was subjected to selling operations the currency pair moved towards the support level of 1.2106.

The recent upward rebound attempts of the USD/JPY currency pair stopped at 137.85 yesterday.