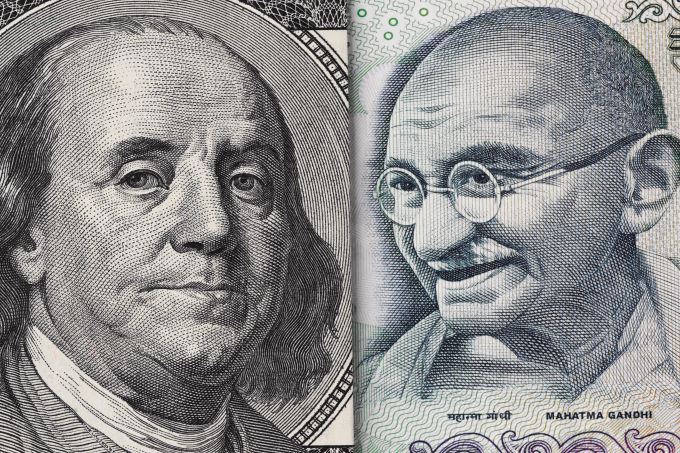

The USD/INR was trading near a high around the 82.7550 ratio last Friday as the currency pair likely continued to make speculators who were attempting to sell rather frustrated.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

The West Texas Intermediate Crude Oil market has pulled back just a bit early during the day on Tuesday, only to turn around and show signs of life.

The S&P 500 has gone back and forth during the trading session on Tuesday, as Jerome Powell had a speech, essentially reiterating everything he’s been saying for quite some time.

Top Regulated Brokers

The Hong Kong Hang Seng index has been rather bullish for some time, which is why I’ve started to cover it a bit more.

The DAX continues to show signs of strength, as it looks like we are trying to break out.

The New Zealand dollar has pulled back ever so slightly during the trading session on Tuesday, as the 0.64 level continues to be very resistant.

The CAC has been somewhat quiet during the trading session on Tuesday, as we continue to hover around the €6800 level.

The USD/JPY exchange rate came under pressure after the latest statement by Jerome Powell and after important Japanese economic numbers.

The EUR/USD price was unchanged after the latest warning by the World Bank on the global economy.

Bonuses & Promotions

The AUD/USD pulled back in the overnight session as focus shifted to the upcoming American consumer inflation data.

My previous GBP/USD signal on 5th January was not triggered, as there was no bullish price action when the price first reached the two support levels that day.

The exchange rate of the TRY/USD recorded a strong movement over the past two days.

Spot natural gas prices (CFDS ON NATURAL GAS) fell during their early trading on Tuesday, to record daily losses until the moment of writing this report by -4.92%.

The Dow Jones Industrial Average declined in its recent trading on intraday levels, recording losses in its last session by -0.34%, to lose about -112.96 points.

As of this writing the USD/JPY is trading near the 132.100 ratio with typical fast price action occurring.