The Dow Jones Industrial Average advanced its recent trading on the intraday levels, to achieve gains for the second session in a row, by 0.76%, adding the index to it about 254.07 points.

The following are the most recent pieces of Forex technical analysis from around the world. The Forex technical analysis below covers the various currencies on the market and the most recent trends, technical indicators, as well as resistance and support levels.

Most Recent

At the beginning of this week's trading, XAU/USD gold prices declined.

The TRY/USD recorded stability during morning trading today, Tuesday.

Top Regulated Brokers

In a twist of irony, the Nifty 50 has been walking along the 50-Day EMA, which of course, is flat.

The NASDAQ 100 has rallied significantly during the trading session on Monday, as we continue to see more of a “risk on” attitude in the United States,

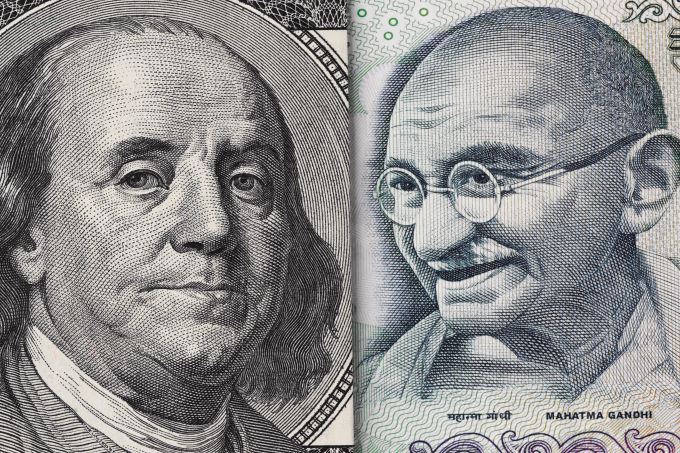

The USD/INR is near values traded last Wednesday, but what happened between then and now shows a large amount of volatility which is likely to continue.

The S&P 500 rallied during the trading session on Monday, slamming into the downtrend line that has been so crucial.

The NZD/USD is near the 0.65040 ratios as of this writing as the currency pair seemingly shows the ability to sustain higher values.

The West Texas Intermediate Crude Oil market has rallied slightly during the trading session on Monday, as we continue to try to break above the highs of the previous week.

Bonuses & Promotions

Gold markets have gone back and forth during the choppy Monday session as we continue to see a lot of hesitation at this point.

The USD/CAD has gone back and forth during the trading session on Monday, as we continue to hang around the 1.3350 level.

The USD/JPY rallied during the trading session on Monday, as we continue to see the market showing signs of support underneath the ¥130 level.

The GBP/USD has gone back and forth during the session on Monday, as we continue to see a lot of noisy behavior.

The EUR/GBP rallied a bit during the trading session on Monday, to break into the previous bearish candle that had traders shorting.

The AUD/USD has broken above the 0.70 level, showing signs of strength yet again.