Fundamental Analysis & Market Sentiment

I wrote on the 1st February that the best trades for the week would be:

- Long of the EUR/USD currency pair following a daily close above $1.2039. This did not set up.

A summary of last week’s most important data in the market:

- Preliminary UoM Inflation Expectations – fell from 4.0% to 3.5%.

- European Central Bank Main Refinancing Rate & Monetary Policy Statement – rates left on hold as expected.

- Bank of England Official Bank Rate, Votes, Monetary Policy Summary & Report - rates left on hold as expected, but there were a couple more abstentions on the vote than were expected, which was a minor dovish tilt, boosting chances of a rate cut in the near term.

- RBA Cash Rate, Rate Statement, and Monetary Policy Statement – the RBA hiked its interest rate by 0.25% as was expected, albeit with 73% probability, so the Australian Dollar rose following this news.

- US JOLTS Job Openings – this was a little worse than expected, which was slightly negative news on the US economy.

- Preliminary UoM Consumer Sentiment – stronger than expected, which was positive news on the US economy.

- US ISM Services PMI – approximately as expected.

- US ISM Manufacturing PMI– considerably stronger than expected, which was positive news on the US economy.

- New Zealand Unemployment Rate – unexpectedly ticked higher to 5.4%.

- Canada Unemployment Rate – unexpectedly fell from 6.8% to 6.5%.

- US Unemployment Claims – slightly higher than expected.

The only two elements here which really affected the markets last week was the continued bullish performance of the US economy, which keeps rate cut expectations low, and the RBA’s rate hike which kept the Australian Dollar performing as the strongest major currency.

Top Regulated Brokers

The other two relevant issues are

- The continuing US military build up against Iran, although the USA and Iran began talks last Friday, with President Trump publicly saying they are going well. Prediction markets currently see a US attack on Iran before July as unlikely.

- An election to the more powerful Lower House of the Japanese Parliament is being held today (Sunday), and opinion polls suggest the new LDP administration will probably win a landslide. This may weaken the Japanese Yen further as the administration truly requires a weaker Yen, or it could be a case of “sell the fact”, which would present a Yen rebound recovery when results start to emerge.

The Week Ahead: 9th – 13th February

The coming week’s most important data points, in order of likely importance, are:

- US CPI (inflation)

- US Average Hourly Earnings

- US Retail Sales

- US Non-Farm Employment Change

- Swiss CPI (inflation)

- UK GDP

- US Unemployment Rate

- US Unemployment Claims

Wednesday will be a public holiday in Japan.

Monthly Forecast February 2025

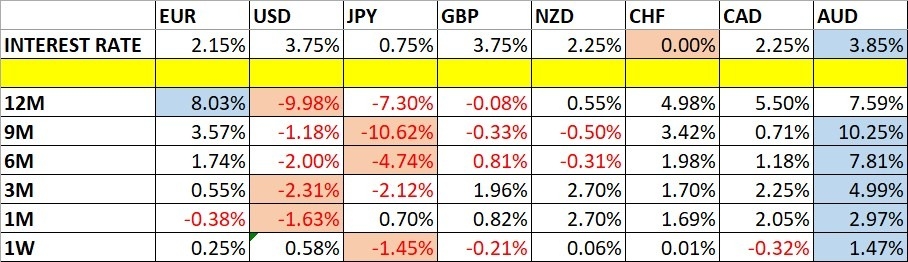

Currency Price Changes and Interest Rates

For the month of February, I forecasted that the EUR/USD currency pair would rise in value.

February 2026 Monthly Forecast Performance to Date

Weekly Forecast 9th February 2026

Last week saw one cross with excessive volatility, so I made the following weekly forecast:

- Short AUD/JPY

The Australian Dollar was the strongest major currency last week, while the Japanese Yen was the weakest. Directional volatility rose significantly last week, with one third of all major pairs and crosses changing in value by more than 1%.

Next week’s volatility is likely to be similar.

You can trade these forecasts in a real or demo Forex brokerage account.

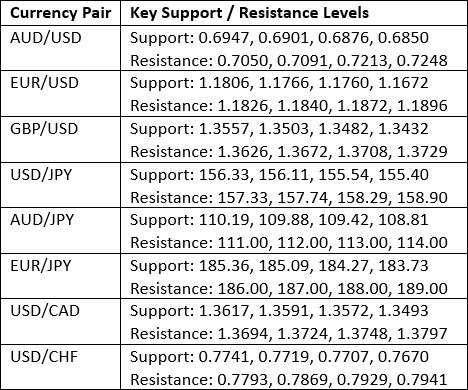

Technical Analysis

Key Support/Resistance Levels for Popular Pairs

Key Support and Resistance Levels

US Dollar Index

Last week, the US Dollar Index printed a bullish candlestick which closed higher but with a significant upper wick, signifying some indecision. This is weakly bullish by itself, but we also have a long-term bearish trend with the price below its levels of both 13 and 26 weeks ago. This gives us a conflicted technical picture about the US Dollar.

So, I see the outlook now as uncertain and the best market opportunities will probably not be US Dollar-dependent.

US Dollar Index Weekly Price Chart

AUD/JPY

The AUD/JPY currency cross made a very strong upwards move, with the weekly close almost right at the high of the range, with unusually high volatility. The price made a bullish breakout to a new 30+ year high.

These are very bullish signs, as are the facts that the Australian Dollar was the strongest major currency last week, backed by an RBA rate hike, while the Japanese Yen continues to depreciate against most currencies as part of its long-term bearish trend, driven by the massive level of Japanese debt.

While this may look like the perfect bullish storm, an excessive weekly move like this is often followed by a retracement for at least a few days, so a drop in price over the next week would not surprise me.

This pair is likely to see the most action in the Forex market next week, at least until the US CPI data is released, so it might be interesting for swing traders on the long side or day traders on the short side.

AUD/JPY Weekly Price Chart

Dow Jones Industrial Average

The major US equity indices like the S&P 500 Index and the tech-focused NASDAQ 100 Index are looking very choppy as they struggle to make new highs, showing swings with high volatility. This suggests an unstable market which, although bullish, may be about to reverse.

Yet, the old fashioned, old economy Dow Jones Industrial Average had a very strong week, closing right on its high at a new record, and breaking the big round number at 50,000 too. These are bullish signs, suggesting that it is the big tech firms which dominate the major indices which are causing poor price action. Away from the big tech giants, we see the basic sectors of the old economy doing well enough to make new record highs.

I am not strongly confident of this trade, but I think a long trade here with a trailing stop loss, due to the US economy’s historically strong track record, is worth taking. You might want to use a smaller than usual position size, like 50% for example.

Dow Jones Industrial Average Weekly Price Chart

Bitcoin

BTC/USD has continued to make significant bearish breakdowns below a few long-term support levels from just above $81,000 and has recently reached a new 16-month low. This is technically very significant in a bearish way.

While stocks and precious metals were rising strongly over recent months, Bitcoin fell from a record high a few months ago and continued to decline. It is clear the crypto sector is in decline, and that Bitcoin is in serious trouble. Bitcoin was meant to change the world, but outside of Africa, is just has not – you still can’t use it and it is unclear what value it really holds.

I do not like shorting assets, and Bitcoin now seems to be staging a recovery, with a significantly long lower wick now showing on the current weekly candlestick.

I think the price to watch is the support level at about $68,500. If the price action settles above this support, the fall will likely at least pause for a while. If the price action settles below this level, we will likely see a further drop towards the $50,000 area soon.

Bitcoin Weekly Price Chart

XAU/USD

Gold, like Silver, saw a massive drop in just a day or two at the end of January. The drop is Silver was stronger, but Gold fell quickly from a record high at about $5,600 to a low at $4,400 by the end of the week, which is shown within the daily price chart below.

Applying a Fibonacci retracement study, we can see that the halfway level of this movement is very confluent with a major round number at $5,000 and this has held firmly as resistance.

The price action suggests we are going to get a consolidation now on gradually declining volatility, like a struck tuning fork playing itself out.

I think short trades from rejections of the $5,000 level as this plays out, provided they are handled skillfully as short-term trades on lower timeframes, is probably going to be the best strategy for trading Gold over the coming week.

If the price gets established above $5,000 that will be a contradictory bullish sign.

Gold Daily Price Chart

Bottom Line

I see the best trades this week as:

- Long of the Dow Jones Industrial Average.

Ready to trade our Forex weekly forecast? Check out our list of the best Forex brokers.