At the time of writing, crypto assets are seeing relief rallies across the board, with Bitcoin climbing back above $78,000 and Ether recovering toward $2,300.

Top Regulated Brokers

What Caused the Crypto Flash Crash?

The sharp downturn in crypto prices stemmed from a confluence of macroeconomic and geopolitical factors amplified by low weekend liquidity and leveraged positions. Escalating U.S.-Iran tensions raised fears of broader conflict, prompting investors to offload risk assets, including Bitcoin, which failed as a safe haven.

A surging U.S. dollar, fueled by Kevin Warsh's nomination for the Federal Reserve Chair role signaling a potential "hard money" policy shift, made dollar-denominated assets more expensive for global buyers and contributed to selloffs in gold, silver, and risk-on assets like cryptocurrencies.

U.S. dollar index. Source: TradingView

U.S. dollar index. Source: TradingView

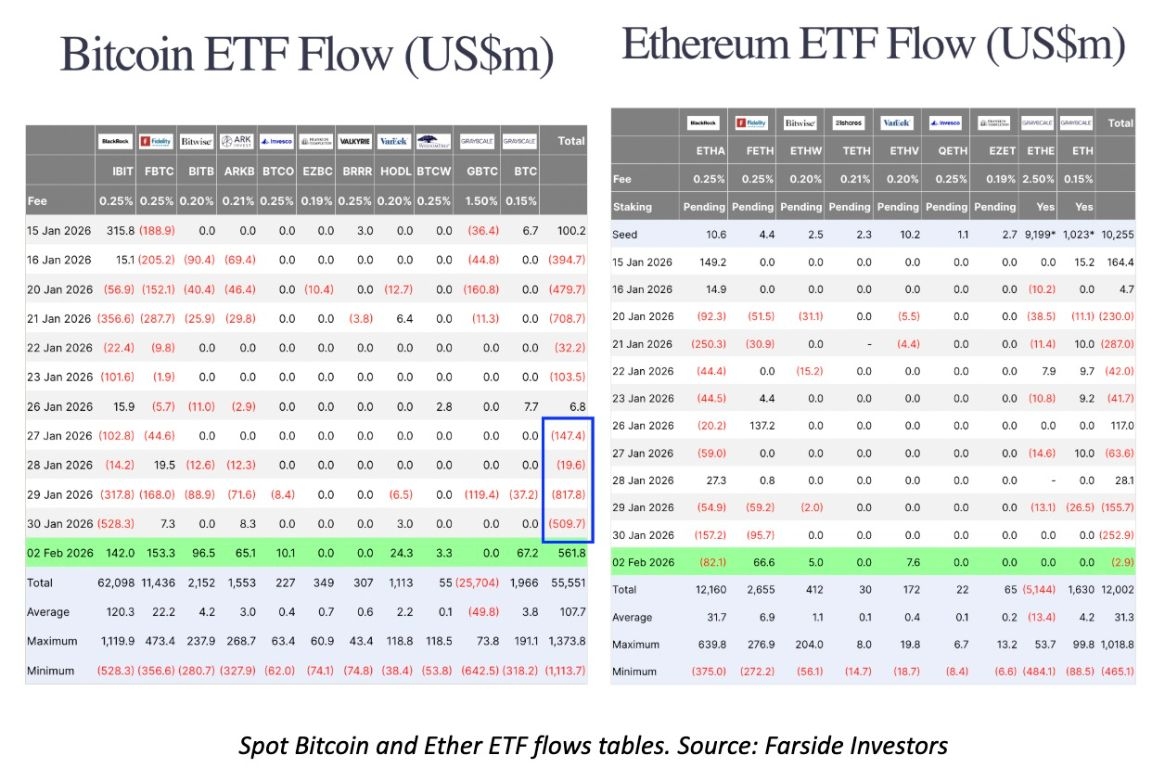

Compounding the pressure were significant outflows from U.S. spot Bitcoin ETFs, totaling nearly $1.5 billion over the prior week, alongside $327 million from Ether ETFs, reflecting a broader retreat from risk-on investments.

Spot Bitcoin & Ether ETF flows tables. Source: Farside Investors

Spot Bitcoin & Ether ETF flows tables. Source: Farside Investors

Fears of a partial U.S. government shutdown and potential popping of the AI investment bubble further eroded confidence.

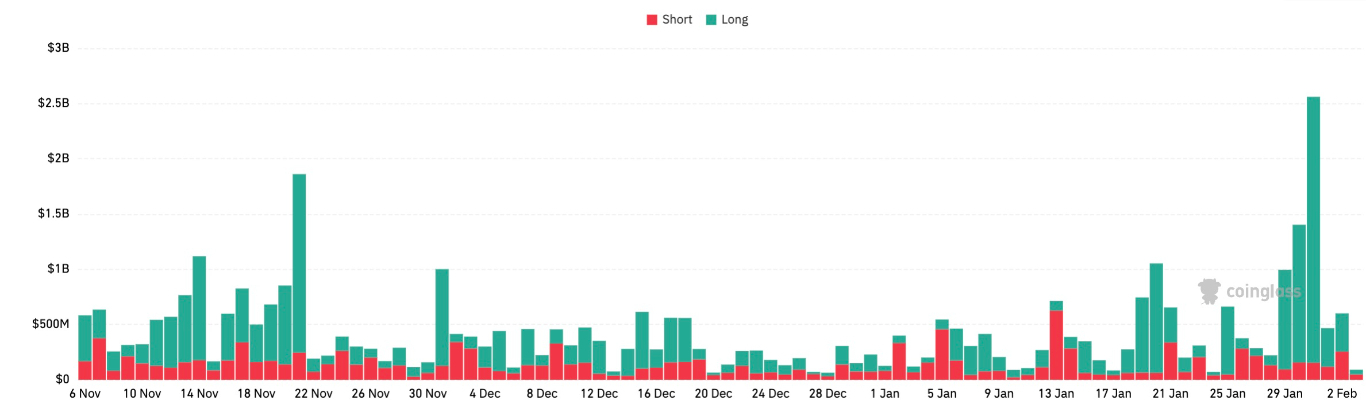

The crash accelerated into a liquidation cascade, with nearly $5.4 billion in leveraged long positions wiped out over 72 hours—$4.9 billion from longs alone. Bitcoin accounted for $1.88 million of all liquidations, while Ether saw $1.9 billion, over the same period. Thin weekend liquidity exacerbated the domino effect, turning modest selling into forced capitulation and erasing hundreds of billions in market value.

Crypto liquidations across all exchanges. Source: CoinGlass

This event exposed underlying fragilities in the post-boom market, where excessive leverage had built up during prior highs.

Bitcoin's Plunge to $74,000: Has the Bottom Been Reached?

Bitcoin's flash crash to a nine-month low of $74,500 extended its deviation to 41% from its $126,000 all-time high reached in October 2025. This drawdown saw the largest cryptocurrency by market capitalization breach key support levels, such as the $80,000 psychological level and Strategy’s costs basis around $76,000.

BTC/USD daily chart. Source: TradingView

Analysts’ opinions remain divided on whether this represents a final bottom or if further downside looms. Some highlight $74,000 as a critical weekly support zone that could temporarily halt selling and trigger a sharp recovery, as seen in April 2025.

If this happens, Bitcoin could embark on a V-shaped recovery, with the first line of resistance emerging from the 50-day SMA at $88,790, the $90,000 psychological level, and the 100-day SMA at $92,400. Higher than that, the BTC/USD pair could rise to tag the range high at $98,000 reached on Jan. 14.

However, some experts warn of prolonged pain. Bearish signals include a confirmed downside breakout, with targets potentially extending to $68,000 (near the 200-week EMA) or even lower in extreme scenarios.

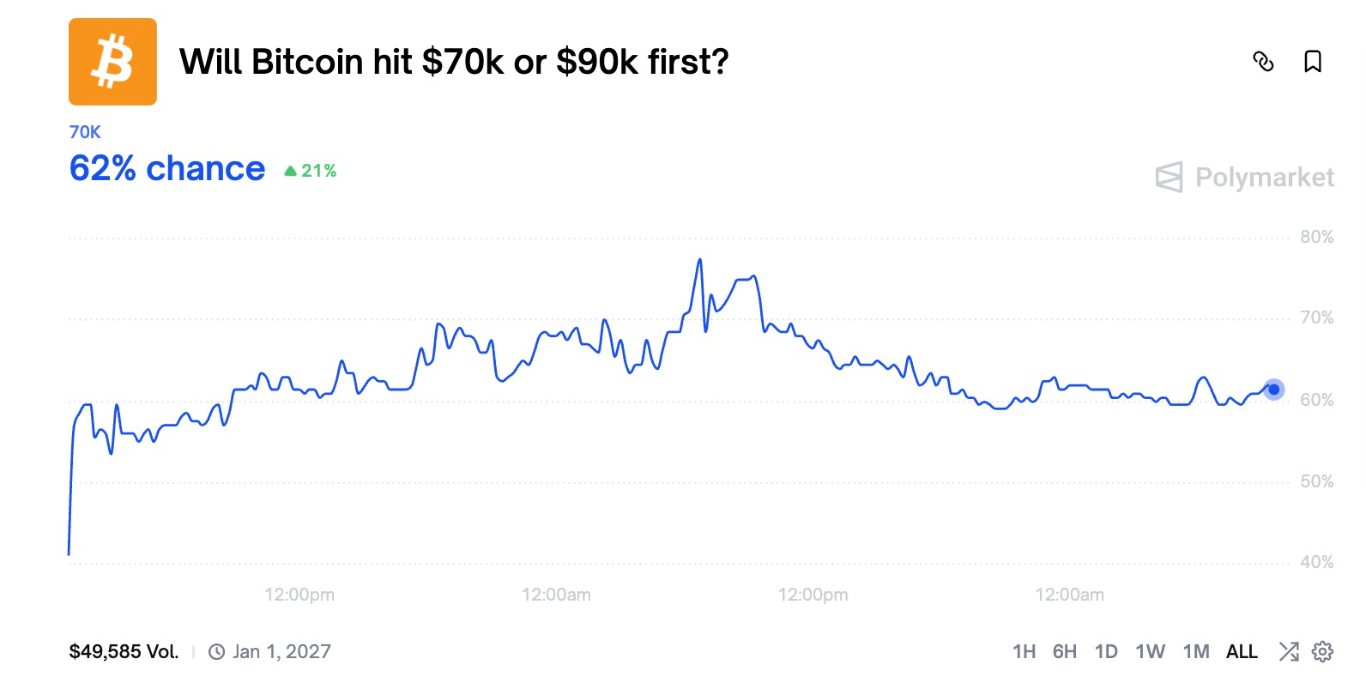

Prediction markets reflect pessimism, showing a 62% probability of Bitcoin hitting $70,000 before reclaiming $90,000.

Bitcoin target price probabilities. Source: Polymarket

Parallels to the 2022 crypto winter raise concerns that speculative excess has not fully unwound, potentially leading to months of consolidation or deeper declines if macro headwinds persist.

While the swift recovery to around $78,000 offers some relief, the consensus leans cautious: no clear bottom until leverage is purged and sentiment stabilizes.

Ether's Drop to $2,100: Is a Recovery Toward $3,000 Feasible in the Near Term?

Ether plunged to lows around $2,150 during the weekend’s rout, down sharply from its August 2025 peak of $5,000 and reflecting a 52% drawdown. The sell-off saw the altcoin hit the bearish target of a symmetrical triangle, as seen in the chart below.

ETH/USD daily chart. Source: TradingView

Technical indicators and on-chain data suggest heavy bearish pressure, with potential for further tests if support fails. However, the asset rebounded to around $2,300 at the time of writing, indicating initial stabilization amid broader market recovery.

A return toward $3,000 in the near term could be derailed by stiff overhead resistance from the $2,400-$2,800 support band, which has now turned into a formidable barrier.

Reclaiming $3,000 could signal renewed momentum, especially if Bitcoin's rebound holds and ETF inflows resume. Historical resilience during corrections, combined with Ethereum's institutional adoption and network upgrades, supports the case for upside.

Yet ongoing macro risks, geopolitical tensions, dollar strength, and liquidation overhangs, could cap gains or trigger retests of lower levels like $2,100-$2,000.

Ready to trade our analyses of Bitcoin and Ethereum? Here’s our list of the best MT4 crypto brokers worth reviewing.