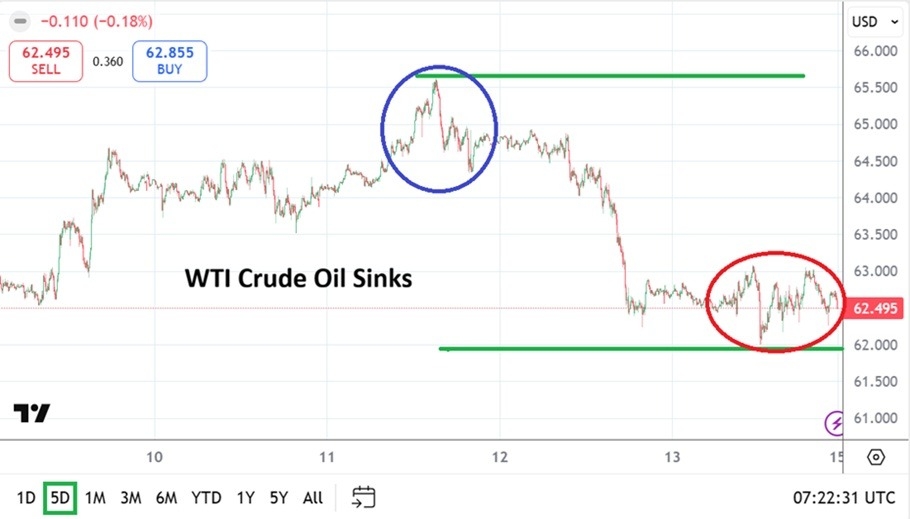

WTI Crude Oil finished near its low for the week on Friday around 42.495, the commodity had tested the 62.000 USD ratio earlier in the day. The high for WTI Crude Oil occurred on Wednesday when the 65.700 mark was challenged.

However, after touching this height, which brought the commodity to within sight of highs seen late in January, WTI Crude Oil ran into pressure downwards. Within hours on Wednesday WTI Crude Oil found itself battling the 65.000 level.

Thursday continued to see some fighting around the 65.000 ratio, but again selling pressure started to mount and this time found the $63.000 level vulnerable as bears started to build power. Upon Friday’s trading beginning, more selling was seen and WTI Crude Oil pushed towards the 62.500 ratio, there was a slight fight higher which brought 63.000 back into sight, but then a push lower sank the commodity to its low for the week.

Top Regulated Brokers

Terrain Has Been Established in WTI Crude Oil

The run higher in the middle of the week for WTI Crude Oil was likely a solid attempt by large speculative players helped by corporate buyers, but the commodity certainly ran into durable resistance. Now the question that will be heard as trading is considered for the start of this coming week is if WTI Crude Oil will run into durable support. Traders should note that the U.S is on holiday tomorrow, so the answer will only come on Tuesday and afterwards.

The downward trajectory of WTI Crude Oil should not have surprised traders, the commodity has been within an established lower realm over the mid-term and has faced selling pressure in many regards the past year. WTI Crude Oil has shown an inability to really create sincere momentum higher. Supply and production remain strong in the commodity, so day traders looking for opportunities will most likely continue to look for places to sell – and then slight reversals higher.

Momentum and WTI Crude Oil Now

Getting a hold of momentum lower at the current juncture may be looked at suspiciously by technical traders who will like perceive support has been prevalent at the prices now being displayed since the 3rd of February.

- But for those with a taste for adventure, WTI Crude Oil was below 62.000 USD before that, and in January for a solid amount of time the commodity traversed below 60.000.

- Yes, there is still a shadow via the build up of U.S military hardware in the Middle East poised for action against Iran, and perhaps this may create price support.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 60.640 to 66.200

WTI Crude Oil remains in a rather nervous position considering the lower realm it has practiced in many respects regarding historical prices. The commodity is still at a lower value based on long-term considerations, but drilling and production of WTI Crude Oil are strong. The shadow of Iran may create some worry regarding stability for energy supply, but large traders in WTI Crude Oil are experienced and during the past year in which noise from the Middle East has often been loud, massive buying has not found a sustained trajectory.

WTI Crude Oil below the 63.000 may appear cheap to many people, but the commodity has certainly been lower in the not so distant past. U.S inflation was lower than expected via the CPI data on Friday and that is because gasoline has been cheaper across the board. The supply of WTI Crude Oil is solid and this is likely not going to change mid-term. While worries persists about worse case scenarios in the Middle East, the simple fact is that experienced traders with large positions are relatively calm. Looking for lows in WTI Crude Oil to persists near-term may not be a mistake.

Ready to trade our weekly forecast? Here are the best Oil trading brokers to choose from.