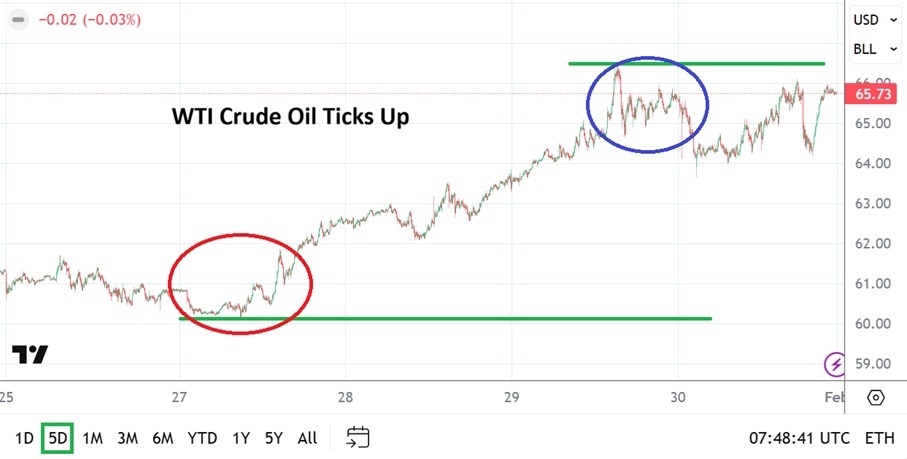

Day traders have been treated to two upwards weeks in WTI Crude Oil and the commodity went into this weekend around 65.730. The last time WTI Crude Oil has traversed these prices was in the last week of September.

And the last time WTI Crude Oil sustained this type of higher price realm was the second week of June 2025 until the end of July. We have seen higher prices in WTI Crude Oil, what is interesting perhaps to technical traders is that the upwards momentum in the commodity has started to show signs of resilience.

Technically support at the 60.000 USD mark held throughout the past week and had begun to show the ability to do this on Friday the 23rd of January. As tomorrow’s trading begins in WTI Crude Oil some commodities traders may believe a speculative buying game can ensue.

Top Regulated Brokers

Jolts and Chaos of Commodity Trading the Past Week

In actuality WTI Crude Oil is still behaving quite well. That sentence is written via the perspective that bone crushing velocity was not seen. Yes, WTI Crude Oil certainly moved higher, on Tuesday jumping from around the mid 60.00 price to the mid 62.00 mark with signs of flirting upwards, Wednesday essentially climbing to the mid 63.00 realm. Thursday and Friday’s price action achieved more upwards momentum clearly.

However, compared to the chaos of the metals markets and perhaps even the soft commodities like cocoa and coffee, WTI Crude Oil has remained polite. Will this change? Commodities have a tendency to show speculative power cyclically in big doses, and WTI Crude Oil has been rather calm the past handful of months. The bearish trend seen in WTI Crude Oil in which the price consistently lowered has certainly shown the ability to stop and reverse higher the past two weeks. Yes, the Iranian situation lingers, but this is likely not the cause of the movement higher.

However, compared to the chaos of the metals markets and perhaps even the soft commodities like cocoa and coffee, WTI Crude Oil has remained polite. Will this change? Commodities have a tendency to show speculative power cyclically in big doses, and WTI Crude Oil has been rather calm the past handful of months. The bearish trend seen in WTI Crude Oil in which the price consistently lowered has certainly shown the ability to stop and reverse higher the past two weeks. Yes, the Iranian situation lingers, but this is likely not the cause of the movement higher.

Iran and Venezuela and the Global Energy Market

There is nothing quite like noise taking over the marketplace with well-meaning banter claiming all types of reasons for sudden price changes in commodities. Weather, war, politics, trade deals and the fact that Mrs. Smith’s dog suddenly developed a cough can all be pointed to, but are any of these reasons correct?

- Commodity traders are experienced and the larger players in the markets have plenty of inside intelligence they have been looking at for months, and years in the past.

- They also have outlooks they are dealing with and then there is this little word: speculation.

- Commodities move faster sometimes simply based on the fact that large orders are coming in and behavioral sentiment shifts.

- WTI Crude Oil is not immune to influences.

- More buyers have come into the energy sector the past two weeks.

- Is it because they want to gamble on prices, believe there is a danger of Middle East chaos, is it a combination of both?

- And there are other reasons like supply and demand, which, by the way, are quite robust.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 59.200 to 70.100

WTI Crude Oil has certainly traded higher. Lower ground around the 60.000 and the mid 60.000 vicinities now appear to be support for the time being. The question as the week starts is if the higher 65.000 mark will now prove durable as support? Commodities have certainly shown power in different sectors the past couple of weeks.

The sudden jump higher in WTI Crude Oil can almost be said to be surprising, but obviously some buyers are showing a taste for the commodity. WTI Crude Oil has traded as higher prices all experienced speculators know in the past. The ability of WTI Crude Oil to raise and sustain incremental upwards moves has been strong the past two weeks. Risk management is always necessary in WTI Crude Oil. Prices can reverse quickly and this can cost a speculator a lot of money.

Ready to trade our weekly forecast? Here are the best Oil trading brokers to choose from.