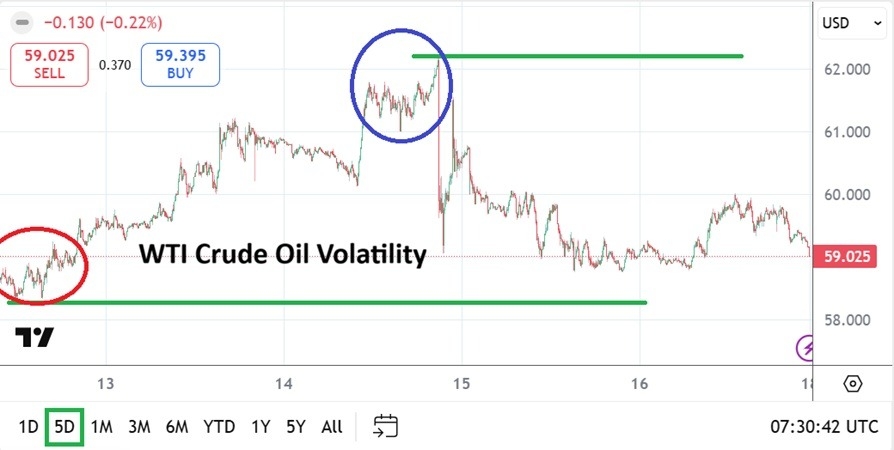

WTI Crude Oil provided speculators and large players a mixture of volatility last week and the commodity may continue to fester opportunities in the days ahead.

Finishing near the 59.020 mark going into the weekend, WTI Crude Oil did climb above the 62.160 ratio on Wednesday momentarily via an incremental fast surge as fears escalated globally of an impending U.S strike on Iran. However, as quickly as the news flashed that a military action was about to be conducted, it was reported that the planes suddenly turned around and calmer heads prevailed in the broad markets.

The sudden dose of non-action by President Trump caused WTI Crude Oil to reverse and within the span of a few minutes the price dropped from above $62.000 to around 59.750. There would be another dose of volatility delivered late Wednesday and into early Thursday, but by the end of trading on the 15th, WTI Crude Oil would not go above $60.000 the remainder of the week. WTI Crude Oil started last week around the 58.800 mark.

Top Regulated Brokers

$62.000 is a Tame Number

The ability of WTI Crude Oil to jump over 62.000 compared to the lows it has been traversing in recent weeks is an accomplishment of sorts for bullish speculators who believed the price was too low. However, in historical terms regarding the trading of oil, a price of 62.000 during threatened conflict in the Middle East must be looked at as a rather tame value. The price of WTI Crude Oil may have gone higher if a military action had been carried out by the U.S certainly, but the decision to not fully act brought the price of the commodity back to its known lower range.

Day traders who are watching the news about Iran this weekend must understand not everything they are hearing or reading is accurate. There is a definite game called ‘the fog of war’ that is being practiced by various nations. The threat of military action still looms and this could affect trading in WTI Crude Oil very early on Monday and the remainder of this week. The rattling of swords is likely not going to disappear completely, in fact new developments regarding Iran could happen in the blink of the eye.

Speculating on WTI Crude Oil

It must be said that supply of oil remains abundant and this is highly unlikely to change. Iran is an important supplier of energy, but its export of the commodity has been highly restricted for years.

- The potential of military action from the U.S and others potentially against Iran should keep speculators nervous.

- Even if news remains quiet in the coming hours and early days of this week, WTI Crude Oil could enjoy rather durable support because of existing nervousness.

- The 59.000 level will be intriguing as a barometer early on Monday.

- Day traders who want to be long WTI Crude Oil based on the assumption that fear will generate buying sentiment cannot be blamed, but it needs to be understood that conditions remain dynamic and dangerous.

- Large players will trade WTI Crude Oil this week depending on their nervous outlooks.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 58.400 to 64.800

Day traders tempted to swim with the sharks in WTI Crude Oil in the days ahead need to use solid risk management. Betting on the energy in either direction could find an opportunity to profit, but also the capability of losing money faster than it can be counted. The political situation in Iran remains ugly and military action will remain a talking point.

Speculators wagering are encouraged to use take profit orders if they are placing buying orders on a belief there is a prospect for conflict. If the U.S were to strike against Iran this could certainly cause a nervous reaction in the WTI Crude Oil marketplace, but it is also questionable how much of an impact the action would have on ultimate pricing. Conservative day traders without deep pockets may want to remain on the sidelines this week in the oil sector.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.