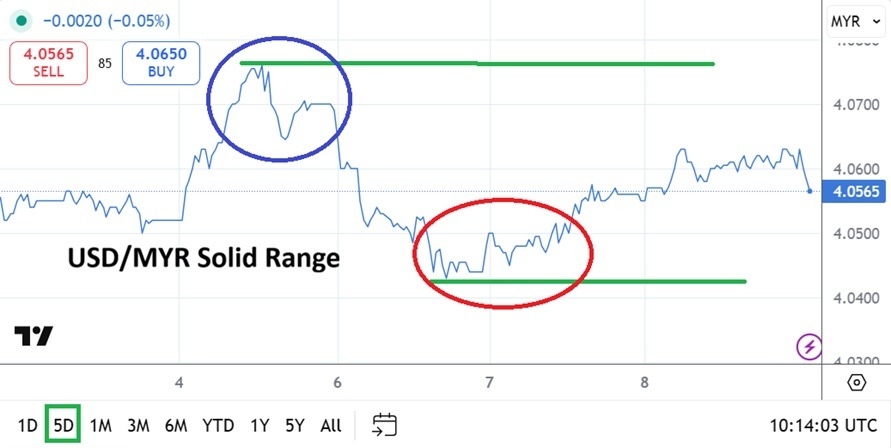

The USD/MYR is trading near the 4.0565 ratio as of this writing, the currency pair has seen a rather tight range develop and importantly has maintained its stronger lower stance since the 22nd of December.

The Malaysian Ringgit continues to perform very well against the USD. It has been a leader regarding strength shown against the USD when compared to other emerging market currencies. The MYR and the South African Rand have done not only well against the USD, but outperformed many other major currencies versus the USD.

The consistent realm the USD/MYR is now traversing, as of this writing the currency pair is near the 4.0565 mark, has been easy to see via technical charts over the mid-term. The USD/MYR broke through the 4.1000 ratio on the 11th and 12th of December and has not looked backwards. Since the 22nd of December the USD/MYR has been consistently trading below the 4.0770 ratio.

Top Regulated Brokers

Financial Institutions Outlook

The ability of the USD/MYR to trade below the 4.0800 realm, and above the 4.0400 mark consistently is remarkable. Yes, the currency pair did go to nearly the 4.0280 ratio briefly on the 26th of December, but this was after the Christmas holiday when volumes were almost nil. However, the rather steady lower track of the USD/MYR the past few weeks has displayed a belief by financial institutions the Malaysian Ringgit is within a solid equilibrium.

Volumes in the USD/MYR are never extremely high. Day traders pursuing the currency pair need to always use entry level prices so they get a price fill that is acceptable. The U.S will be releasing jobs numbers tomorrow, but this will happen after the USD/MYR is done trading for the day. Thus, Malaysian financial institutions may stay rather quiet tomorrow and wait for the results to come in and react on early Monday. The rather muted realm of the USD/MYR means traders participating tomorrow should use quick hitting targets to try and cash in winnings if they develop.

Near-Term Considerations and Ratios

Next week’s results in the USD/MYR should be intriguing. If the U.S jobs numbers are solid tomorrow this could help the currency pair see some more downwards price action.

- However, speculators should not target realms below the 4.0400 ratio unless they have deep pockets and a lot of patience, which translates into being able to allow the USD/MYR trade overnight and absorb carry charges that brokers’ certainly will charge.

- The USD/MYR may need another dose of impetus to break below the 4.0400 mark and sustain its power lower.

- However, the Malaysian Ringgit has been a solid performer and looking for incremental lower price action seems to be logical.

- Perhaps conservative day traders may want to see some higher moves before seeking reversals lower as a wagering tactic.

USD/MYR Short Term Outlook:

Current Resistance: 4.0570

Current Support: 4.0530

High Target: 4.0630

Low Target: 4.0420

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Malaysia to check out.