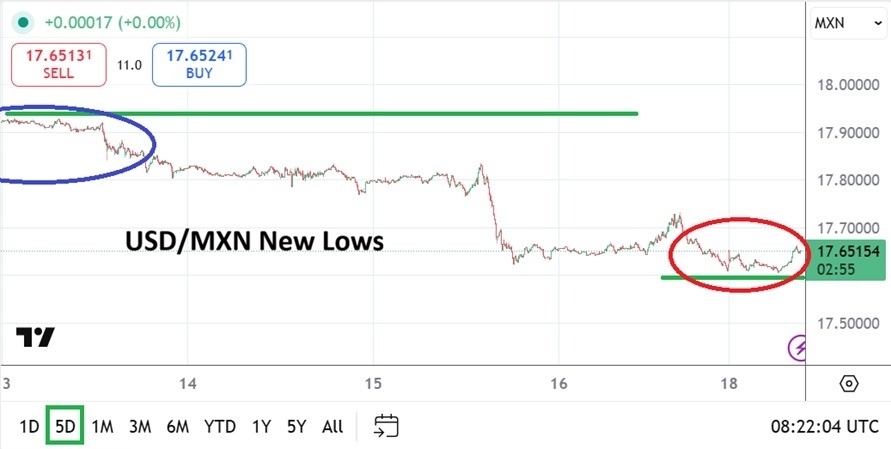

The USD/MXN is trading around the 17.65300 ratio early on Monday, this as a wide spread is seen and as the currency pair continues to cascade lower and make support levels appear vulnerable.

As the USD/MXN trades around the 17.65300 vicinity early this morning, the currency pair is traversing values that it has not seen in a sustained manner since July of 2024. This point is interesting because the USD/MXN was within these values in the aftermath of the Mexico elections which saw Claudia Sheinbaum win the Presidency.

Financial institutions now have the USD/MXN within realms a month after the results of the 2024 Mexican election. Intriguingly before the Mexican vote in early June of 2024, the currency pair was near 16.60000 in April. Day traders should certainly not get too ambitious regarding the potential of the USD/MXN to fall to those April 2024 depths. However, the ability of the USD/MXN to trade in a strong bearish manner since April 2025 when it was above the 20.00000 ratio is rather breathtaking.

Top Regulated Brokers

Waving Goodbye to the 18.00000 Level

The USD/MXN since penetrating the 18.00000 level and remaining below on the 9th of January this year has continued to incrementally move lower. Except, that last Thursday saw an additional spike lower by the USD/MXN from around the 17.78000 vicinity to realms it remains within in this morning. The lack of a strong reversal upwards since the dive lower on Thursday seems to have been greeted with a belief the USD/MXN is within values it belongs.

The USD/MXN in the short and near-term should be watched for possible reactions by large players who may believe the currency pair has been oversold. But if the 17.65000 level remains within sight and no strong moves are made above the 17.70000 mark, perhaps the USD/MXN will find its new ground becomes a known trading terrain.

Near-Term Nervousness from Afar

Global Forex conditions have been nervous elsewhere. The USD has been stronger against many other major currencies, but not the Mexican Peso. The USD/MXN traversing its current ratios is rather remarkable and points to the potential acknowledgement that Mexico is within calmer waters when dealing with the Trump administration.

- Risk premium which was factored into the USD/MXN last year during the height of tariff nervousness has faded almost completely.

- Yes, President Trump is able to get verbally loud at any moment and impact markets with surprises, but the USD/MXN from a behavioral sentiment viewpoint seems to have found a tranquil place.

- News globally regarding Iran remains a talking point today, and traders need to be ready for potential nervousness a U.S military action could have on the financial markets.

- However, for the moment day traders now need to view the USD/MXN with long-term charts and test sentiment which adjusts to the lower realms being traversed.

USD/MXN Short Term Outlook:

Current Resistance: 17.65600

Current Support: 17.65110

High Target: 17.71010

Low Target: 17.60400

Ready to trade our Forex daily analysis and predictions? Here are the best forex brokers in Mexico to choose from.