- The US dollar has been a bit choppy against the Japanese yen early on Tuesday, as we continue to see a lot of noisy trading behavior.

- This is not a surprise considering that Friday is the non-farm payroll announcement and that will have a major influence on the US dollar and quite often influences the bond market, which has a major influence on this pair.

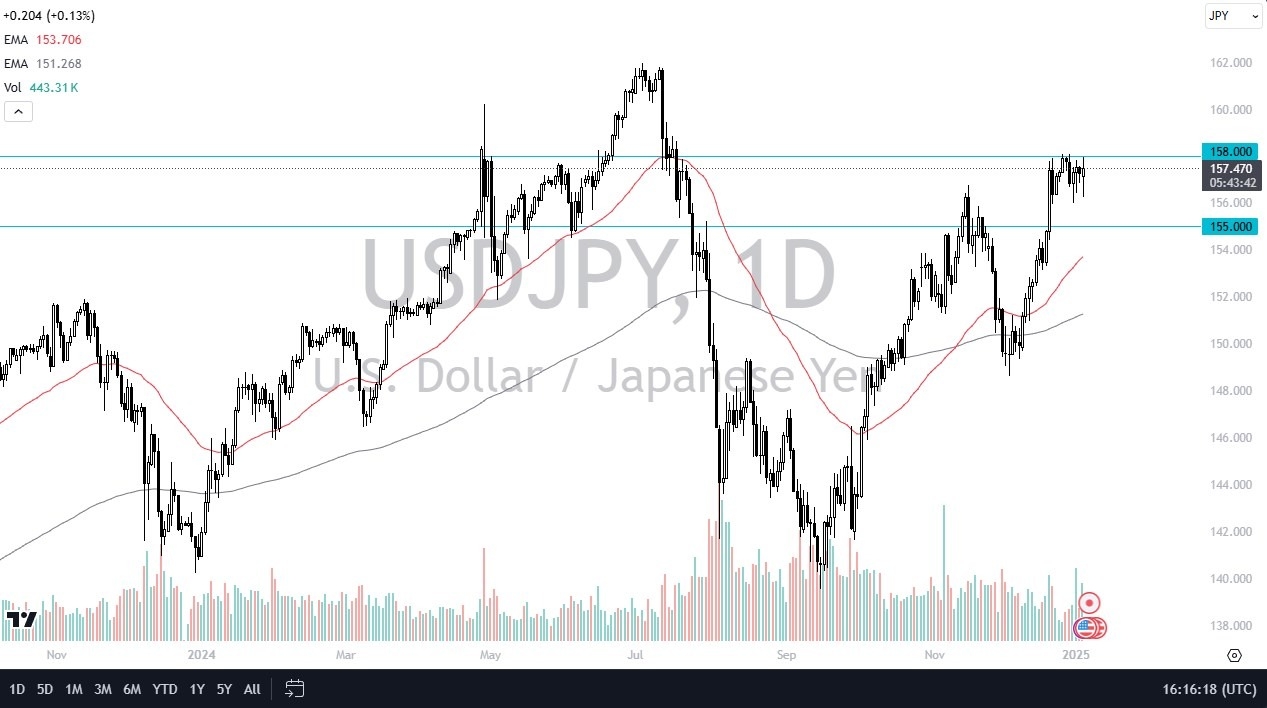

- That being said, we are essentially in the middle of an overall consolidation range between 158 yen on the top and 154.5 yen on the bottom.

- Over the longer term, I think the interest rate differential continues to be a major driver of where we go, and that, of course, favors the United States dollar.

The Potential Strengthening Point for the Yen

We might have a bit of a shrinking of the interest rate differential over the next several months, but I do not think it is likely to be enough to turn the market around on its own. The one thing that could come into the picture as a potential strengthening point for the yen would be if we get some type of economic problem that affects the globe or geopolitical concerns.

Top Regulated Brokers

This is a market that generally favors the US dollar due to interest rate differential, but if we have a major risk-off event, then traders will, of course, come running to the Japanese yen.

As long as we stay above the 154.5 yen level, I think buying the dips will continue to be the move, as the interest rate differential continues to get you paid at the end of each session. The carry trade seems to still be alive and well at the moment.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.