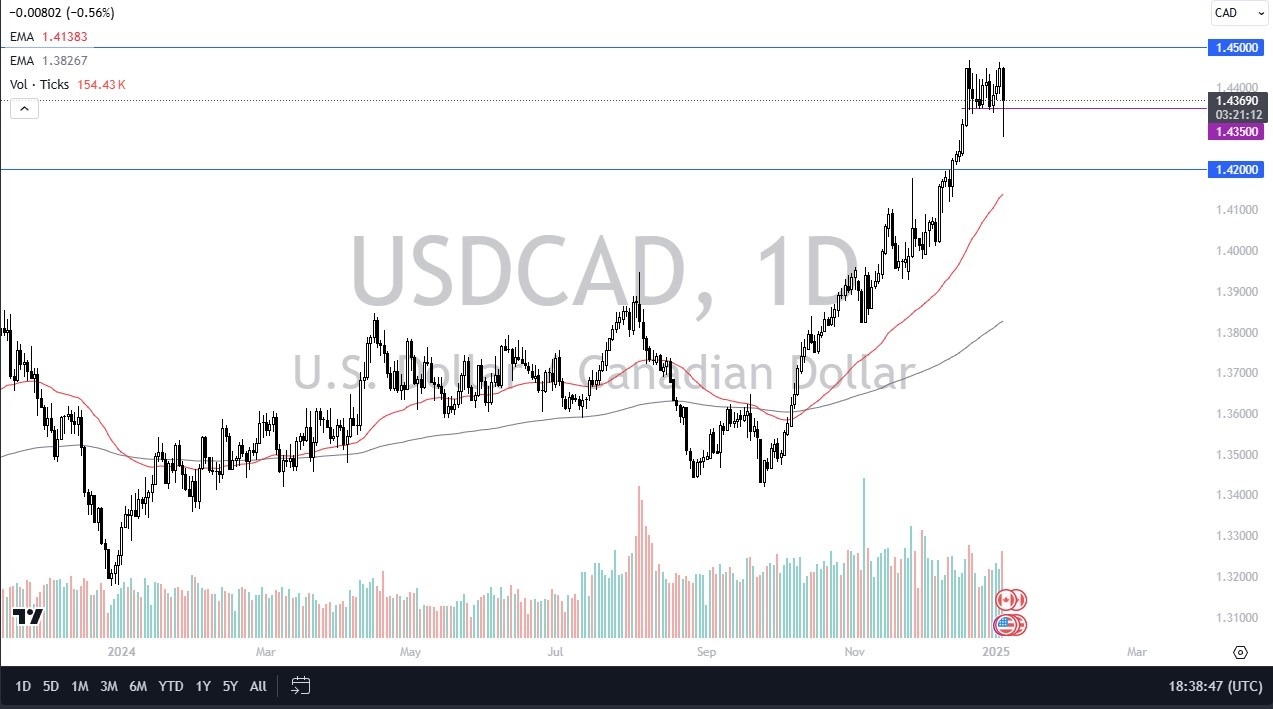

- The United States dollar has risen slightly against the Canadian dollar during early Tuesday trading as we continue to focus on the 1.38 level.

- There is quite a bit of noise in this pair under the best of circumstances because most of the transactions that you see between the United States dollar and the Canadian dollar are done out of necessity as they are such huge trading partners.

That being said, there are some other factors that are coming into the picture at the moment. On the positive side for this pair, we continue to see oil look very soft, and the interest rate differential does favor the United States dollar at the moment, although it is not a huge interest rate differential; some traders will take that into account.

Top Regulated Brokers

The 1.38 Level Offering Resistance Makes Sense

The 1.38 level offering resistance makes a certain amount of sense because the area has been important multiple times, but it is also worth noting that oil is also dragging the Canadian dollar overall. It is not that the Canadian dollar is heavily influenced by oil against the US dollar directly, but just generally speaking, as the United States itself produces 13.5 million barrels a day.

So with all of that tied together at this level, I think we are looking at a scenario where the market may stay in a bit of stasis for the short term as we are waiting for employment figures on Friday from both of these countries coming out simultaneously and that will make a major difference in where we go next if one of these countries ends up being completely out of balance. As things stand right now, it looks like a market that is trying to find some type of support and recovery, and I do think we will eventually find a larger consolidation area from which to stay in. As things stand right now, I would point out that the 1.36 level seems to be the floor.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.