Long Trade Idea

Enter your long position between £412.60 (the lower band of its horizontal support zone) and £420.70 (Friday's intra-day high).

Market Index Analysis

The UK's stock market landscape presents a mixed technical environment that warrants careful consideration. While the FTSE 100 displays some concerning technical signals—including decreasing bullish trading volumes and a bearish chart pattern—the Bull Bear Power Indicator suggests early bullish momentum with a negative divergence warning of potential short-term pullbacks. This context is important for Tesco investors, as the retail and consumer staples sector often benefits from market rotations into defensive assets during periods of uncertainty.

- Tesco (LSE:TSCO) is a member of the FTSE 100 Index.

- This index is in a bearish chart pattern with decreasing bullish trading volumes, which does not confirm the recent uptrend.

- The Bull Bear Power Indicator for the FTSE 100 is bullish with a negative divergence, hinting at a potential short-term reversal.

Market Sentiment Analysis

Recent market sentiment toward the retail sector has been cautiously optimistic, particularly for large-cap grocers. Tesco's resilience during market volatility reflects strong investor confidence in its business model. The recent sell-off, which brought LSE:TSCO down 1.59% in the previous session, appears to represent a buying opportunity rather than a fundamental deterioration. Insider buying activity and positive forward guidance from management have sustained institutional interest despite macro headwinds affecting broader UK equities. Sentiment indicators suggest accumulation phases among sophisticated traders ahead of the anticipated earnings announcements.

Top Regulated Brokers

Tesco Fundamental Analysis

Tesco is a multinational grocery and general merchandise retailer. It is the UK's market leader in groceries and a Top 10 global retailer. Tesco is a high-volume, low-cost retailer, catering to a range of social groups through its low-cost "Tesco Value" and premium "Tesco Finest" ranges.

Why I'm Bullish on LSE:TSCO After Its Recent Breakdown

Several converging fundamental factors support a bullish thesis on TSCO.L despite the recent selloff:

Expanding Market Share and Competitive Positioning

Tesco continues to consolidate its market leadership in the UK grocery segment, leveraging its omnichannel capabilities and digital infrastructure. The company's strategic investments in online fulfillment and convenience store expansion position it favorably against competitors, particularly as consumer shopping patterns remain tilted toward convenience and digital options.

Insider Buying—A Bullish Signal

On January 9, 2026, CEO Ken Murphy's transaction demonstrated significant management conviction in the stock's valuation and medium-term prospects. When executives and directors purchase shares with their own capital at current market prices, it signals confidence that the stock represents compelling value relative to fundamental earnings potential. This is particularly meaningful when occurring during periods of market weakness, as it indicates management believes the sell-off is overdone.

Strong Sales Momentum to Start 2026

Early year comparable sales growth and trading statements highlighted robust consumer demand, particularly in Tesco's core grocery and household essentials categories. This momentum, combined with disciplined cost management, supports earnings growth estimates.

Healthy Profit Margins Despite Rising Input Costs

Despite inflationary pressures on input costs, Tesco has maintained resilient operating margins through pricing discipline and operational efficiency improvements. This demonstrates pricing power and operational excellence in a challenging cost environment.

Reasonable Valuation with Excellent Upside Potential

At a P/E ratio of 18.06, TSCO offers compelling value relative to the broader UK market. With the average analyst price target at 473.75p, the stock presents approximately 14.0% upside from current levels, providing an attractive risk-reward profile for long-term investors. The valuation discount reflects temporary market pessimism rather than fundamental deterioration, as evidenced by strong comparable sales growth and margin resilience.

Solid EPS Growth Rates

Forward earnings per share guidance suggests consistent mid-single-digit growth, supported by operational leverage and market share gains. This earnings visibility supports valuation expansion as the market reprices the stock.

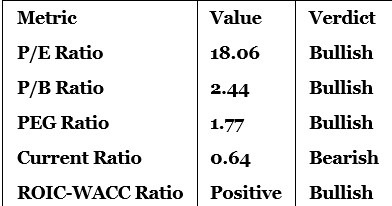

Tesco Fundamental Analysis Snapshot

The price-to-earnings(P/E) ratio of 18.06 makes LSE:TSCO an inexpensive stock relative to historical trading ranges and the broader UK market. For a market leader with Tesco's scale, profitability, and dividend sustainability, this valuation represents meaningful discount to peers.

The average analyst price target for LSE:TSCO is 473.75p. It suggests approximately 14% upside potential with decreasing downside risks, supported by consensus earnings growth estimates.

Why the Current Ratio of 0.64 Is Not a Concern

The current ratio of 0.64 (current assets to current liabilities) may appear concerning at face value, but it requires important context specific to Tesco's business model and retail industry dynamics:

- 1. Retail Business Model Characteristics: Large-cap retailers like Tesco operate with structurally lower current ratios than manufacturing or capital-intensive businesses. This reflects their operational model: inventory turns rapidly (every 2-3 weeks in grocery retail), generating continuous cash inflows, while suppliers typically grant 30-60 day payment terms. The company receives cash from customers immediately or within days but pays suppliers on extended terms, creating a natural working capital advantage.

- 2. Inventory as Liquid Asset: Tesco's current assets include approximately £6.8 billion in inventory, which is highly liquid in the grocery retail context. Unlike manufacturing inventory, grocery inventory converts to cash within 2-3 weeks through rapid sales cycles. This makes the current ratio figure less concerning than it would be for a retailer with slower turnover.

- 3. Operational Cash Flow Strength: What matters most for solvency is not the current ratio in isolation, but operational cash flow generation. Tesco generates approximately £3.0-3.5 billion in annual operating cash flow, far exceeding current liabilities. The company's ability to service debt and fund operations through operations cash is not constrained.

- 4. Established Credit Facilities: As a FTSE 100 member with investment-grade credit ratings (A- from S&P, A3 from Moody's), Tesco maintains substantial undrawn credit facilities and regular access to debt capital markets. This provides liquidity cushion beyond the current ratio metric.

- 5. Consistent Dividend Payments: The fact that Tesco maintains and grows its dividend (currently yielding ~3.2%) despite the low current ratio demonstrates investor and creditor confidence in the company's underlying financial strength and cash generation capability. Dividend cuts would be the first signal of liquidity stress, which hasn't materialized.

- 6. Historical Precedent: Tesco has operated with similar current ratios for over a decade without liquidity issues, demonstrating this is a structural feature of its efficient retail model rather than a sign of distress. The metric has remained stable even during prior market downturns.

In summary, the 0.64 current ratio reflects Tesco's efficient working capital management and rapid inventory turnover, not financial weakness. For grocery retailers, this is normal and expected. The company's true solvency position—as evidenced by operating cash flow, credit ratings, dividend sustainability, and access to capital markets—is robust.

Tesco Technical Analysis

Today's LSE:TSCO Signal

The technical setup for LSE:TSCO on January 12th, 2026 presents a compelling long entry opportunity following the recent breakdown. The stock has bounced off its horizontal support zone at 412.60, confirming the strength of this technical floor. Price action between 412.60 and 420.70 represents a consolidation pattern typical of accumulation phases before breakout moves. The recent sell-off cleared weak hands from the position, setting the stage for institutional accumulation.

Key technical observations include:

(1) The stock respects its horizontal support zone, indicating strong buyer interest at these levels;

(2) The bounce off support to Friday's intra-day high of 420.70 demonstrates resilience and buying momentum;

(3) Upper resistance at 474.30-479.75 provides a clear technical target aligned with analyst price targets;

(4) Volume dynamics during the recent decline suggest institutional buyers were accumulating on weakness, rather than capitulating sellers dominating the market.

From a technical perspective, the risk-reward setup is favorable, with defined support levels below and target resistance above, making this an ideal entry zone for position traders and swing traders alike.

Tesco Price Chart

My TSCO Long Stock Levels and R/R

- LSE:TSCO Entry Level: Between £412.60 and £420.70

- LSE:TSCO Take Profit: Between £474.30 and £479.75

- LSE:TSCO Stop Loss: Between £382.40 and £393.60

- Risk/Reward Ratio: 2.04

Ready to trade our analysis of Tesco? Here is our list of the best stock brokers worth reviewing.