- It has shown multiple times that it wants to go higher over the longer term.

S&P 500

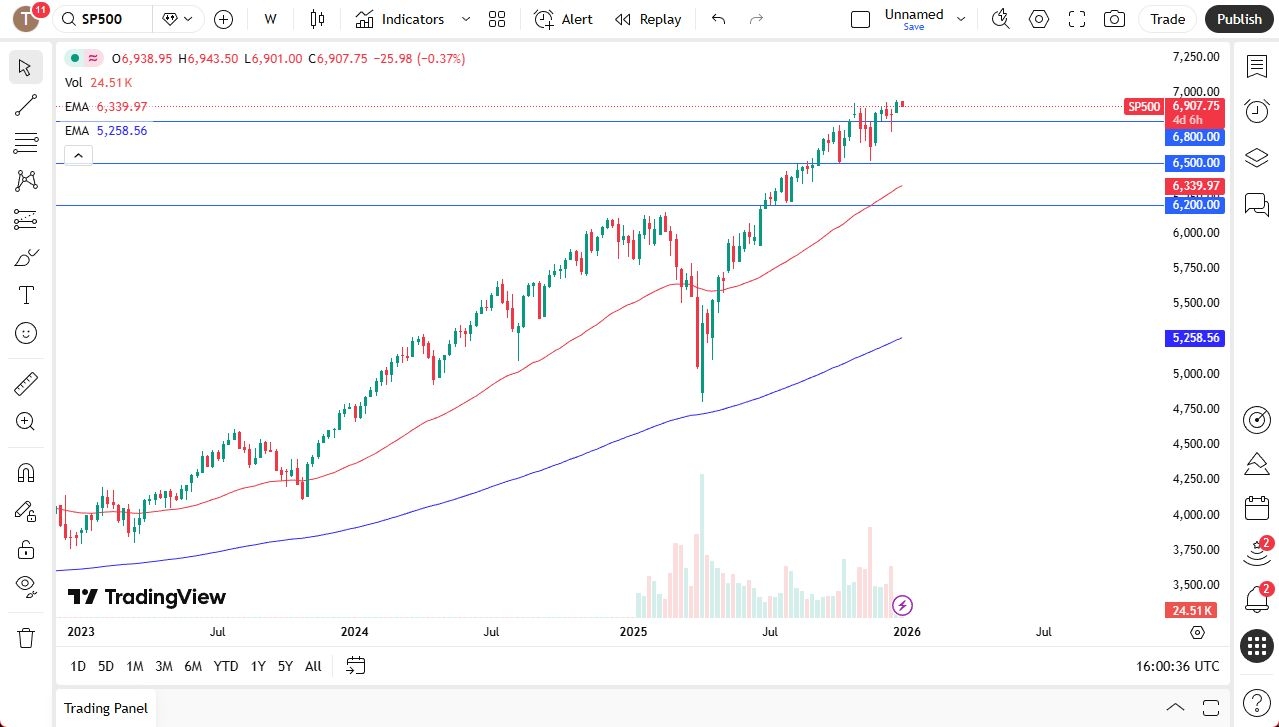

The S&P 500 has been choppy during most of the month of December, but it has shown multiple times that it wants to go higher over the longer term. I do, in fact, think that the month of January should be positive in general. And although it will be noisy, I think we have a situation where the market is likely to continue to find buyers on each and every dip.

One level that I'm watching at the moment is the 6,800 level. If we were to break down below there, then I have a lot of interest in the 6,700 level. Over the longer term, I think this is a market that will try to get to the 7,000 level, and I would fully anticipate that we probably see that sometime during January. If we can break above there, then the market could go quite a bit higher.

Top Regulated Brokers

Economic Strength

All things being equal, I think we've got a situation where the US economy is fairly strong, and I think it should continue to be one of these situations where people start to talk about how, although the Federal Reserve may not cut as aggressively as people think, the reality is that the market is likely to see a lot of positive reports coming out of earnings calls. And I do think that the future looks fairly bright for the US.

Keep in mind that most of the year has been a recovery from the early spring crash. And since then, we've done nothing but go higher. The latest action is a little choppier than some of the previous action, but that does make sense. Eventually, you have to digest some of the gains, and as December, of course, features two major holidays, it does make sense that it was December that we really slowed down. I think that once we get back into trading in 2026, the buyers will return, and we will continue.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.