- The S&P 500 has been quiet in the early hours of Wednesday as traders are starting to look forward to the Friday non-farm payroll announcement.

- This, of course, will be a major influence on where we go next, so do keep that in mind.

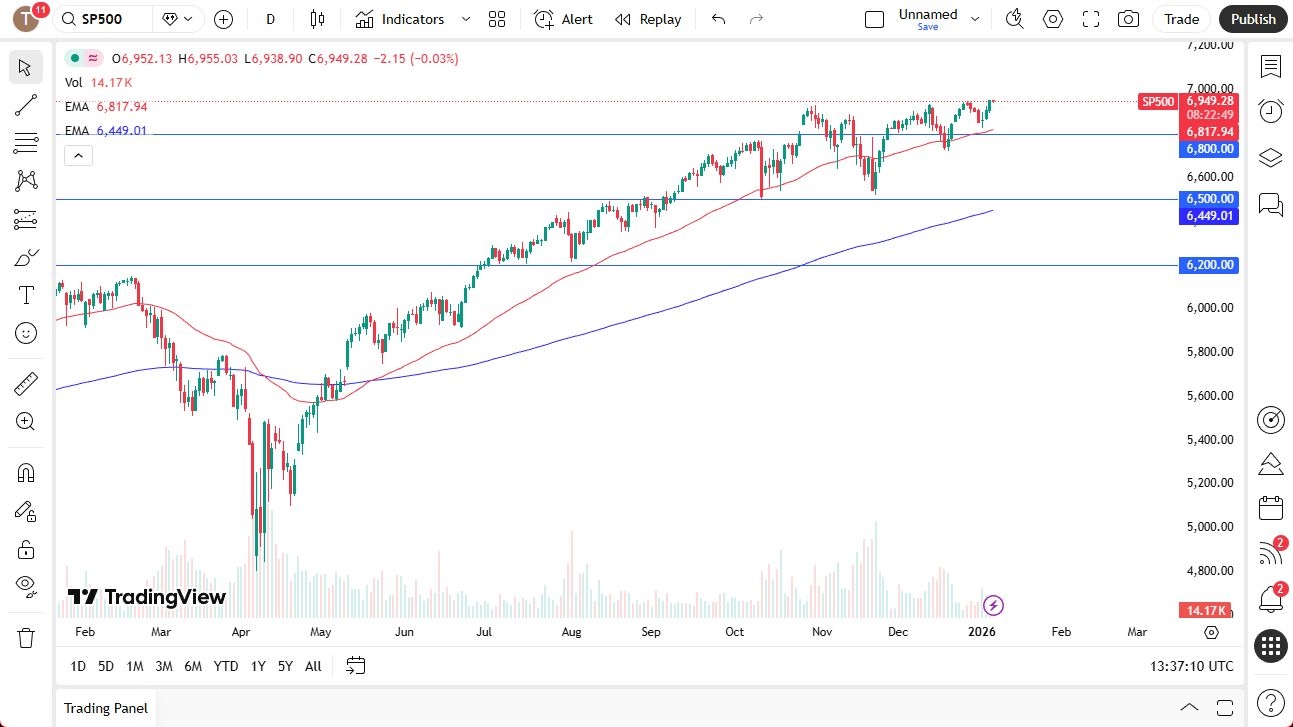

In the short term, when I look at this chart, I see several different things going on at the same time. To begin with, we obviously are very strong to the upside, and with this being the case, it is a market that you have to be looking for long positions. The ADP employment numbers came out fairly strong, and as a result, that has the markets are looking forward to the Friday official numbers, which, of course, traders are hoping for some type of number that forces the Federal Reserve to get a little bit more aggressive with its interest rate cuts.

The Technical Path to 7000

The technical levels that I am watching without a doubt will be the 6800 level. That is a bit of a line in the sand for the S&P 500. The 7000 level above, I think, is inevitable. The question, of course, is whether we will get there right now or if we have to wait a while. I suspect it happens quicker than most people think, but even if it does not happen this week, I would be looking for next week to be challenging that. After all, it is just 50 points above where we are as I write this article.

Top Regulated Brokers

The bulk of trading right now is position starting, meaning that money managers are starting to put on their positions for the year for clients, and therefore, I think you will see a little bit of churn and perhaps a little bit of rotation from one sector to another.

As a result, I think this uniquely puts the S&P 500 at an advantage over a lot of other indices simply because there are more stocks involved. I have no interest in shorting this market, and you can even make a little bit of an argument for an ascending triangle that just got broken to the upside, which could potentially measure all the way to the 7300 level. That would be a longer-term target, but it certainly would not be out of the question.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.