- The S&P 500 has been somewhat noisy on Friday, as traders around the world have many things to ponder, including tariffs, geopolitics, and the US labor markets.

S&P 500

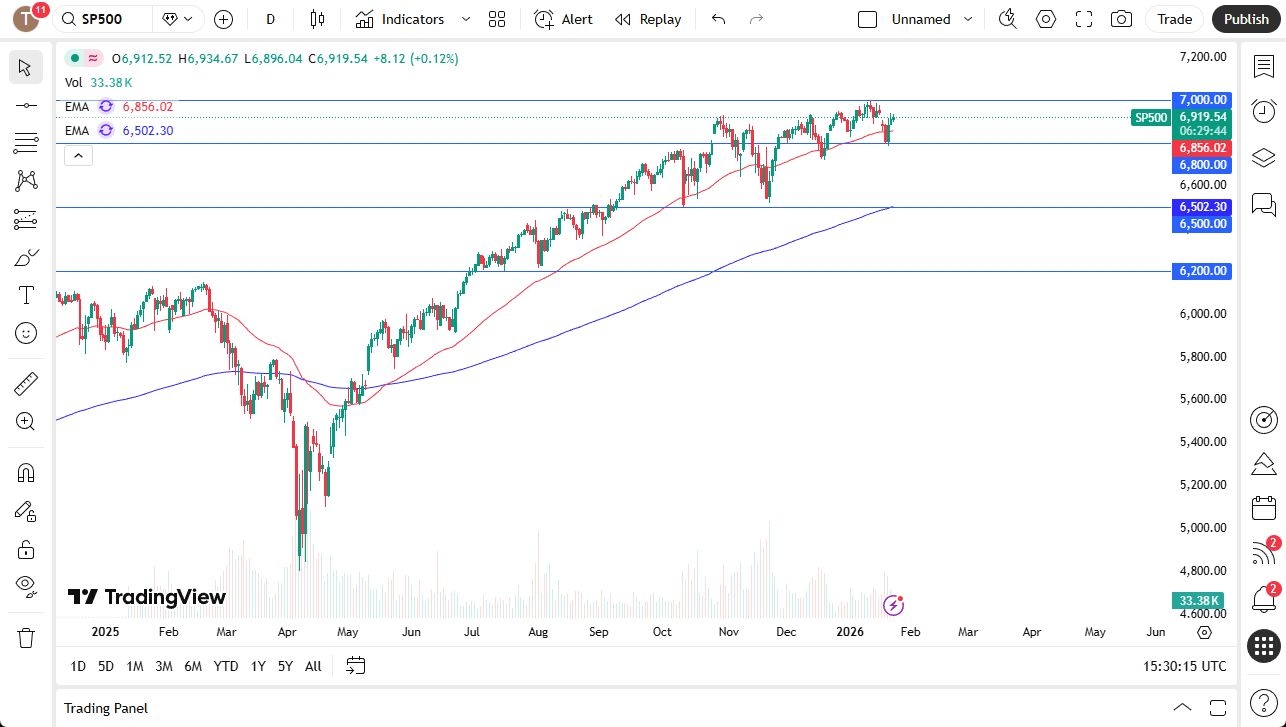

The S&P 500 has been somewhat noisy on Friday as traders continue to navigate the hangover from the trade tariff situation and, of course, the spat between the United States and Europe. That being said, we are rapidly approaching the bulk of earnings calls for the season, and that, of course, will have traders looking to see where company earnings are going to drive the stock market next.

It's worth noting that the risk sentiment is more positive than it was just a few days ago, and this allows capital to be rotated back into tech and growth, so that is starting to help the index a bit. For what it's worth, some of the smaller companies have, in fact, done quite well, all one has to do is look at the Russell 2000 to see how the overall health of the US stock market is pretty strong. The S&P 500, of course, is much more diversified in the sense that it's not just tech in comparison to the Nasdaq, so it has a bit more stability.

Top Regulated Brokers

Consolidation Leading to Continuation

If we can break above the 6,986 level, then I think it opens up the door to 7,000, anything above there continues the longer-term uptrend. Short-term support continues to see itself placed at 6,796 and possibly even the 50-day EMA between here and there.

This is a market that's done a little bit of sideways dancing over the last several weeks, but it has more of an upward tilt, suggesting that we will eventually see consolidation lead to continuation, which most technical traders suspect will be the case when you see this type of chart pattern anyway. I remain bullish; I look at short-term dips as potential buys.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.