Short Trade Idea

Enter your short position between $160.34 (yesterday's intra-day low) and $168.92 (yesterday's intra-day high).

Market Index Analysis

- Shopify (SHOP) is a member of the NASDAQ 100 Index.

- The NASDAQ 100 pushed cautiously higher to start 2026 with the index hitting record highs above 25,060, yet bearish trading volumes are rising. The Relative Strength Index (RSI) has tipped into overbought territory, signalling that buyers are running out of conviction as the rally enters mature late-cycle territory.

- The Bull Bear Power Indicator of the NASDAQ 100 Index is bullish but below its descending trendline, a classic bear divergence that suggests institutional momentum is fading even as the index trades near all-time highs, pointing to elevated near-term pullback risk.

Market Sentiment Analysis

Shopify entered 2026 on the back of strong Q3 2025 earnings that beat expectations with 32% revenue growth and 18% free cash flow margins, yet recent analyst downgrades in early January 2026 have raised concerns about elevated expectations and the sustainability of agentic commerce momentum versus reality. While the market has embraced the narrative that AI-powered tools and autonomous commerce agents will unlock incremental monetization, profit margin pressures are beginning to emerge as Shopify's operating expenses as a percentage of revenue rose from 31.5% in Q4 2024 to 41-42% in Q1 2025, a major red flag for margin trajectory.

The stock's 52.8% year-to-date run has priced in years of uninterrupted AI-driven growth acceleration, yet tariff uncertainty, FX headwinds, and broader e-commerce sector uncertainty suggest that the Street's consensus expectations may be at peak optimism. Most concerning is that despite strong Q3 results, analyst sentiment has shifted from bullish to mixed, with recent downgrades suggesting that valuation extremes leave no room for any disappointment on either the revenue ramp or margin recovery fronts.

Shopify Fundamental Analysis

Shopify is a leading e-commerce platform with nearly 60% of its business in the US. It is known as the go-to e-commerce platform for startups due to its fair fee structure and user-friendly platform.

So, why am I bearish on SHOP despite its platform expansion?

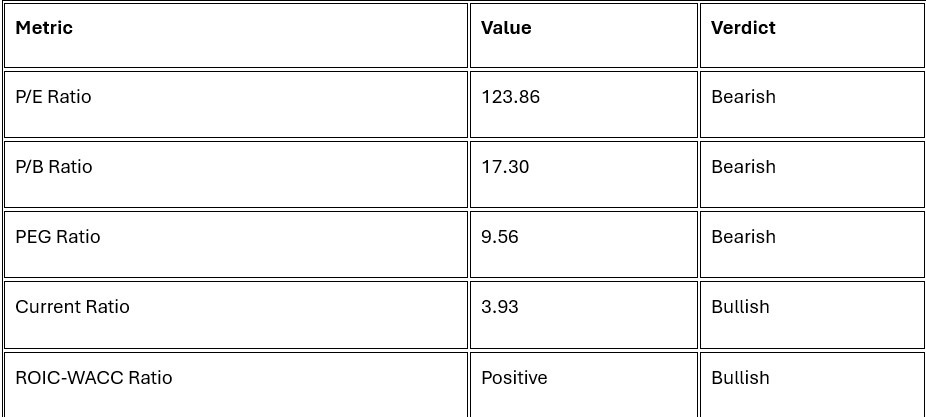

Shopify's P/E ratio of 123.86—a staggering 3.66x premium to the NASDAQ 100 Index average of 33.82—represents the most excessive valuation in the e-commerce space, leaving zero room for margin disappointment or guidance misses that are all but inevitable once agentic commerce hype moderates. The company's recent analyst downgrades in January 2026 reflect growing skepticism about whether the agentic commerce narrative is overstated given current competitive pressures from Amazon, BigCommerce, and other platforms also racing to embed AI agents.

Profit margins are deteriorating faster than consensus expects, with operating expenses rising to 41-42% of revenue in Q1 2025 guidance versus just 31.5% in Q4 2024—a massive spike that signals management is spending aggressively to defend market share and fund AI development, but with uncertain ROI. The PEG ratio of 9.56, grotesquely high relative to even the most aggressive growth names, suggests that current valuations have already priced in a scenario where Shopify achieves 30%+ growth indefinitely, a scenario that simply cannot withstand any competitive pressure or tariff-driven slowdown.

At current valuations, the stock offers very limited upside potential of about 5%; any missed quarter or failure to demonstrate dramatic margin expansion would trigger sharper-than-expected downside repricing, particularly given the elevated leverage embedded in options markets and momentum-driven hedge fund positioning.

Shopify Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 123.86 makes SHOP an expensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 33.82.

The average analyst price target for SHOP is $177.47. It suggests limited upside potential with rising downside risks, particularly given the recent wave of analyst downgrades and deteriorating margin guidance.

Shopify Technical Analysis

Today's SHOP Signal:

- The SHOP D1 price chart below shows price action breaking through the $165.00 key support level after failing to hold up above $168.92, a bearish breakdown that suggests the recent consolidation phase is ending and weakness is beginning to accelerate lower toward the $160.00 supportive level.

- SHOP trades at levels where the Stochastic Oscillator has rolled into overbought territory (>80), yet the stock is showing bearish divergence as recent rallies fail to push above the $169.00 intra-day high, a classic warning signal that early buyers are taking profits and conviction is waning.

- The Bull Bear Power Indicator on the SHOP daily chart has begun to roll over from bullish to neutral, with the indicator failing to confirm the recent price action above $168.00, a bear divergence that suggests institutional buying momentum has peaked and distribution may be starting.

- Average trading volumes on recent rally attempts toward $168.92 resistance are declining relative to the 20-day average, a red flag that suggests early bulls are losing interest and near-term pullbacks are likely as profit-taking accelerates.

- SHOP has begun to underperform the broader NASDAQ 100 Index on a relative strength basis after nine consecutive months of outperformance, with the stock now trading lower despite the index hitting record highs—a deteriorating technical signal that undercuts the bullish agentic commerce narrative.

Shopify Price Chart

My SHOP Short Stock Levels and R/R

- SHOP Entry Level: Between $160.34 and $168.92

- SHOP Take Profit: Between $115.95 and $123.00

- SHOP Stop Loss: Between $177.47 and $182.19

- Risk/Reward Ratio: 2.59

Ready to trade our analysis of Shopify? Here is our list of the best stock brokers worth checking out.