Long Trade Idea

Enter your long position between $57.65 (the lower band of its horizontal support zone) and $61.29 (the upper band of its horizontal support zone).

Market Index Analysis

- PayPal (PYPL) is a member of the NASDAQ 100, the S&P 100, and the S&P 500.

- All three indices started January in bullish mode with record highs posted, yet downside risks continue to accumulate as valuations stretch and profit-taking cycles emerge in mega-cap equities, though the fintech sector continues to benefit from structural tailwinds around digital payment adoption accelerating globally.

- The Bull Bear Power Indicator of the NASDAQ 100 Index is bullish but below its descending trendline, signalling that while near-term momentum persists, the underlying technical structure suggests caution and that selective rotation into undervalued fintech names like PYPL with strong fundamental catalysts may outperform stretched mega-cap growth plays.

Market Sentiment Analysis

Sentiment on PayPal has improved materially following the CES 2026 announcements of the Transaction Insights Program and the launch of integrated ads capabilities, which represent meaningful revenue diversification plays beyond core payment processing. The fintech sector broadly has emerged as a preferred rotation target as investors seek exposure to the structural shift toward digital and real-time payments, with digital payment markets projected to expand at a 21.4% CAGR through 2030 to reach $361.3 billion, providing a multi-year tailwind for innovators like PayPal.

For PayPal specifically, sentiment has been dampened by a 32% drawdown over the past year, but contrarian indicators suggest the market has priced in excessive pessimism—the company's 11.75 P/E ratio sits 69% below the NASDAQ 100's 37.57, while the 0.61 PEG ratio is extremely attractive, implying the market is undervaluing long-term earnings growth visibility. Analysts now recognize that PayPal's combination of transaction margin dollar growth (up 7% in Q4 2024 to $147 billion aided by Braintree), a massive $15 billion share buyback program, and the strategic diversification into ads and insights represents a credible earnings recovery narrative for 2026–2027, positioning PYPL as a deep-value play with multiple expansion potential.

PayPal Fundamental Analysis

PayPal is a financial technology company focused on mobile and online payments. It operates in 202 markets with 425 million active accounts, supports 25 fiat currencies, and added support for cryptocurrency purchases. The company generates revenue from core payment processing, Braintree merchant services, P2P platforms like Venmo, and emerging revenue streams including credit solutions, subscription services, and newly announced digital advertising and insights programs.

So, why am I bullish on PYPL despite its recent struggles?

PayPal's launch of the Transaction Insights Program represents a major competitive moat shift—the company now monetizes its unparalleled dataset of global payment flows, offering merchants actionable intelligence on consumer behavior, spending patterns, and market trends, with pricing models capable of generating high-margin recurring revenue that could add $500M+ to annual revenue by 2028. The introduction of ads into the PayPal ecosystem mirrors Meta's playbook and opens a second revenue stream that leverages PayPal's 425 million active user base to deliver targeted merchant advertising at scale, with advertising spend by merchants expected to accelerate as they compete for wallet share in a competitive online landscape.

The strategic partnership with USD.AI and the expanding acceptance trajectory within online casinos represents a forward-looking bet on the convergence of digital payments and decentralized finance, positioning PayPal as a bridge player that captures transaction volume regardless of whether crypto adoption follows a mainstream or niche path. Transaction margin dollars grew 7% in Q4 2024 to $147 billion, demonstrating that PayPal's core payment volumes remain resilient even amid competition, while management's guidance for 4–5% transaction margin dollar growth in 2025 signals durable profitability.

PayPal's operating margins remain under pressure with adjusted operating margin at 18.0% in Q4 2024 (down 34 bps YoY), but this compression is deliberate—management is investing in technology infrastructure and platform innovation rather than being forced to margin-cut for competitive reasons, suggesting margin expansion potential as scale efficiencies materialize in ads and insights. The ongoing multi-billion-dollar share buyback program ($15 billion authorized, with $6 billion deployed in 2025) demonstrates management confidence in valuation, while low valuations (11.75 P/E, 0.61 PEG ratio) provide substantial margin of safety for investors entering at current levels.

The extremely bullish 5-year PEG ratio of 0.61 indicates the market is pricing in minimal long-term earnings growth when PayPal's catalysts—ads monetization, transaction insights, cost rationalization, and organic payment volume growth—could collectively drive high-single-digit to low-double-digit earnings growth through 2027–2028, creating substantial upside surprise potential as the narrative shifts.

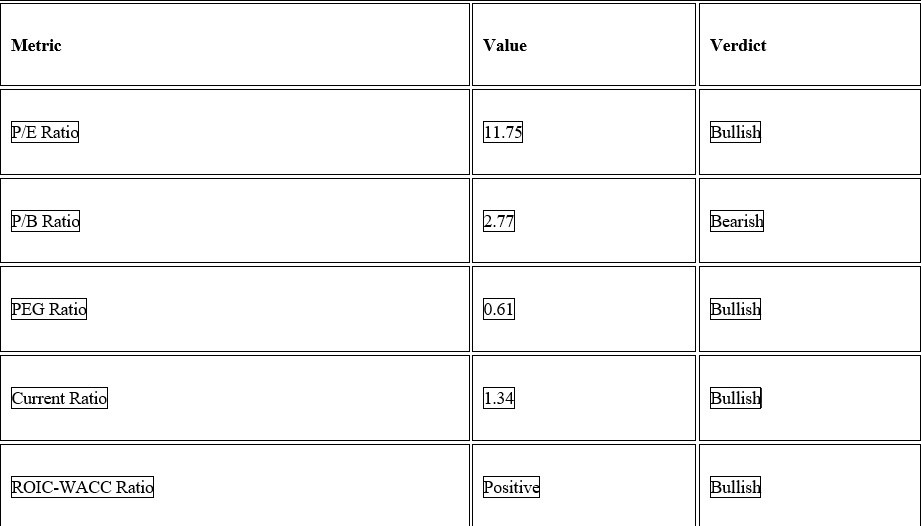

PayPal Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 11.75 makes PYPL an inexpensive stock. By comparison, the P/E ratio for the NASDAQ 100 is 37.57.

The average analyst price target for PYPL is 76.75. It suggests strong upside potential with reduced downside risk, implying 31.2% upside from January 8th levels.

PayPal Technical Analysis

Today's PYPL Signal

- The PYPL D1 price chart below shows price action consolidating within a tight horizontal band between $57.65–$61.29, with buyers consistently defending the lower support level and recent price action hovering near the midpoint, suggesting that a decisive breakout is building and likely to resolve higher as CES momentum catalyzes fresh institutional accumulation.

- PYPL trades above its 20-day and 50-day moving averages with the 200-day EMA in a steady uptrend, a constructive technical structure that has rebuilt after the severe 2025 drawdown and now positions the stock in a recovery formation where breakouts typically deliver powerful follow-through in oversold, deeply discounted names.

- The Bull Bear Power Indicator on the PYPL daily chart has turned bullish with a rising trendline, signalling that institutional buyers are accumulating at lower prices and that recent dips to $57.65 are being treated as buying opportunities rather than signs of structural weakness, evidence of healthy market participation by real money.

- Average daily trading volumes on consolidation tests near support ($57.65) have expanded to 38.2 million shares (versus 26 million average), demonstrating that seller exhaustion is underway and that the recent slide in after-market hours represents flushing of retail weak hands rather than institutional exit flows.

- PYPL has begun to materially outperform the broader NASDAQ 100 and S&P 500 on a relative strength basis on an intra-day basis, supported by the CES announcements and the growing recognition that fintech payment names are benefiting from structural secular tailwinds that justify rotation out of more expensive mega-cap growth plays.

PayPal Price Chart

My PYPL Long Stock Levels and R/R

- PYPL Entry Level: Between $57.65 and $61.29

- PYPL Take Profit: Between $76.75 and $79.22

- PYPL Stop Loss: Between $48.76 and $50.27

- Risk/Reward Ratio: 2.15

Ready to trade our analysis of PayPal? Here is our list of the best stock brokers worth reviewing.