Long Trade Idea

Enter your long position between $45.14 (yesterday's intra-day low) and $46.74 (an intermediate horizontal resistance level).

Market Index Analysis

The Canadian equity market landscape presents a supportive environment for technology stocks like Open Text. While the S&P/TSX remains near all-time highs, the index composition has shifted toward quality software and IT services companies with strong cash flow generation and strategic positioning in cloud and AI. For Open Text investors, the TSX technology sector backdrop is particularly favorable, as investor rotation toward profitable software businesses with recurring revenue models supports valuations for companies demonstrating disciplined capital allocation and portfolio optimization. The TSX's relative stability—combined with growing institutional demand for Canadian-listed tech companies with global footprints—creates a supportive fundamental environment. The completion of the $163 million eDOCS divestiture signals management's commitment to sharpen focus on higher-margin, cloud-based businesses, a narrative that resonates well with current Canadian investor preferences for growth companies with disciplined financial management.

Market Sentiment Analysis

Market sentiment toward Open Text has shifted markedly positive following the January 12, 2026 announcement of the completed $163 million eDOCS divestiture to NetDocuments. The transaction was immediately viewed favorably by institutional investors, with the stock rallying 2.08% on the news. This sentiment reflects recognition of management's strategic clarity: divesting low-margin, on-premise solutions to concentrate capital and management attention on higher-growth, cloud-native, and AI-driven platforms. Canadian tech investors have grown increasingly supportive of Open Text's transformation narrative, particularly as the company demonstrates tangible progress in shifting toward software-as-a-service (SaaS) and AI-enabled solutions. The completion of this transaction removes a strategic ambiguity overhang, allowing investors to focus on the company's core growth drivers: cloud services, cybersecurity, and AI capabilities. Analyst sentiment has begun reflecting this strategic shift, with recent upgrades acknowledging the improved financial flexibility from debt reduction and portfolio streamlining.

Open Text Corporation Fundamental Analysis

Why I'm Bullish on OTEX Following Its Breakout.

The January 12, 2026 completion of the $163 million eDOCS divestiture, combined with strategic cloud and AI investments, creates a compelling bullish thesis:

eDOCS Divestiture of $163 Million Clarifies Strategic Direction

On January 12, 2026, Open Text completed the sale of eDOCS—an on-premise solution from its Analytics portfolio—to NetDocuments Software, Inc. for $163 million in cash (before taxes and fees). This transaction represents a significant strategic milestone, removing non-core, declining-margin assets and allowing management to concentrate resources on higher-growth, cloud-native platforms. The net proceeds will be deployed to reduce the company's outstanding debt ($6.63 billion as of the most recent quarter), improving leverage ratios and financial flexibility. This disciplined portfolio optimization validates management's commitment to sharpen the business focus and accelerate profitability improvements. For investors, the divestiture signals the company is transitioning from a sprawling, conglomerate-like structure to a more focused cloud and AI software company, a narrative highly valued in current markets.

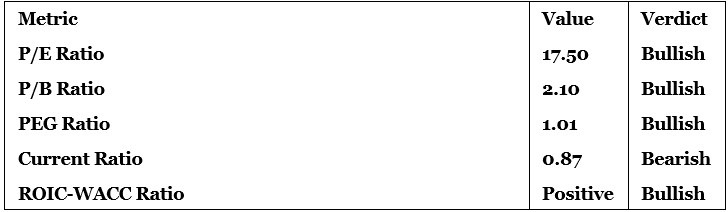

Above-Average Return on Capital Supports Valuation

Open Text generates returns on invested capital that exceed both its weighted average cost of capital and peer averages for enterprise software companies. This indicates genuine economic value creation through capital-efficient business operations. The company's recurring revenue model from subscriptions and cloud-based services drives strong cash flow generation, enabling reinvestment in high-return R&D initiatives and strategic acquisitions without excessive capital intensity. This capital efficiency is a key driver of long-term shareholder value and supports the stock's valuation multiple.

Ongoing Strategic Acquisitions and Cloud/Cybersecurity Push

Open Text has systematically built its cloud capabilities through strategic acquisitions and organic development investments. Recent initiatives include expanded AI-powered threat detection, identity security, and application protection offerings—critical capabilities in an era of rising cybersecurity threats. The company's partnerships—including recent collaboration with TELUS to deliver Canadian sovereign AI-powered solutions—position Open Text favorably to capture market share in the high-growth cybersecurity and AI analytics sectors. These strategic moves directly address market demand for integrated software platforms that combine content management, AI, and security capabilities.

Undervalued Company Relative to Growth Prospects

Trading at a P/E ratio of 17.50, compared to the S&P/TSX's 20.10, Open Text trades at a discount to the broader Canadian market despite offering superior growth prospects in cloud services and AI. The company's transition from on-premise to cloud-based SaaS models should drive margin expansion and earnings acceleration through 2026-2027, yet the market has not fully priced this transformation. Current valuations offer meaningful margin of safety for investors with conviction in management's strategic execution.

Favorable 5-Year PEG Ratio Signals Attractive Growth-Adjusted Valuation

The PEG ratio of 1.01 indicates the market is pricing Open Text at reasonable valuations relative to expected earnings growth. With consensus expectations for double-digit earnings growth as cloud revenues scale and operating leverage improve, a PEG below 1.0-1.25 is typically considered attractive for quality growth software companies. This metric suggests limited valuation risk while offering meaningful upside potential if execution meets expectations.

Open Text Corporation Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 17.50 makes TSX:OTEX an inexpensive stock relative to both its historical trading range and the broader Canadian market. At a 13% discount to the S&P/TSX's 20.10 P/E, Open Text trades at reasonable valuations for a company benefiting from cloud migration tailwinds and AI adoption trends. The company's earnings growth profile should accelerate as higher-margin cloud revenues scale and on-premise legacy products are divested, supporting multiple expansion from current levels.

The average analyst price target for OTEX is $49.75, suggesting approximately 6.7% upside potential from current levels at $46.56. This conservative target likely reflects analyst caution regarding near-term execution and debt leverage, but the completion of the eDOCS divestiture removes key strategic uncertainties. Upside risks include faster cloud adoption than modeled, successful AI product penetration, and additional debt reduction enabling higher dividend payments or accelerated share buybacks.

Open Text Corporation Technical Analysis

Today's OTEX Signal

The technical setup for TSX:OTEX on January 13th, 2026 presents a compelling long entry opportunity following a breakout from consolidation and positive momentum from the eDOCS divestiture announcement. Open Text has bounced decisively from the $45.14 support level and is testing the $46.74 resistance zone, with the recent 2.08% intra-day gain indicating genuine institutional accumulation. The stock has established an uptrend over the past 5 trading days with improving technical confirmation.

(1) The stock has broken above the 50-day moving average (approximately $45.50) with steady volume, indicating accumulation phase development

(2) The 200-day moving average at $48.20 represents the next key technical target and aligns with the analyst consensus price target of $49.75;

(3) The Relative Strength Index (RSI) has moved from oversold territory (below 35) to neutral territory (currently 50-55), suggesting healthy momentum development without overbought exhaustion

(4) Support levels are firm at $45.14 (recent support) and $42.50 (previous consolidation low)

(5) Resistance targets above current price are at $46.74 (intermediate resistance), $48.20 (200-day moving average), and $49.75 (analyst consensus target). Volume increases on up-days confirm institutional buying interest rather than retail-driven moves.

From a technical perspective, the risk-reward setup is favorable for longs in the $45.14-$46.74 entry band, with defined support below and multiple resistance targets providing structured profit-taking opportunities.

My TSX:OTEX Long Stock Levels and R/R

- OTEX Entry Level: Between $45.14 and $46.74

- OTEX Take Profit: Between $53.56 and $56.00

- OTEX Stop Loss: Between $41.09 and $42.37

- Risk/Reward Ratio: 2.08

Ready to trade our analysis of OpenText? Here is our list of the best stock brokers worth checking out.