Long Trade Idea

Enter your long position between $89.74 (the lower band of its horizontal support zone) and $95.30 (the upper band of its horizontal support zone).

Market Index Analysis

- Netflix (NFLX) is a member of the NASDAQ 100, the S&P 100, and the S&P 500 indices.

- All three indices started January in bullish mode with record highs, yet downside risks continue to accumulate as valuations reach stretched levels and profit-taking emerges, particularly in mega-cap growth names, though media and entertainment stocks benefit from structural tailwinds around premium content demand and streaming consolidation theses.

- The Bull Bear Power Indicator of the NASDAQ 100 is bullish but below its descending trendline, signalling that while near-term momentum persists, underlying technical structure suggests caution—however, Netflix's transformational WBD acquisition insulates it from near-term macro noise and positions it as a long-term consolidation beneficiary within the media sector.

Market Sentiment Analysis

Sentiment on Netflix remains mixed following the surprise announcement on December 5, 2025, of the $72 billion acquisition of Warner Bros. Discovery's studios and streaming division, with the market pricing in meaningful uncertainty around regulatory approval and integration execution, yet Morgan Stanley and consensus analysts view the deal as highly accretive long-term despite near-term headwinds. Netflix's transformation from disruptor to studio operator marks an unprecedented consolidation moment in entertainment—the company will absorb HBO Max, HBO, Warner Bros. film and television studios, and a massive library of IP, effectively creating a vertically integrated media powerhouse capable of competing with traditional studios on creative output while maintaining streaming-native distribution advantages.

Top Regulated Brokers

Market concerns center on three fronts: (1) regulatory scrutiny from the Department of Justice and international authorities citing competition concerns; (2) the $82.7 billion total enterprise value (including debt) representing a 121.3% premium to WBD's September 10, 2025 pre-rumor price, raising acquisition premium risk; and (3) complexity of integrating Warner Bros. operations while WBD's Global Networks division spins off into Discovery Global in Q3 2026. Despite these risks, Morgan Stanley maintained an Overweight rating on Netflix, citing longer-term consolidation benefits, while noting the company's ad revenue doubled in 2024 and the ad-supported tier now accounts for 55% of new signups in available territories, providing a powerful margin expansion tailwind.

Netflix Fundamental Analysis

Netflix is the best-known over-the-top subscription video-on-demand service with 302 million global subscribers as of Q4 2024. It operates its own production studios, acquires original programming, and showcases third-party content via its subscription-based streaming services. Netflix expanded into gaming and live sporting events, and pending the WBD acquisition closing in Q3 2026, will now control HBO Max, HBO, and major film and television studios, transforming the company into a full-stack media and entertainment conglomerate.

So, why am I bullish on NFLX at current prices?

Netflix's $72 billion acquisition of Warner Bros. Discovery represents the culmination of a multi-year consolidation thesis in streaming and marks the company's transformation into a vertically integrated studio operator with unmatched content scale and global distribution—the combined entity will control over 80 years of archives, thousands of film and TV titles, and the production capability to generate blockbuster content across every major genre, providing Netflix with defensible competitive moats that are difficult for potential rivals to replicate.

Regulatory scrutiny, while real, appears unlikely to derail the deal—Netflix received CFIUS approval as a non-foreign transaction, and the company has committed to maintaining theatrical releases for Warner Bros. films, which addresses cinema advocates' concerns and likely reduces political opposition from lawmakers seeking to protect traditional exhibition. The WBD board's January 7, 2026, reaffirmation of the deal despite competing interest from Paramount Skydance strengthens the deal's momentum and signals confidence that Netflix overpaid only modestly for transformational strategic value.

Netflix's advertising strategy continues to deliver exceptional results—the company doubled ad revenue in 2024 and expects to double it again in 2025, with ad-supported plans now representing 55% of new signups in territories where available, up from 50% in Q3 and 40% in Q1 2024, demonstrating rapid penetration and signalling that the company is successfully monetizing its massive subscriber base at high margins. Operating margins reached 27% in 2024 despite continued content investment, and management projects margins to expand further as ad revenue and price increases flow through, while the WBD acquisition is expected to unlock $2-3 billion in annual cost synergies by year three, providing accretion to earnings.

The undervalued content library argument is particularly compelling—Netflix will gain immediate access to HBO's prestigious content catalog, Warner Bros.' 100-year film archive, and the production studios' pipeline of future releases, eliminating the need for Netflix to develop equivalent content in-house and creating a content moat that justifies premium valuations relative to pure-play streamers.

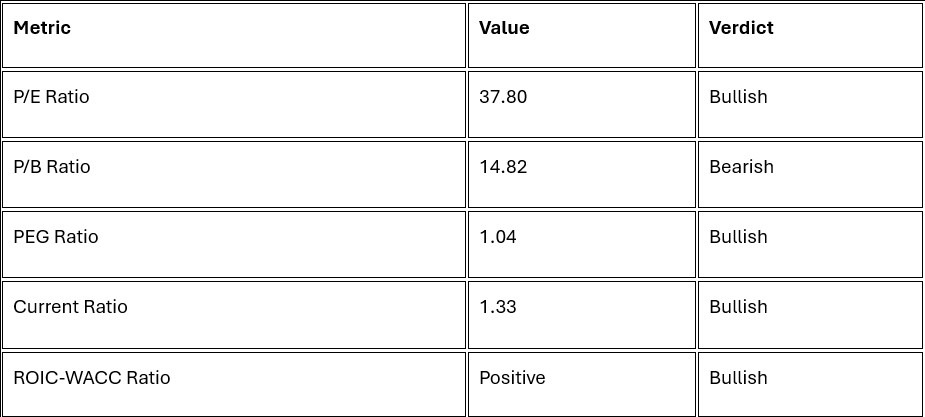

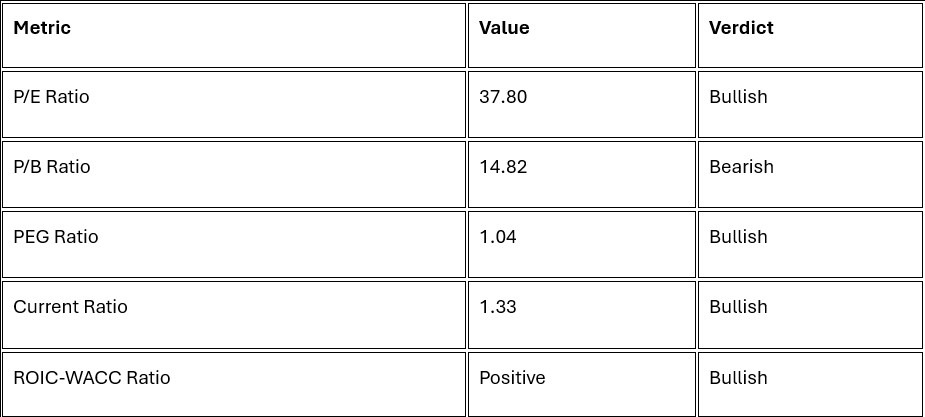

Netflix's bullish 5-year PEG ratio of 1.04 suggests the market is undervaluing long-term earnings growth when accounting for the WBD accretion, subscriber momentum (+19 million in Q4 2024, far exceeding 9.8 million consensus), and the structural shift to ad-supported monetization that offers superior margin profiles versus pure subscription models.

The January 20th earnings release will provide crucial guidance clarity on 2026 outlook post-acquisition announcement, and cautious optimism is warranted given the company's history of beating subscriber targets and exceeding margin expectations. Excellent profit margins (27% in 2024, targeting 35%+ by 2027 with WBD synergies) combined with the company's operational excellence track record strongly suggest Netflix can execute on the integration and deliver the promised cost saves, justifying the premium valuation and providing multiple expansion potential as deal risk declines post-regulatory approval.

Netflix Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 37.80 makes NFLX trading in line with the NASDAQ 100 Index's 37.57, suggesting reasonable valuation when accounting for WBD deal accretion and margin expansion trajectory.

The average analyst price target for NFLX is $126.18. This suggests strong upside potential with reduced downside risk, implying 39.0% appreciation from January 8th levels.

Netflix Technical Analysis

Today's NFLX Signal

- The NFLX D1 price chart below shows price action consolidating within a tight horizontal band between $89.74–$95.30, with buyers consistently defending the lower support level and price action oscillating near the midpoint as the market digests the transformational WBD acquisition announcement, setting the stage for a breakout that resolves either sharply higher on regulatory approval confirmation or lower on deal pessimism.

- NFLX trades above its 20-day and 50-day moving averages with the 200-day EMA in steady uptrend formation, a constructive technical backdrop that has rebuilt following the post-announcement consolidation and now positions the stock to capitalize on any positive regulatory developments or earnings guidance that de-risks the deal thesis.

- The Bull Bear Power Indicator on the NFLX daily chart has turned bullish with a rising trendline, signalling institutional accumulation into the consolidation zone and suggesting that recent weakness to $89.74 has attracted value buyers who recognize the long-term strategic value of the WBD acquisition despite near-term uncertainty.

- Average daily trading volumes on consolidation tests near support ($89.74) have remained elevated at 38.8 million shares (well above the 24.5 million average), demonstrating sustained institutional participation and confirming that recent price weakness represents healthy base-building for the next leg higher rather than structural selling pressure.

- NFLX has begun to outperform the broader NASDAQ 100 and S&P 500 indices on a relative strength basis as the market rotates into media and entertainment consolidation plays, with Morgan Stanley's Overweight rating and improving sentiment on streaming consolidation beneficiaries providing constructive technical support.

Netflix Price Chart

My NFLX Long Stock Levels and R/R

- NFLX Entry Level: Between $89.74 and $95.30

- NFLX Take Profit: Between $116.73 and $120.69

- NFLX Stop Loss: Between $78.01 and $82.11

- Risk/Reward Ratio: 2.31

Ready to trade our analysis of Netflix? Here is our list of the best stock brokers worth reviewing.