The focus in the AI trade is now starting to shift a bit from the chips sector into a lot of software areas.

- The Nasdaq 100 has been a little quiet during the trading session here on Wednesday, which is probably to be expected.

- After all, we have the non-farm payroll announcement on Friday, and traders will be digesting the ADP numbers, which had a little bit more firmness to them than I think a lot of people anticipated.

The Agentic AI era is here, and this means that the rally in the Nasdaq might not be about chip manufacturing so much anymore, such as Nvidia, but the deployment of Agentic AI software that performs automatic tasks and autonomous tasks. This is expected to drive earnings for broader software and consumer internet companies in 2026. This is something to watch.

Most analysts expect about 15% earnings growth for the totality of the index, and that could help justify current valuations. Interest rates will, of course, impact, and while the Fed cuts rates, it does have an issue with inflation being sticky, so the 10-year yield is expected to grind a little bit higher to 4.35% later this year, which could put a little bit of pressure on this market.

Top Regulated Brokers

There are some people out there calling for a potential recession; current estimates from people like JP Morgan are closer to 35%, but they say that every year. It’s basically a way for the banks to cover their backsides, if you will.

Market Support and Technical Targets

One of the biggest risks right now is the concentration in the names that are so strong, but let’s be honest here, that’s what drove it higher in the first place. So, the earnings in late January and early February could be a major event, but this is still a market that’s bullish.

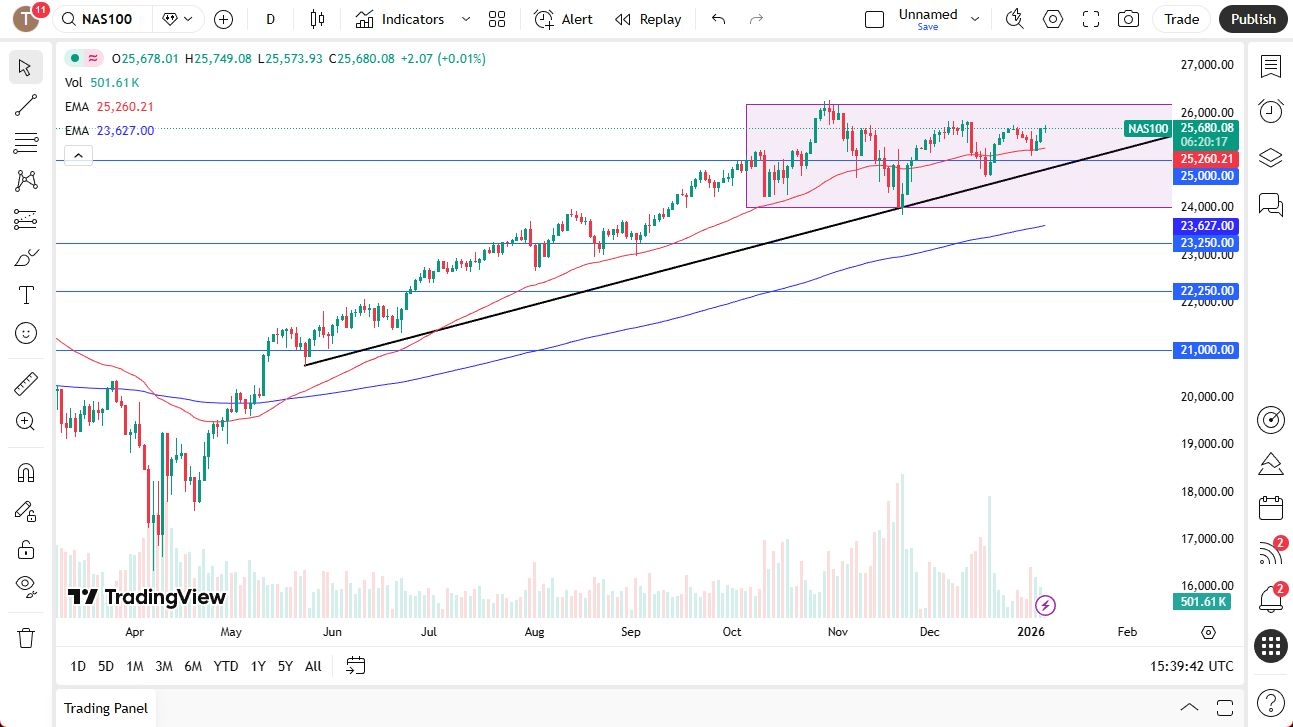

I still look at this as a market that’s trying to get to the 26,000 level. If it can clear the recent swing high at about 26,300, we’re off to the races and start grinding higher. I see support at the 50-day EMA and the 25,000 level underneath.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.