Long Trade Idea

Enter your long position between A$205.07 (yesterday's intra-day low) and A$210.09 (today's intra-day high).

Market Index Analysis

- Macquarie Group (ASX:MQG) is a member of the S&P/ASX 50 Index.

- The S&P/ASX 200 Index started January in mixed mode with modest gains offset by profit-taking in financials, yet the Australian market continues to benefit from structural tailwinds around infrastructure development and M&A activity, with Macquarie positioned as a core beneficiary of both trends.

- The Bull Bear Power Indicator of the S&P/ASX 50 is bearish with a descending trendline, signalling that while near-term momentum has stalled, selective rotation into high-quality investment banking and infrastructure advisory names like Macquarie may continue as investors seek exposure to disciplined capital allocators with diversified income streams.

Market Sentiment Analysis

Sentiment on Macquarie has shifted constructively following recent analyst price target increases and the company's reaffirmed commitment to disciplined capital allocation through strategic divestitures of non-core assets and a robust share buyback program totalling A$2 billion over 12 months. The Australian financial services sector has entered 2026 with cautious optimism, with market participants recognizing that Macquarie's diversified revenue streams—spanning M&A advisory (where it ranks as Australia's premier adviser), infrastructure asset management, banking and financial services, and commodities trading—insulate the company from cyclical downturns in any single business line.

Macquarie's announcement of up to €510 million in special dividends from its Irish banking unit demonstrates management's confidence in capital optimization and signals to investors that the company's disciplined portfolio management is unlocking hidden value across geographies and business lines. Investor enthusiasm centers on three factors: (1) the recent price target increases to A$224.48–A$255.00 by major brokers including Ord Minnett, signalling fresh upside recognition; (2) the company's strong position as an infrastructure advisor with A$870 billion in assets under management, providing recession-resistant revenue; and (3) trading valuations appearing attractive relative to historical multiples, with a P/E of 18.84 below the ASX 200's 20.46, creating a margin of safety for long positioning.

Macquarie Group Fundamental Analysis

Macquarie Group is a multinational investment banking and financial services group. It is one of the world's largest infrastructure asset managers and ranks as Australia's premier mergers and acquisitions adviser, with more than A$870 billion in assets under management.

So, why am I bullish on ASX:MQG at current levels?

Macquarie's low valuations, with a P/E ratio of 18.84 and a PEG ratio of 0.83, suggest the market is pricing in minimal long-term earnings growth when the company's diversified platform—spanning M&A advisory, infrastructure asset management, banking services, and commodities trading—positions it to capture secular growth in infrastructure development across Australia, Asia-Pacific, and Europe. The recent divestitures of non-core assets to increase its capital buffer demonstrate management's disciplined capital allocation approach, freeing up balance sheet capacity for opportunistic acquisitions, special dividends, and share buybacks that enhance shareholder returns without sacrificing financial stability.

Recent price target increases from major brokers including Ord Minnett (A$255.00 target implying 25% upside) and consensus estimates around A$224.48–A$234.42 signal that sell-side analysts increasingly recognize Macquarie's structural advantages and execution capabilities, with the stock historically re-rating higher as guidance visibility improves and capital allocation narratives gain credibility.

The bullish 5-year PEG ratio of 0.83 suggests the market is substantially undervaluing long-term earnings growth potential, particularly given Macquarie's exposure to infrastructure development themes that benefit from aging asset replacement cycles, renewable energy buildouts, and government stimulus across developed markets. This low PEG combined with the company's demonstrated ability to generate high-return-on-equity businesses and its disciplined capital management provides substantial multiple expansion potential as the earnings growth narrative becomes visible to mainstream investors.

The anticipated special dividend of up to €510 million from the Irish banking unit represents a near-term capital return catalyst and signals management's confidence in the profitability and liquidity of that operation, providing immediate cash returns to shareholders while underlining the company's portfolio optimization strategy. The combination of disciplined capital allocation, strong M&A pipeline momentum (with Macquarie maintaining its position as Australia's premier M&A adviser through the cycle), a diversified infrastructure asset management business generating sticky recurring revenue, and attractive entry valuations creates a compelling risk/reward profile for long positioning into calendar 2026.

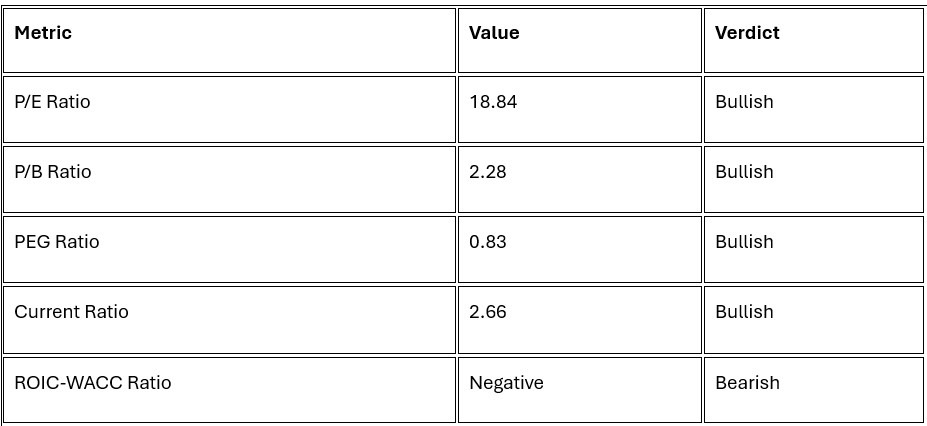

Macquarie Group Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 18.84 makes MQG a relatively cheap stock. By comparison, the P/E ratio for the ASX 200 is 20.46.

The average analyst price target for MQG is A$224.48. This suggests decent upside potential with manageable downside risk.

Macquarie Group Technical Analysis

Today's MQG Signal

- The MQG D1 price chart below shows price action consolidating within a tight horizontal band between 205.07–210.09, with buyers consistently defending the lower support level and price oscillating near the midpoint, suggesting that a directional breakout is building and likely to resolve higher given the improving fundamental backdrop around capital deployment and M&A activity.

- MQG trades above its 20-day and 50-day moving averages with the 200-day EMA in steady uptrend, a constructive technical structure that has rebuilt following Q4 2025 consolidation and now positions the stock to capitalize on positive broker recommendations and analyst price target increases.

- The Bull Bear Power Indicator on the MQG daily price chart shows weakening momentum, but the relative strength index remains in neutral territory, suggesting that institutional accumulation into recent weakness near A$205.07 may be underway as sophisticated investors position for a re-rating as capital allocation narratives crystallize.

- Average daily trading volumes have remained steady at 293,000 shares over the past 5 trading days (consistent with 6-month daily average), indicating healthy liquidity and suggesting that price consolidation within the A$205.07–A$210.09 band represents healthy base-building rather than capitulation selling or institutional distribution pressure.

- MQG has begun to slightly outperform the broader ASX 200 Index on a relative strength basis, supported by recent price target increases and analyst upgrades, with financials and diversified financial services names benefiting from renewed interest in dividend-yielding, capital-return-oriented businesses as growth expectations moderate.

Macquarie Price Chart

My MQG Long Stock Levels and R/R

- MQG Entry Level: Between A$205.07 and A$210.09

- MQG Take Profit: Between A$224.48 and A$231.48

- MQG Stop Loss: Between A$196.08 and A$198.50

- Risk/Reward Ratio: 2.16

Ready to trade our analysis of the Macquarie Group? Here is our list of the best stock brokers worth reviewing.