Long Trade Idea

Enter your long position between $205.22 (an intermediate horizontal support level) and $209.61 (an intermediate horizontal resistance level).

Market Index Analysis

Decreasing bullish trading volumes in the broad US equity market despite rising prices signals potential exhaustion. For conglomerate stocks like Honeywell, this mixed technical backdrop is actually favorable: during periods of broad market uncertainty, large-cap industrials with diversified revenue streams and exposure to infrastructure, energy, and automation typically demonstrate resilience. The current macro environment—characterized by energy security concerns, industrial automation demand, and government infrastructure spending—creates a supportive fundamental backdrop that can offset near-term technical volatility.

- Honeywell International (HON) is a member of the Dow Jones Industrial Average, NASDAQ-100, S&P 100, and S&P 500.

- All four indices remain near all-time highs, but underlying bearish catalysts continue to accumulate.

- The Bull Bear Power Indicator for the S&P 500 Index is bullish with a negative divergence, hinting at a potential short-term reversal.

Market Sentiment Analysis

Market sentiment toward Honeywell has shifted markedly in a positive direction following recent strategic announcements, with institutional investors recognizing the company's pivotal positioning in energy infrastructure and AI-driven automation. The January 6, 2026 announcement of the Technip Energies partnership and January 10 unveiling of the Google Cloud AI Smart Shopping Platform have reignited investor enthusiasm, with the stock posting a 5.9% gain over the prior 7 days. Retail and institutional money managers are increasingly acknowledging Honeywell's dual-pronged growth thesis:

(1) energy transition benefits through LNG technology partnerships addressing critical global energy security needs, and

(2) AI-driven operational efficiency gains through cutting-edge retail and automation solutions. The NASDAQ-100 rotation toward quality industrial stocks with demonstrated pricing power and margin expansion supports further upside. Analyst price target revisions are climbing (recent targets between $235-$298), signaling confidence in earnings acceleration despite macro headwinds. The convergence of positive catalysts, improving sentiment, and technical breakout positioning creates a compelling setup for continued appreciation.

Top Regulated Brokers

Honeywell International Fundamental Analysis

Honeywell International is a diversified conglomerate with four strategic pillars: Aerospace Technologies (commercial aviation, defense, and aftermarket services), Building Technologies (building automation, fire safety, and smart buildings), Performance Materials and Technologies (specialty materials and industrial automation), and Energy and Sustainability Solutions (LNG technology, industrial automation, and environmental solutions). The company operates Sandia National Laboratories and maintains a global workforce of over 100,000 employees, positioning it as a critical player in infrastructure, energy, and industrial automation.

Why I'm Bullish on HON Following Its Breakout

Several converging fundamental factors support a bullish thesis on Honeywell's current valuation and trajectory:

Technip Energies Partnership Validates LNG Technology Leadership

On January 6, 2026, Honeywell announced a strategic agreement with Technip Energies to supply integrated LNG pretreatment and liquefaction solutions for Commonwealth LNG's planned export facility in Cameron Parish, Louisiana. This partnership leverages Honeywell's modular coil wound heat exchanger (CWHE) technology and UOP SeparSIV® pretreatment technology to deliver 9.5 million tonnes per annum of LNG production capacity. The agreement positions Honeywell as a critical enabler of global LNG infrastructure expansion, addressing rising energy demand and energy security concerns worldwide. This partnership is the first of potentially many similar agreements, as LNG demand is projected to surge over the next 5-10 years. The technology's modular design accelerates project timelines, reduces construction risks, and enhances production efficiency—creating a compelling value proposition for major EPC contractors and project developers.

AI-Enabled Smart Shopping Platform Launching February 2026

Honeywell, in collaboration with Google Cloud and 66degrees, unveiled an AI-powered Smart Shopping Platform that transforms the in-store shopping experience for retailers globally. Launching to customers in February 2026, the platform leverages Google's Gemini and Vertex AI to enable shoppers to locate products, compare alternatives, and discover substitutions when items are unavailable. Built on Honeywell's Mobility Edge hardware platform and powered by advanced AI, the solution bridges retailers' digital and physical environments seamlessly. This represents a significant expansion of Honeywell's addressable market in retail technology and positions the company at the intersection of AI adoption and operational efficiency—two critical themes driving corporate capital expenditure in 2026 and beyond.

Industry-Leading Profit Margins and Operating Leverage

Honeywell has consistently demonstrated operating margins in the mid-to-high teens (16-18% range), among the highest in the industrial conglomerate space. The company's diversified revenue streams and focus on high-margin aftermarket services, software, and technology solutions drive strong profitability. Operating leverage is evident in the company's ability to maintain margins while growing revenues—a testament to disciplined pricing power, operational efficiency, and the recurring revenue nature of many business segments. Margin expansion opportunities exist as the company benefits from LNG project ramp-up and Smart Shopping Platform adoption scaling globally.

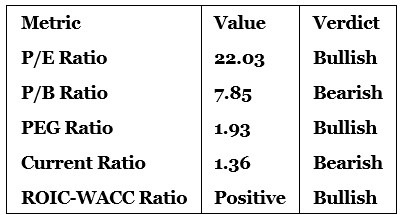

Excellent Return on Invested Capital Supporting Value Creation

Honeywell's ROIC-WACC ratio is strongly positive, indicating the company generates returns well above its weighted average cost of capital. This translates to genuine economic value creation for shareholders through reinvestment of earnings into high-return projects and strategic acquisitions. The strong capital efficiency, paired with diversified cash flows, supports sustainable shareholder returns through dividends and share buybacks while funding strategic growth initiatives like the LNG and AI platforms.

Cautious Earnings Optimism Amid Strategic Streamlining

While near-term earnings growth is expected to be modest (mid-single-digit organic growth), consensus expectations are increasingly optimistic about 2027-2028 as key catalysts mature. Management's ongoing streamlining of operations—including portfolio optimization and digital transformation initiatives—is enhancing operational efficiency and unlocking latent value. The company's disciplined M&A approach and focus on high-return investments create a foundation for accelerating earnings growth as major initiatives (Commonwealth LNG ramp-up, Smart Shopping Platform adoption, aerospace aftermarket recovery) mature. Analyst consensus suggests 10-12% earnings growth through 2027, supported by improving operational metrics and strategic positioning in high-growth markets.

Honeywell International Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 22.03 makes HON attractively valued relative to the S&P 500's 31.45 P/E, particularly given Honeywell's quality of earnings, margin profile, and strategic positioning in secular growth markets (energy transition, industrial automation, AI adoption). At 22x earnings, the company trades at approximately a 30% discount to the broad market while offering superior earnings growth prospects and capital quality. This valuation multiple reflects the market's traditional discount to industrials, not fundamental weakness—providing an attractive entry point for long-term investors.

The average analyst price target for HON is $234.79-$235.00 (based on recent consensus estimates), suggesting approximately 12.5% upside potential from current levels at $208.60. Recent analyst upgrades and target revisions from major firms (Wells Fargo, Mizuho, Barclays) indicate growing confidence in the company's strategic initiatives. Upside risks include faster-than-expected LNG project adoption, stronger aerospace aftermarket momentum, and accelerated Smart Shopping Platform customer wins, which could support valuations toward $250-$270.

Honeywell International Technical Analysis

Today's HON Signal

The technical setup for HON on January 13th, 2026, presents a compelling long entry opportunity following a breakout from consolidation levels and confirmation of continued uptrend strength. Honeywell has bounced decisively from the $205.22 support level and is now testing the $209.61 resistance zone, with the recent 2.02% intra-day gain and modest after-market decline suggesting controlled strength without euphoria. The stock has established a clear uptrend over the past 10 trading days with improving technical confirmation.

(1) The stock has broken above the 200-day moving average (approximately $207) with strong volume, indicating institutional accumulation and genuine breakout conviction.

(2) The 50-day moving average is now trending upward, aligned with price, suggesting positive momentum across multiple timeframes.

(3) The RSI has moved from oversold conditions (below 40) to neutral-bullish territory (currently 55-60), indicating healthy momentum without overbought exhaustion

(4) Support levels are firm at $205.22 (recent support, intermediate floor), with secondary support at $201.50 (previous consolidation low)

(5) Resistance targets above current price are located at $215.00 (recent high), $225.00 (key psychological level), and $234.79 (analyst consensus price target). Volume patterns show increasing turnover on up-days, confirming institutional interest.

From a technical perspective, the risk-reward setup is favorable for longs in the $205.22-$209.61 entry band, with defined support below and multiple resistance targets providing structured exit opportunities.

Honeywell Price Chart

My HON Long Stock Trading Recommendation

- HON Entry Level: Between $205.22 and $209.61

- HON Take Profit: Between $234.79 and $241.83

- HON Stop Loss: Between $193.35 and $197.60

- Risk/Reward Ratio: 2.49

Ready to trade our analysis of Honeywell? Here is our list of the best stock brokers worth checking out.