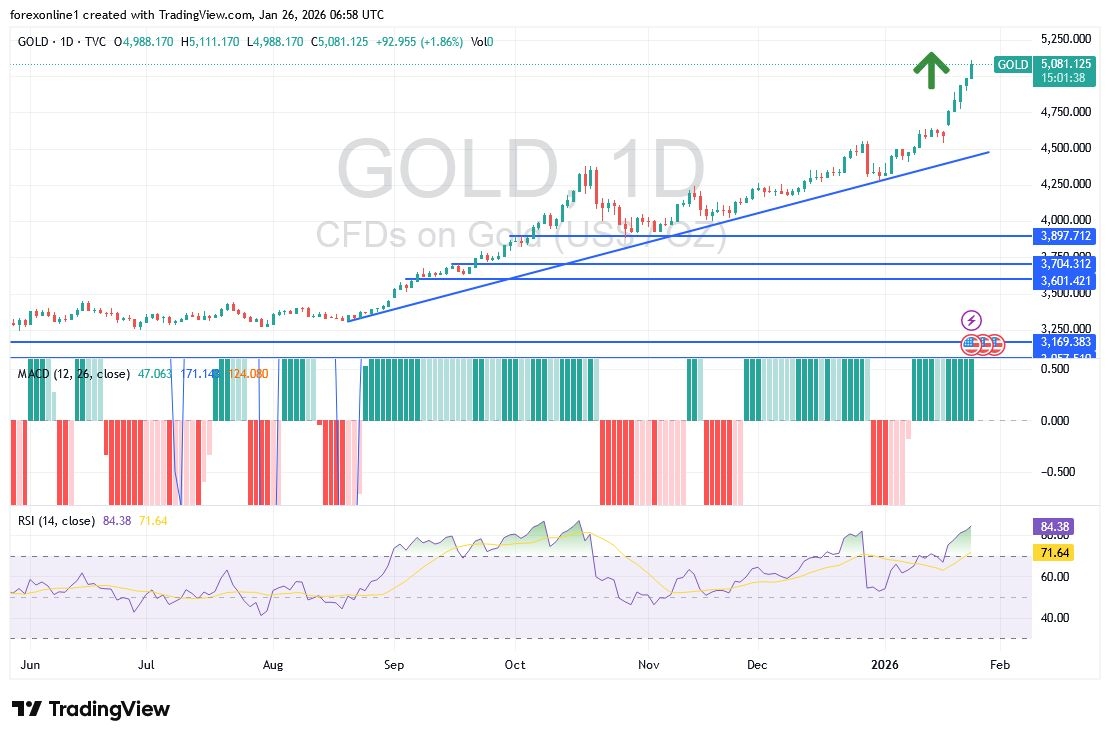

Today’s Gold Analysis Overview:

- The overall Gold Trend: Strongly bullish.

- Today's Gold Support Points: $5040 – $4900 – $4770 per ounce.

- Today's Gold Resistance Points: $5130 – $5220 – $5300 per ounce.

Today's Gold Trading Signals:

- Sell gold from the resistance level of $5220 with a target of $4800 and a stop-loss at $5300.

- Buy gold from the support level of $4940 with a target of $5200 and a stop-loss at $4900.

Top Regulated Brokers

Technical Analysis of Gold Price (XAU/USD) Today:

By the end of last week's trading, silver futures surpassed the $100 barrier for the first time in history, recording a jump of over 5% amid a meteoric rise in the metals market. According to gold trading platforms, silver futures rose to $101.775 per ounce at 18:16 GMT Friday on the COMEX division of the New York Mercantile Exchange. Consequently, Silver recorded weekly gains of 13%, adding to its year-to-date gains of 43%. Over the past twelve months, silver prices have surged by more than 200%.

The current price of silver is around $109.44 per ounce, a new all-time high.

As for Gold—Silver’s sister commodity—it crossed the $5,000 per ounce threshold for the first time in history. Last week, gold prices rose by 8%, bringing year-to-date gains to 15%. Gold is currently trading around $5,110 per ounce, marking a new historical bullish record.

Factors Driving the Silver Market Strength

According to commodities experts, Silver’s appeal lies in its dual role as both an investment and an industrial metal. This gives the "white metal" a powerful boost. Experts expect Silver to continue benefiting from the same factors supporting investment demand for Gold. Additional support is expected to come from ongoing tariff concerns and declining physical liquidity in the London market.

Broadly speaking, concerns persist regarding the global silver supply deficit, which may worsen under the tariffs imposed by President Donald Trump. Additionally, other factors, including a weakening US Dollar and central bank purchases, have contributed to supporting precious metal prices.

However, the other metals market saw a notable rally at the end of last week's trading. It remains to be seen whether this metals boom will continue. Some believe that a global deficit could drive prices higher, while others believe that weak demand and overbought conditions could lead to a sharp reversal.

Will Gold Prices Rise in the Coming Days?

According to gold analysts and disregarding recent gains in the gold market and the fact that all technical indicators have reached strong overbought levels, the price of gold is expected to surpass the $5,000 per ounce mark, a significant psychological level. This surge is driven by the weakening US dollar and bolstered by geopolitical concerns.

Experts and analysts believe that the upward movement following the breakout of the flag pattern is nearing its end. This pattern, a technical analysis indicator that follows a sharp market move, suggests the continuation of the trend. They add that, barring any new geopolitical conflicts, gold may experience some consolidation after the breakout, as it tends to stabilize around key levels.

This pattern last occurred around the $2,000 per ounce level, around which gold remained stable for most of 2020-2023. Overall, commodity market experts continue to monitor geopolitical hotspots such as Venezuela, Iran, and Greenland.

Trading Tips:

Dear TradersUp trader, we recommend continuously monitoring the drivers of the gold market rally to anticipate further gains or potential exposure to profit-taking selloffs. Generally, utilize any Gold pullbacks as an opportunity to look for new buying entries.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.