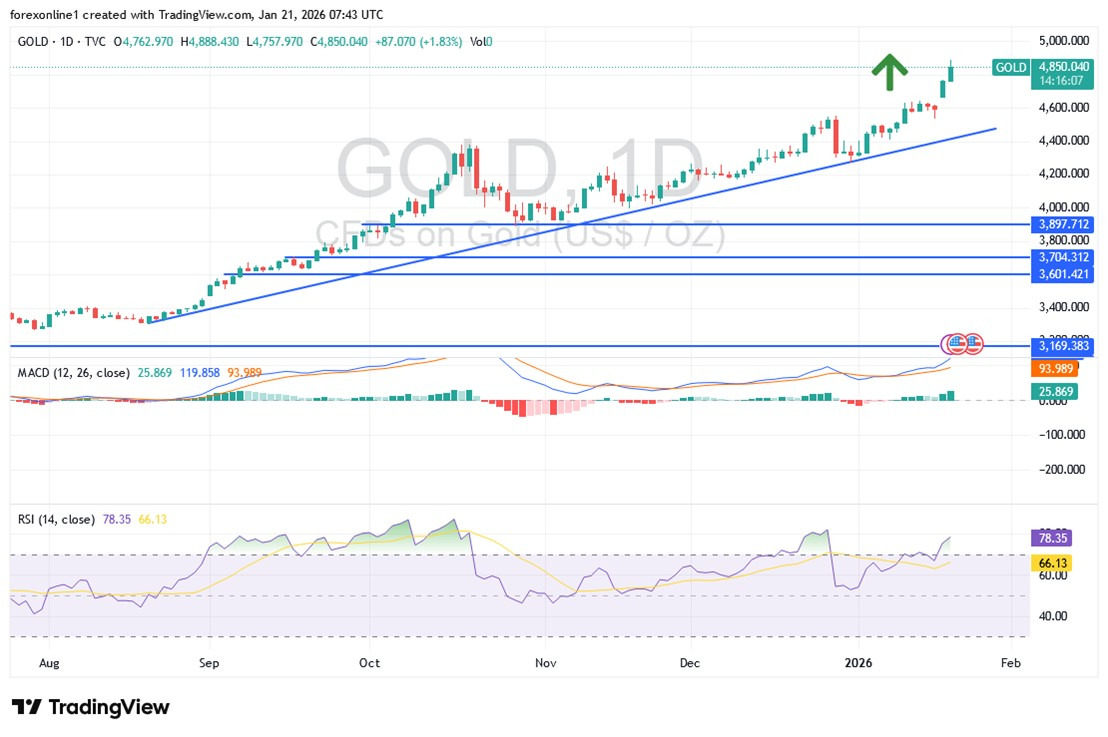

Today’s Gold Analysis Overview:

- The overall Gold Trend: Strongly bullish.

- Today's Gold Support Points: $4720 – $4650 – $4560 per ounce

- Today's Gold Resistance Points: $4880 – $4965 – $5060 per ounce.

Today's Gold Trading Signals:

- Sell gold from the resistance level of $5000 with a target of $4500 and a stop-loss at $5090.

- Buy gold from the support level of $4670 with a target of $5000 and a stop-loss at $4600.

Technical Analysis of Gold Price (XAU/USD) Today:

Despite all technical indicators reaching extreme overbought levels, spot gold prices have surged to new historic record highs, approaching the $4,800 per ounce peak. This rally is driven by aggressive safe haven buying amid ongoing tensions between the United States and Europe regarding Greenland. According to gold trading platforms, the price of the yellow metal is stabilizing around $4,766 per ounce, the highest price ever recorded to date.

Will gold prices rise further in the coming days? And where to?

According to gold analysts: Yes. The recent escalation by the U.S. President against NATO allies is likely to shake market participants' confidence in the U.S. Dollar as a safe haven, pushing them toward other assets. Gold prices previously broke the $4,700 barrier for the first time, fueled by a weakening U.S. Dollar and fears of renewed trade tensions. A weaker Dollar makes gold cheaper for buyers using other currencies.

In general, a combination of geopolitical uncertainty and concerns about central bank independence has unsettled investors, driving flows into precious metals after last year's exceptionally strong performance. Investors generally favor gold and silver over currencies and government bonds amid rising US debt levels and increasing policy unpredictability.

Top Regulated Brokers

Gold is poised for a rapid surge toward the $5,000 per ounce peak

According to market activity, gains increased amid rising geopolitical risks. Referring to U.S. interest in purchasing Greenland, Trump stated on "Truth Social" that Greenland is essential for national and global security, adding, "There is no turning back." He also agreed to meet various parties at the World Economic Forum in Davos to discuss the issue.

Currently, financial markets are awaiting Europe's response to Trump's threat to impose tariffs on eight European countries opposing his Greenland ambitions. Simultaneously, French President Emmanuel Macron rejected an invitation to join a "Peace Council" for Gaza proposed by Trump. Silver also touched an all-time high of $95.866 per ounce before retracing.

Recently, the US threat to its NATO allies has roiled markets, boosting demand for safe-haven assets and reviving the "sell America" trade. French President Macron intends to invoke the EU's anti-coercion mechanism, although German Chancellor Friedrich Merz has said he is trying to persuade Macron to tone down his response.

Trump will travel to the World Economic Forum in Davos, threatening eight European countries with tariffs for opposing his claims to Greenland. European Commission President Ursula von der Leyen stated in a speech today in Davos: “The European Union and the United States reached a trade agreement last July. In politics, as in business, an agreement is an agreement. And when friends shake hands, it must mean something.” Meanwhile, Trump announced tariffs of 10% on goods from eight European countries, effective February 1st, to rise to 25% in June unless an agreement is reached to purchase Greenland.

According to commodity market experts, we have entered an era of national competition for resources among major powers. Therefore, investing in currencies is not necessarily the best way to navigate this geopolitical landscape. They emphasized that gold remains a strong investment option, while cautioning against expecting easy returns from silver. The crisis that followed the US arrest of the Venezuelan leader has further fueled the sharp rise in precious metal prices. The Trump administration’s renewed attacks on the Federal Reserve have also contributed to the rise in gold and silver prices this year, reviving concerns about the independence of the US central bank.

On another front that could impact the market, investors will also be closely watching the US Supreme Court's hearing on President Trump's efforts to remove Lisa Koch, the Federal Reserve Chair, scheduled for Wednesday. This hearing could be crucial for the continued independence of the US central bank.

Trading Tips:

We still prefer investing in gold, especially buying at lower prices rather than risking buying at higher prices.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.