Friday’s trading in the broad Forex market saw widespread volatility develop. The EUR/USD was part of this mixture. Day traders who have been seeking volatility in Forex and complaining that price action has largely disappeared from the speculative landscape the past year and a half suddenly found themselves in the midst of a storm.

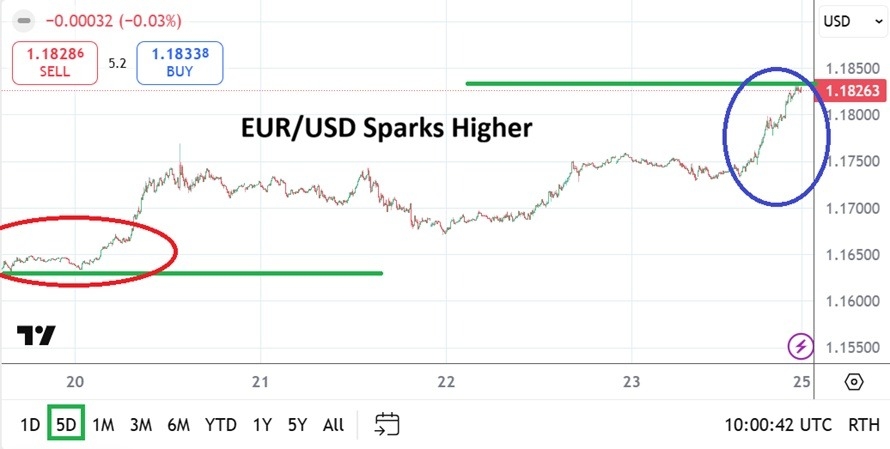

The EUR/USD which had largely been challenging the resistance level of 1.17500 and finding pushback most of last week, suddenly found momentum sustained on Friday and higher ground to explore.

Sustained buying going into this weekend and a finish near the 1.18263 level has put the EUR/USD into a realm last seen in the middle of September 2025. The broad financial markets are not exactly showing a huge amount of risk appetite, but they are showing uncertainty and this is leading to a lot of explanations, but also perhaps wrong thinking regarding why the EUR/USD is cascading upwards along with other assets which are showing strong volatility.

Top Regulated Brokers

Trump, U.S GDP and the Federal Reserve

While many analysts are suggesting the EUR/USD has climbed because of President Trump’s rhetoric in Davos in the middle of last week, suggesting the EUR is now being bought as some sort of protest, this is difficult to believe. U.S GDP numbers came in stronger than anticipated on Thursday and this may have been a reason why Forex suddenly started to shake. Considerations and debate about what the U.S Federal Reserve will do this coming week and over the mid-term are certainly legitimate concerns.

The Fed will deliver its FOMC Statement this coming Wednesday. Vocal debates are being heard about interest rate policy and leadership of the U.S central bank. The U.S is showing solid growth, and inflation remains tame, which are classical reasons for a dovish Federal Reserve, but that may not translate into reality this coming week. Fed Chairman Powell remains very cautious and his leadership may influence the Fed to keep interest rates in place this coming week. Trump is not a fan of Jerome Powell.

Words and Actions Translated into Market Sentiment

The broad financial markets are showing nervousness in the U.S via equity indices, yet they remain within sight of highs. Gold is trading in record territory and Silver is too. Suddenly Forex, including the EUR/USD, is starting to show volatility.

- What day traders need to understand is that behavioral sentiment appears to be fragile because of loud rhetoric coming from many global corners.

- It is advised that day traders try to take deep breaths and use solid risk management to guard against sudden gyrations.

- The ability of the EUR/USD to trade above the 1.18000 mark and sustain values on Friday, will create a lot of interested observers early this coming week in Forex.

EUR/USD Weekly Outlook:

Speculative price range for EUR/USD is 1.17655 to 1.18980

Like lightning out of the sky, the EUR/USD suddenly jumping above the 1.18000 mark on Friday and finishing near the 1.18263 ratio must be taken seriously. More volatility early on Monday and into this coming week is a near certainty. The Federal Reserve decision and rhetoric via its FOMC meeting will shake the markets. While it seems unlikely the Fed will cut interest rates this week because of the level of caution Fed Chairman Jerome Powell expressed last month, this doesn’t mean it would be the right decision.

Based on the stronger than expected GDP on Thursday of last week and the rather tame inflation numbers the week before, the Fed, per dovish observers, certainly has reasons to cut interest rates again. So if Powell and the FOMC members do not cut interest rates this week, what they say about the coming months will be important. And here is where things get interesting, financial institutions seem to be buying the EUR/USD as if they believe the U.S Fed is going to become more dovish over the mid-term if inflation remains tranquil no matter what Jerome Powell says. The EUR/USD above 1.18000 was seen in September of 2025, but the last time the currency pair saw sustained higher price action was in 2021. Day traders need to brace for more volatility this week as long-term sentiment gets tested.

Ready to trade our weekly forecast? We’ve shortlisted the best European brokers in the industry for you.