My previous EUR/USD signal on 22nd January was not triggered.

Today’s EUR/USD Signals

- Risk 0.75%.

- Trades may only be entered prior to 5pm London time today.

Short Trade Ideas

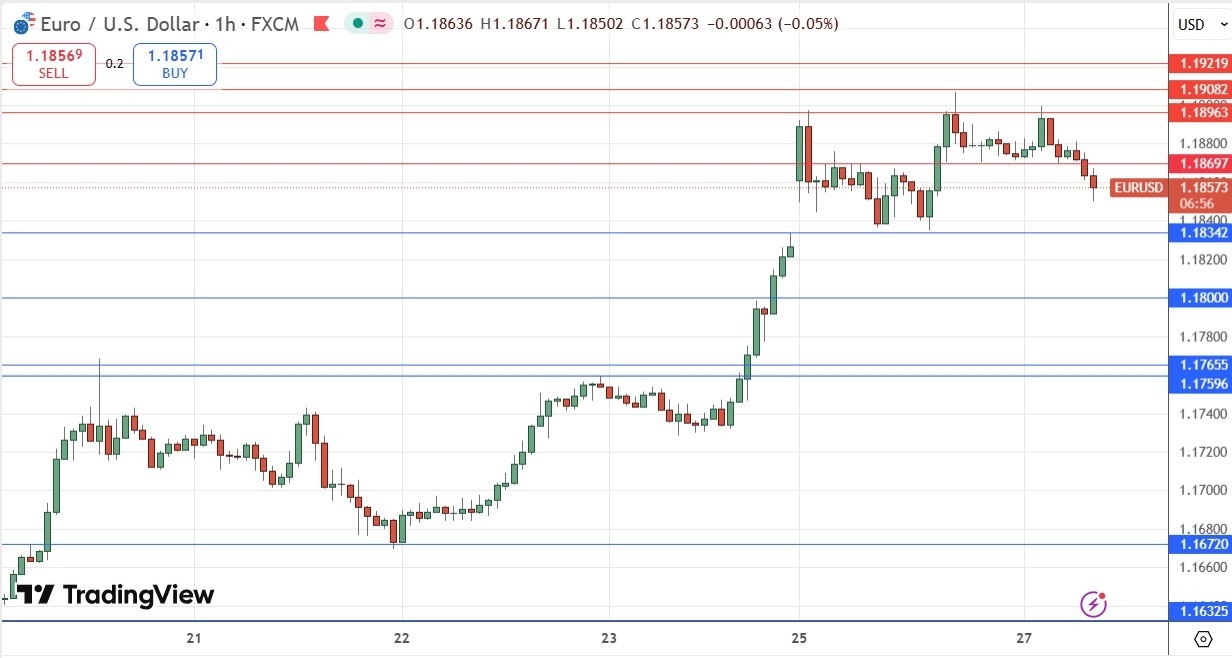

- Go short following a bearish price action reversal on the H1 timeframe immediately upon the next touch of $1.1870, $1.1896, or $1.1908.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 timeframe immediately upon the next touch of $1.1834, $1.1800, $1.1766.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Top Regulated Brokers

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

In my previous EUR/USD analysis last Thursday, I thought that the EUR/USD currency pair was likely to range over the day between $1.1672 and $1.1760. This was a good call, although the direction over the day was bullish and not choppy.

Yesterday saw an important development which materially changed the technical picture: The price made its highest daily close since September 2025, and the 50-day moving average is now above the 200-day moving average. This will be a signal for trend following funds and strategies to go long, so we should see institutional money buying EUR/USD futures.

This currency pair has historically shown a strong propensity to trend, so I am comfortable being long here with a wide stop as a medium to long-term play.

Two notes of caution for bulls:

- This currency pair tends to trend slowly and make many deep retracements along the way. This means that over the short term, bulls should not be worried by the price going down to $1.1800 or even lower.

- Although we did see a high closing price yesterday, the infective September 2025 above $1.1900 was not broken, or even tested. Once the price gets beyond that level, it will make sense to be more bullish.

I would be happy to go long at any bounce from any of the identified support levels.

Fundamentally, there are growing signs that the US Dollar is in some trouble because the world doesn’t trust the US to stick to a rules-based international order anymore, following President Trump’s recent statements and actions. I think this is a bit of an exaggeration, but it is probably a factor in the Dollar weakness.

There is nothing of high importance due today regarding either the Euro or the USD.

Ready to trade our daily Forex signals? Here is our list of the best Forex brokers in the world worth reviewing.