EUR/USD Analysis Summary Today

- Overall Trend: Strong bullish.

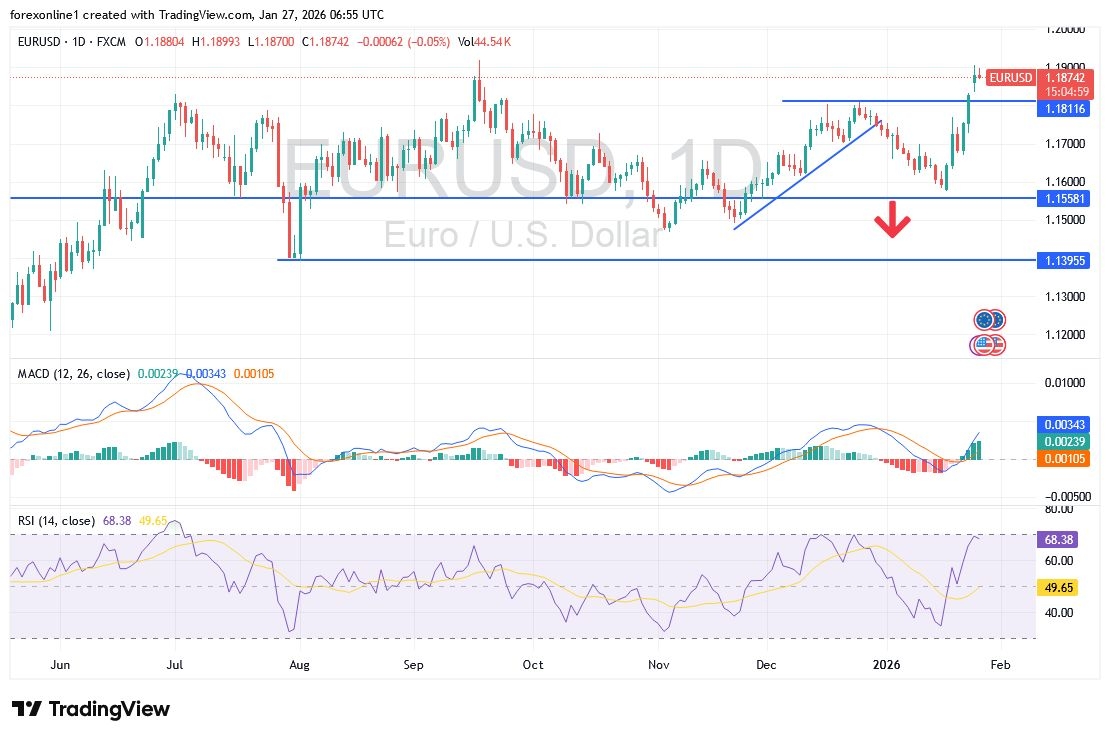

- Support Levels for EUR/USD Today: 1.1830 – 1.1760 – 1.1690.

- Resistance Levels for EUR/USD Today: 1.1930 – 1.2000 – 1.2080.

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1750 with a target of 1.2000 and a stop-loss at 1.1680.

- Sell EUR/USD from the resistance level of 1.1980 with a target of 1.1600 and a stop-loss at 1.2070. Live EUR/USD Chart

Top Regulated Brokers

Technical Analysis of EUR/USD Today:

Uncertainty surrounding the future policies of the US Federal Reserve has weakened the US Dollar against other major currencies across trusted trading platforms. This provided a prime opportunity for EUR/USD bulls to drive the pair toward the 1.1906 resistance level—its highest point in four months—before stabilizing around 1.1875 at the start of Tuesday's session.

According to forex market data, the EUR/USD exchange rate fell to its lowest level below 1.16 at the beginning of last week amid concerns about the imposition of additional tariffs on European economies due to escalating tensions in Greenland.

However, tensions eased during the Davos summit meetings, and the EUR/USD exchange rate rose sharply, surpassing 1.1750 and reaching the 1.1900 resistance level. Growing concerns about US policies led to a decline in the dollar amid the risk of capital outflows from US markets. Technically, these gains support the bullish shift for the EUR/USD pair. This is further confirmed by the Relative Strength Index (RSI) stabilizing around 68.50, nearing the overbought level of 70. Similarly, the MACD indicator is holding steady. The psychological resistance level of 1.2000 remains the ideal target for bulls to maintain control of the EUR/USD trend in the coming days.

EUR/USD Bearish Scenario

Based on the EUR/USD daily chart, a return to the 1.1600 support level would be significant for the bears to regain control of the trend. We expect the EUR/USD to remain within its current range until the markets and investors react to the US Federal Reserve's announcement tomorrow, Wednesday, and any developments in US-EU relations.

EUR/USD Exchange Rate Forecast

According to currency trading experts, after initial gains, Wells Fargo expects the EUR/USD exchange rate to fall to 1.15 by the second quarter of 2027. Conversely, Danske Bank anticipates the EUR/USD to rise to 1.23 within 12 months as confidence in US assets declines.

Wells Fargo expects further US interest rate cuts by the Federal Reserve in the first half of the year to lead to further net losses for the dollar. The bank also addressed the overall outlook for the dollar, stating: “While we maintain our firm position that the Federal Reserve is, and will remain, an independent institution, broader concerns in the financial markets about the credibility of the US central bank could also contribute to dollar weakness in the coming months.” It added: “In the near term, the dollar’s depreciation is expected to be broad-based and will be seen against G10 and emerging market currencies, with a few exceptions.”

Trading advice:

Dear TradersUp trader, we recommend waiting for the market reaction to the US Federal Reserve's decisions before committing to new EUR/USD positions.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.