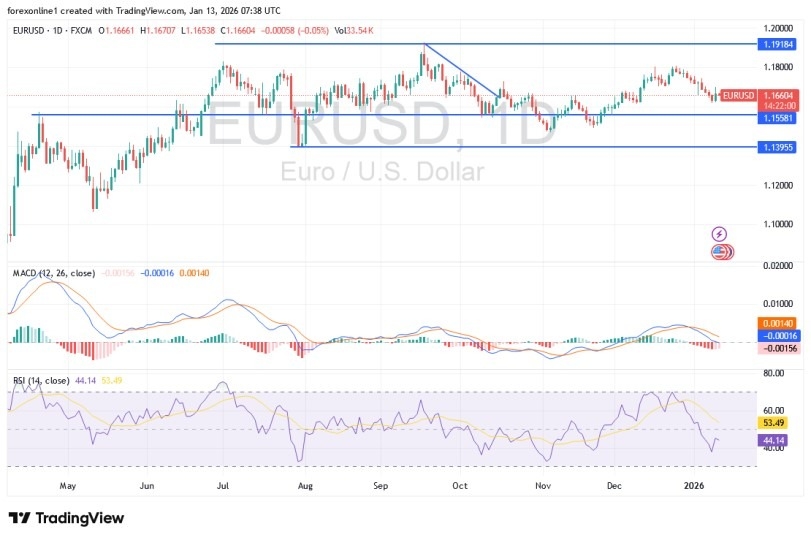

EUR/USD Analysis Summary Today

- Overall Trend: Still Bearish.

- Support Levels for EUR/USD Today: 1.1635 – 1.1580 – 1.1500

- Resistance Levels for EUR/USD Today: 1.1720 – 1.1800 – 1.1880

EUR/USD Trading Signals:

- Buy EUR/USD from the support level of 1.1590 with a target of 1.1820 and a stop-loss at 1.1500.

- Sell EUR/USD from the resistance level of 1.1770 with a target of 1.1500 and a stop-loss at 1.1840.

Technical Analysis of EUR/USD Today:

Based on recent trading, the EUR/USD pair continues to trade within a short-term downtrend line, having recorded lower lows and higher highs. The price is currently hovering around the 1.1670 level, so a bounce is possible before the downtrend resumes. Technically, the Fibonacci retracement tool indicates areas where bears might be waiting to re-enter. The decline could reach the 38.2% Fibonacci level at 1.1666, which coincides with a secondary resistance zone. The 50% level is located at 1.1680, while a larger retracement could test the 61.8% Fibonacci level at 1.1695, which is close to the downtrend line resistance.

Top Regulated Brokers

Overall, if any of these Fibonacci levels manage to halt the gains, the EUR/USD pair could resume its decline towards the lows of 1.1619 or lower. A sustained break below these levels could lead to a sharp decline in the currency pair's price. Regarding moving averages, the 100-day simple moving average (SMA) remains below the 200-day SMA, suggesting that the most likely trend is downward, or that selling pressure will gain too much momentum to reverse. Both indicators are above the current price action and could form dynamic resistance for any corrective attempts.

However, the Stochastic oscillator is rising from the middle of its range, which could give buyers enough momentum to push for a near-term bounce. The indicator has room to rise before reaching overbought territory, meaning the correction could continue until then. The Relative Strength Index (RSI) is moving sideways, reflecting bearish exhaustion and a chance of consolidation. However, a rise could attract more buyers in anticipation of a subsequent decline to Fibonacci levels.

Trading Tips:

The EUR/USD pair can be affected by released economic data and statements from central bank officials, especially any changes in monetary policy expectations that could impact the strength of the US dollar. Be cautious before entering trades on this currency pair.

The future of Federal Reserve policies and their impact on EUR/USD trading

Based on performance across top trading platforms, the EUR/USD exchange rate may see a significant improvement this week. It appears that the legal actions taken by the Trump White House against the Federal Reserve have halted the intense sell-off of the euro against the US dollar.

According to currency market activity, the EUR/USD pair had fallen to a low of 1.1618 after 11 consecutive days of decline, but at the start of the trading week, it saw a notable rise of 0.50% to 1.1698, thanks to Trump's recent actions.

After failing to heed Trump's demands for more aggressive US interest rate cuts, the Federal Reserve is now facing a lawsuit from the US Department of Justice regarding the costs of renovating its headquarters in Washington. The Justice Department has also threatened Federal Reserve Chairman Jerome Powell with criminal charges in this case. Legal documents were filed on Friday, but these developments only came to light over the weekend.

The overall decline in the US dollar reflects financial markets' concerns about the future independence of the Federal Reserve. The White House's efforts to exert control over the Fed will have long-term implications for US monetary policy, as well as for the stability of the US financial market and economic growth.

Of course, the short-term implications for the US central bank's policy, and consequently for the dollar, are unclear, as it is difficult to predict how the Fed's upcoming monetary policy decisions will be affected. If they are, the dollar could recover and push the euro/dollar exchange rate lower again.

However, we believe these events serve as a reminder that markets will not tolerate political agendas manipulating US institutions, and this could put further downward pressure on the dollar due to the risks involved. Given the recent volatility in the dollar's upward trend, we expect the EUR/USD exchange rate to rise to 1.1750 this week, with a difficult break above the psychological resistance level of 1.1800.

On the economic front, watch for the US inflation data release today, Tuesday, at 3:30 PM Cairo time, to monitor for any potential volatility. A higher-than-expected interest rate hike could remind financial markets that the Federal Reserve cannot cut interest rates while inflation remains resistant to decline. However, a reading in or below the target range would reinforce our positive outlook for next week.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.