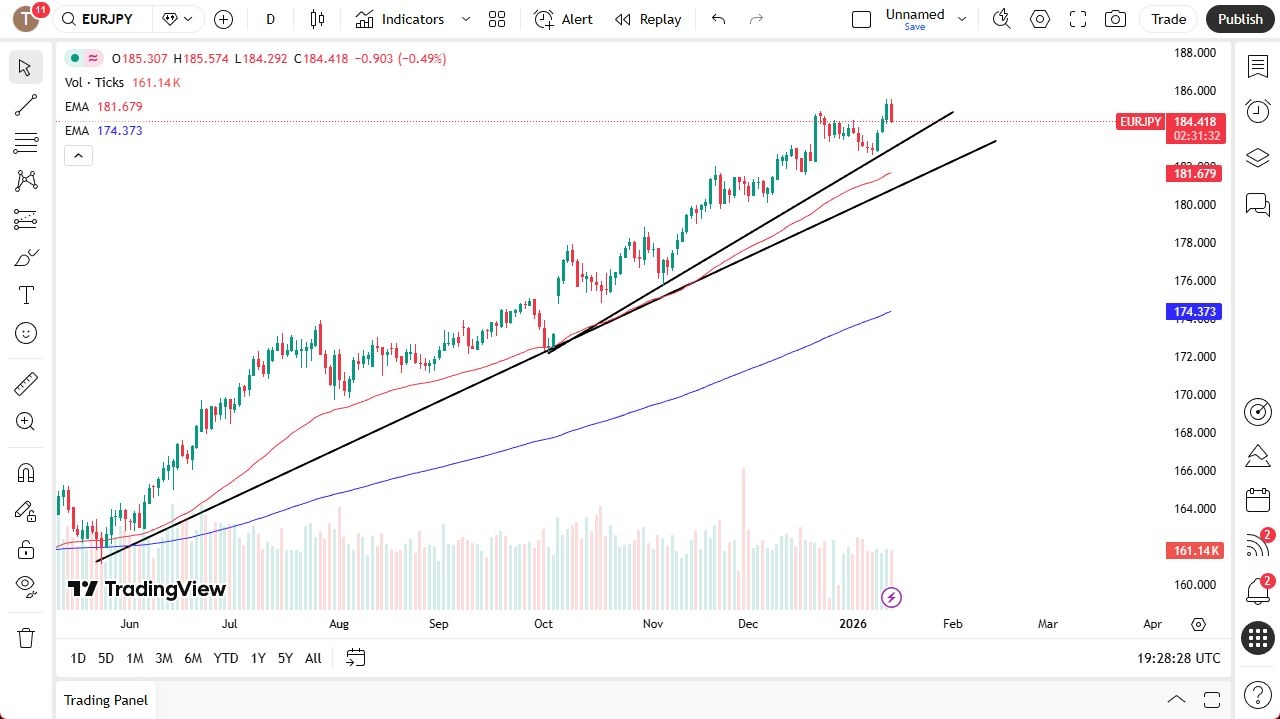

The euro weakened temporarily against the yen due to yen-driven risk flows, but the broader uptrend remains intact. Structural policy differences favor buying dips, with expectations for a rebound and continued positive momentum.

The euro has struggled a bit against the Japanese yen during the trading session on Wednesday, but this has been a Japanese yen-related move and not really anything to do with the euro. There are a lot of geopolitical concerns out there, and the handful of traders who believe in doomsday are buying the yen for the session. The reality is that the trend is very strong and is light years away from changing.

Top Regulated Brokers

At this point in time, to assume that sooner or later the buyers come back is the camp being taken. Somewhere near the 183 level, there should be traders willing to get involved, assuming the market gets anywhere near there. The 50-day EMA is at the 181.67 yen level, and there are also a couple of trend lines in the same mix.

Monetary Policy and Carry Trade Support

The Japanese yen is backed by a Bank of Japan that simply cannot do anything to tighten monetary policy significantly, and that is the part that most traders need to be paying attention to. The focus is on a drop and a bounce. So far, the drop has occurred, but the bounce has not. Once the market starts to take off to the upside, there is a willingness to buy the right-hand side of the V pattern.

This could send the market towards the 186 level, possibly even higher than that. Ultimately, traders get paid at the end of every day to collect the carry trade. With that being said, this is a market with no interest in shorting. The overall momentum and bulk of the market’s attitude remain positive, and this dip should offer a buying opportunity for those patient enough.

Begin trading our daily forecasts and analysis. Here is a list of Forex brokers in Japan to work with.