Ethereum has recently witnessed a surge in network activity, with daily transactions reaching record highs amid growing on-chain demand. As technical indicators point to a potential breakout, analysts are eyeing a $4,500 price target for ETH, driven by robust fundamentals and institutional interest.

Ethereum’s Network Activity Is Through the Roof

Ethereum's blockchain is experiencing unprecedented levels of activity in early 2026, underscoring a resurgence in user engagement and on-chain utility.

On Jan. 16, the network processed a record 2,885,524 transactions, the highest daily count on record, according to Glassnode. The surge caps a sharp pickup in on-chain activity this month, with transaction volumes pushing to new highs into early 2026.

Daily transaction count on the Ethereum network. Source: Glassnode

The seven-day moving average has hovered near 2.5 million, nearly double the levels from the same period in 2025, highlighting a sharp reversal from the downtrend that persisted until mid-December 2025.

This explosion in transaction volume coincides with remarkably low gas fees, averaging around $0.15 and dropping as low as $0.04 for swap transactions, the lowest in the network's modern history.

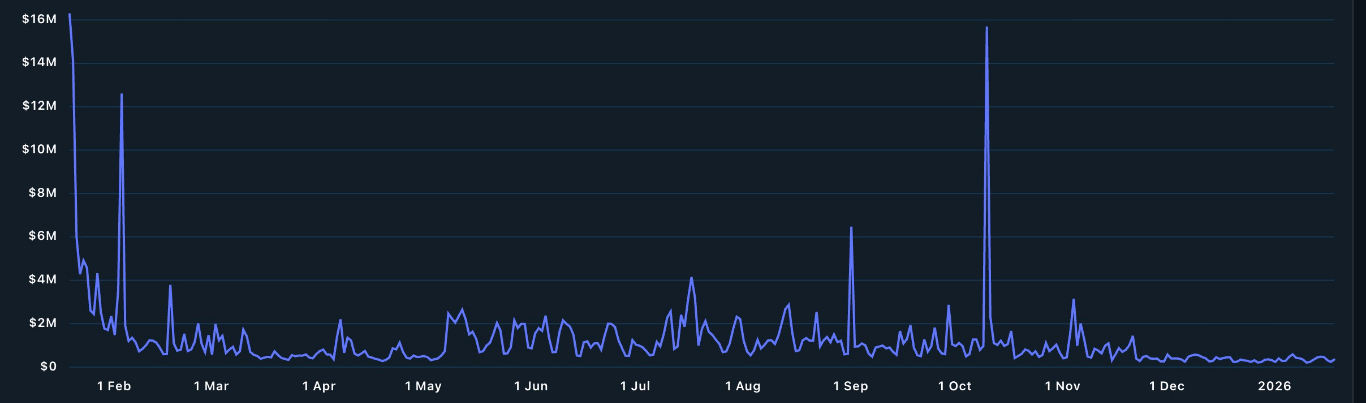

Ethereum network fees. Source: Nansen

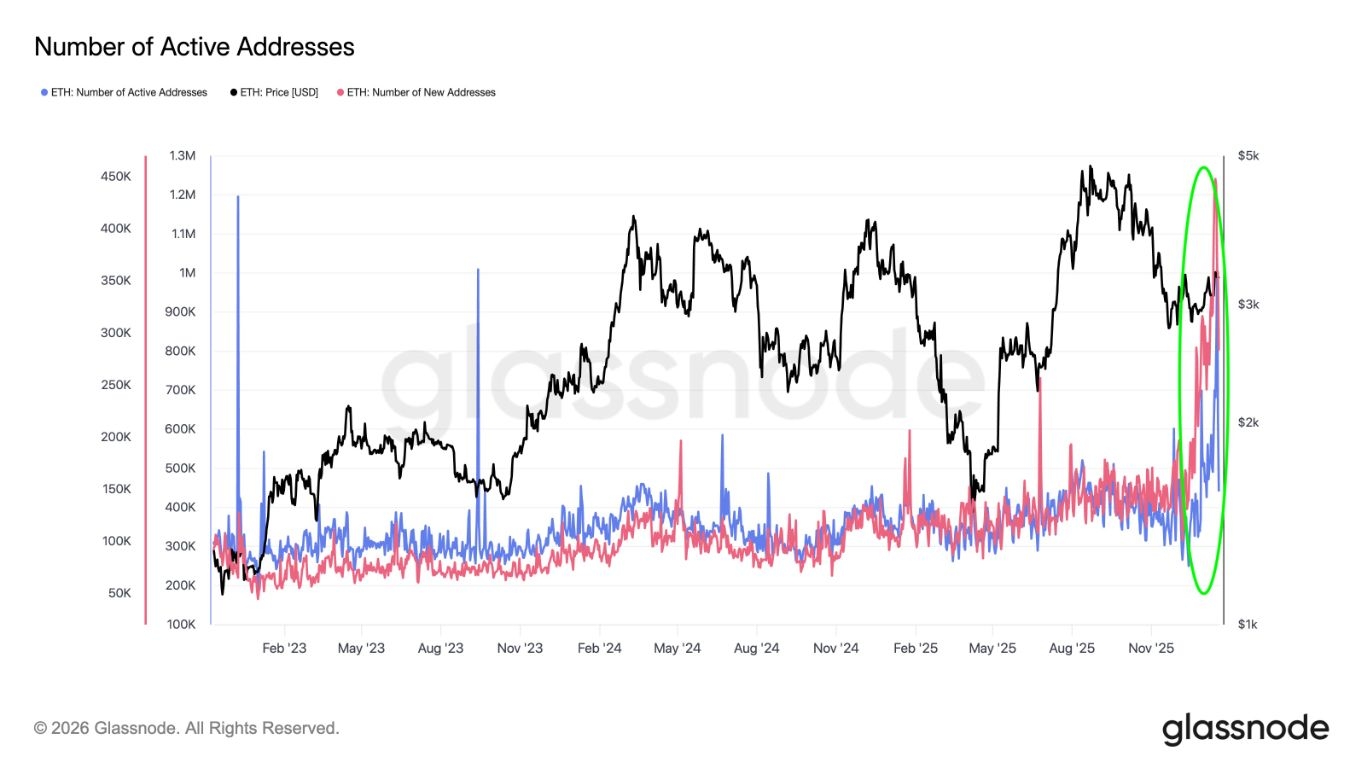

Such affordability has likely fueled the surge, making Ethereum more accessible for everyday users and decentralized applications. As a result, daily active addresses hit a three-year high of $1.03 million on Jan. 16, nearly doubling to 8 million in just one month, driven by a wave of new wallets interacting with the network.

New address creation has also new all-time highs, with an unprecedented 450,000 wallets created on January 11, 2026, reflecting a 130% jump since the Fusaka upgrade in December 2025.

Ethereum: Number of daily new and active addresses: Source: Glassnode

The increase in user addresses is due to a combination of seasonal factors with structural improvements like the recent "BPO" hard fork, which enhanced scalability and reduced costs. This influx of first-time users indicates strong organic growth, with retention rates improving as more addresses engage actively over 30 days.

This "exploding" activity suggests Ethereum is reclaiming its position as the go-to platform for decentralized finance, NFTs, and enterprise applications, potentially setting the stage for sustained price appreciation amid broader market recovery.

High Institutional Demand to Push ETH Higher

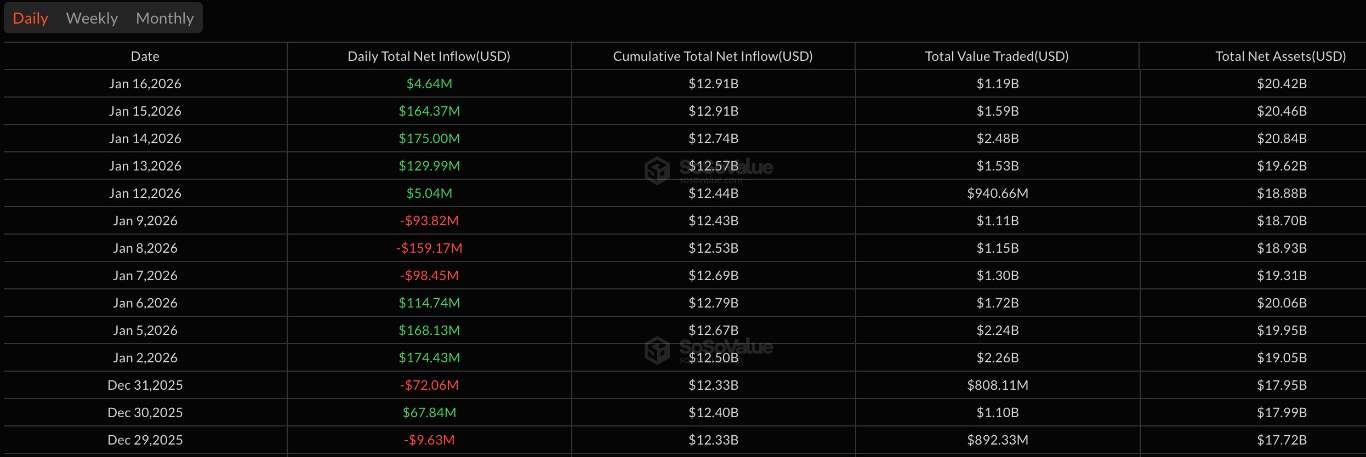

Institutional investors are showing renewed confidence in Ethereum, with spot ETFs recording substantial inflows last week.

According to data from SoSoValue, these funds saw a net inflow of approximately $479 million, marking the first positive week since October 2025 and the highest weekly figure on record for Ethereum ETFs. This surge brings cumulative net inflows since launch to $12.91 billion, with total net assets under management reaching $20.42 billion.

Spot Ethereum ETF flows table. Source: SoSoValue

BlackRock's ETHA led the pack, attracting $219 million - nearly half of the weekly flows -followed by notable contributions from Grayscale's products and others like Fidelity's FETH.

Additional data from Capriole Investments shows that institutional buying now outpaces Ethereum's new supply issuance, creating upward pressure on prices.

Ethereum: Daily rate of institutional buying. Source: Capriole Investments

Analysts note that such flows signal long-only allocators re-entering via regulated channels, tightening effective supply amid lower whale selling. Weekly trading volume across Ethereum ETFs hit $7.74 billion, reflecting heightened interest from traditional finance players.

This demand resurgence comes as Ethereum's price consolidates around $3,200, down slightly but holding key supports. If inflows continue, analysts predict it could catalyze a rally back above $4,000 over the next few weeks, especially with on-chain signals pointing to early markup phases.

Ether’s Symmetrical Triangle Targets $4,500

The ETH/USD pair was rejected by the 100-day simple moving average at $3,300 and has now fallen back into the symmetrical triangle, as shown in the daily chart below.

The immediate support now sits at $3,080, embraced by the 50-day SMA. A rebound from this level could propel ETH back above the upper trendline of the triangle at $3,220.

Other levels to watch on the upside are the 100-day SMA, the 200-day SMA at $3,660, and the $4,000 psychological level. Bulls are required to push ETH above these barriers toward the bullish target of the symmetrical triangle at $4,500. Such a move would represent a 40% rise above the current price.

ETH/USD daily chart. Source: TradingView

The relative strength index has dropped to 52 from 64 over the last five days, indicating declining upward momentum.

As such, a daily candlestick close below the 50-day SMA at $3,080 would trigger a downward cascade toward the bearish target of the prevailing chart pattern at $1,850.

Ready to trade ETH/USD? Here’s a list of some of the best crypto brokers to check out.